|

|

Debt ceiling politics (Page 8)

|

|

|

|

|

Clinically Insane

Join Date: Jul 2005

Location: Vacation.

Status:

Offline

|

|

Originally Posted by Wiskedjak

And, this is the problem. All of the "decision" makers are thinking only about the next election and not about actually solving the issue.

To be completely honest, they're thinking about two things:

1) The next election.

2) Getting their names into the history books.

|

|

Been inclined to wander... off the beaten track.

That's where there's thunder... and the wind shouts back.

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

I'm sure politicians of both parties will go down.

In history or other ways.

-t

|

|

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Jan 2003

Location: Great White North

Status:

Offline

|

|

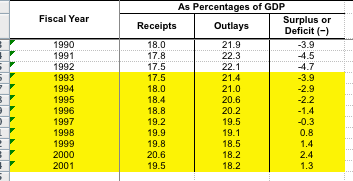

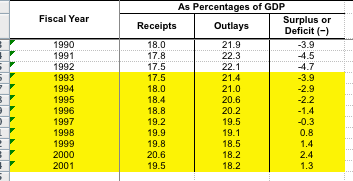

Looks like if Bush didn't do the tax cuts the blue line would be above the red line until before 2010 and the gap between the two wouldn't be much larger then in the 80's, and Revenue isn't part of the problem.....

|

|

Blandine Bureau 1940 - 2011

Missed 2012 by 3 days, RIP Grandma :-(

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by screener

It's also interesting how in the chart the 90s are looking pretty good, despite having a higher tax rate for the rich.

I don't quite understand why some people want to pin our success in the 90s solely on the dot com bubble while giving zero credit to the Clinton administration. There have been many bubbles over the last several decades, including the most recent housing bubble.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Dec 1999

Status:

Offline

|

|

Originally Posted by ebuddy

There's only one difference between our complaints olePigeon, I substantiated mine.

You might as well said you substantiated your claims from Glenn Beck's chalk board. Since you're being an ass: here. I can make you another link regarding the credibility of their "research" if you like.

|

|

"…I contend that we are both atheists. I just believe in one fewer god than

you do. When you understand why you dismiss all the other possible gods,

you will understand why I dismiss yours." - Stephen F. Roberts

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by ebuddy

There's only one difference between our complaints olePigeon, I substantiated mine.

Substantiated with a blog from the Tax Foundation expressing an opinion?

No wonder why you are so uninformed cause you are relying on the Heritage Foundation, who have been deliberately misleading with data like how Pres. Obama is solely responsible for the 2009 budget and deficit. Even the Cato Institute wouldn't go down to such a level and defended Pres. Obama against the Heritage Foundation's false claim and misleading data.

Isn't the Tax Foundation pretty much the same guys as the Heritage Foundation? Seems that they often promote the Heritage Foundation.

The Tax Foundation - Staff > Scott A. Hodge

Before joining the Tax Foundation, Scott was Director of Tax and Budget Policy at Citizens for a Sound Economy. He also spent ten years at The Heritage Foundation, including eight years as Heritage’s Grover Hermann Fellow in Federal Budgetary Affairs. Scott began his career in Chicago where he helped found the Heartland Institute in 1984. He holds a degree in political science from the University of Illinois at Chicago.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Oh look, the Koch brothers and their big oil money again. So the same guy who worked for CSE went to work for the Heritage Foundation, now works at the Tax Foundation. All spreading the Koch brother's lies. FreedomWorks? Americans for Prosperity? Astroturfing the Tea Party.

Citizens for a Sound Economy

Citizens for a Sound Economy - Wikipedia, the free encyclopedia

Citizens for a Sound Economy (CSE) (1984–2004) was a conservative political group operating in the United States, whose self-described mission was "to fight for less government, lower taxes, and less regulation." In 2004, Citizens for a Sound Economy split into two new organizations, with Citizens for a Sound Economy being renamed as FreedomWorks, and Citizens for a Sound Economy Foundation becoming Americans for Prosperity.

Citizens for a Sound Economy (CSE) was established in 1984 by David H. Koch and Charles G. Koch of Koch Industries.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by olePigeon

You might as well said you substantiated your claims from Glenn Beck's chalk board. Since you're being an ass: here. I can make you another link regarding the credibility of their "research" if you like.

Is your position so indefensible that you have to get personal with me? Is Paul Krugman supposed to be a bastion of moderate politics or does he not consider his blog The Conscience of a Liberal? C'mon man.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Jul 2001

Location: I don't know anymore!

Status:

Offline

|

|

Originally Posted by ebuddy

Is your position so indefensible that you have to get personal with me? C'mon man.

Pot, kettle.

|

|

Why is there always money for war, but none for education?

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Jul 2001

Location: I don't know anymore!

Status:

Offline

|

|

Originally Posted by screener

They're absolutely right.

|

|

Why is there always money for war, but none for education?

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

So the only response from the right since the Fact Check chart is ebuddy claiming a personal attack.

Nice.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

Pfff, nothing a spending cut couldn't achieve.

-t

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by screener

So the only response from the right since the Fact Check chart is ebuddy claiming a personal attack.

Nice.

I'm not sure what your view is on the chart since you didn't offer anything the right would be compelled to address such as; "you righties are wrong, it's a revenue problem." So, I'll start by assuming that's what you're arguing. Please pay close attention: Outlays are spending. Revenues are taxes. Outlays are indicated in the chart as the red line; the one that is consistently higher than the blue line indicating revenues since the 1940's. That means the government has been spending more than it has been taking in the overwhelming majority of the time. Spending in red, the higher line and revenues in blue, the lower line. Think of this as your income in blue vs your spending in red. You have a spending problem by definition. Quick Tip: it would behoove you to allow a little headroom in your expenditures for fluctuating market conditions. It is apparent from the chart that this is also a very real problem. So the chart clearly shows outlays consistently exceeding revenue, outlays spiking higher under this Administration than any other level since WWII, and revenues dropping with increasing unemployment.

So... what response from the right were you hoping for, thanks for the chart?

Let's assume your other argument is that tax increases are necessary to increase revenue. After all, your article even says; "The current situation is a marked change from the booming 1990s. In those years revenues increased, due to a 1993 tax increase, which fell most heavily on those making more than $200,000 a year." Let's also pretend for a moment the article isn't riddled with adjectives for Bush's spending and justifications for Obama's.

In your article, they tell you where they're getting the data with a link that loads an excel spreadsheet of historical budget data provided by the OMB and CBO. Did you download that spreadsheet? You should.

Interesting read.

As usual, "factcheck" forgot to check all the facts like the Taxpayer Relief Act signed into law by Clinton in 1997. I've performed subtle formatting to make the spreadsheet easier for you to look at. See the little minus signs before the numbers in the Surplus or Deficit column? The little minus sign is bad, the years 1993 through 1997. See the little numbers without the minus signs? Those are good, the years 1998 through 2001.

I wouldn't know for sure, but you might argue that it was the cuts in spending from 1996 to 2000 that produced the surplus, not revenues. I'm glad they cut spending. The political climate shifted dramatically in 1996 and spending cuts were demanded of government. The problem with this argument however is that revenues also increased and remained higher in the years following the tax cut of 1997 than they did any of the years following the tax increase of 1993. At least, according to your article.

Thanks again.

(

Last edited by ebuddy; Aug 12, 2011 at 07:19 AM.

)

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

Originally Posted by ebuddy

So the chart clearly shows overlays consistently exceeding revenue, outlays spiking higher under this Administration than any other level since WWII, and revenues dropping with increasing unemployment.

Seems to me, according to the chart, trickle down wasn't too effective.

Makes me wonder why Reagan is such an icon for some.

He did raise taxes and said his biggest regret was the deficit he left.

You could say, trickle down didn't work.

Originally Posted by ebuddy

Let's assume your other argument is that tax increases are necessary to increase revenue. After all, your article even says; "The current situation is a marked change from the booming 1990s. In those years revenues increased, due to a 1993 tax increase, which fell most heavily on those making more than $200,000 a year." Let's also pretend for a moment the article isn't riddled with adjectives for Bush's spending and justifications for Obama's.

Reagan did it, Bush senior did it and Clinton did it.

Bush Jr. inherited a balanced budget, gave a tax cut, started a war without funding it and took the country to near ruin.

Bravo.

Originally Posted by ebuddy

I wouldn't know for sure, but you might argue that it was the cuts in spending from 1996 to 2000 that produced the surplus, not revenues. I'm glad they cut spending. The political climate shifted dramatically in 1996 and spending cuts were demanded of government. The problem with this argument however is that revenues also increased and remained higher in the years following the tax cut of 1997 than they did any of the years following the tax increase of 1993. At least, according to your article.

It's called compromise and it worked.

What's happening now with the chuckleheads, mostly those appeasing the tea party idiots running the show, is pure lunacy.

Originally Posted by ebuddy

Thanks again.

For what?

The S$P link is a gift to you to tear apart, yet you choose not to.

Why?

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by screener

Seems to me, according to the chart, trickle down wasn't too effective.

Makes me wonder why Reagan is such an icon for some.

He did raise taxes and said his biggest regret was the deficit he left.

You could say, trickle down didn't work.

Reagan did it, Bush senior did it and Clinton did it.

Bush Jr. inherited a balanced budget, gave a tax cut, started a war without funding it and took the country to near ruin.

Bravo.

It's called compromise and it worked.

What's happening now with the chuckleheads, mostly those appeasing the tea party idiots running the show, is pure lunacy.

For the benefit of the forum, I ripped the little "factcheck" chart to shreds and your response is; "what about the Standard and Poor's link?!?"

Then, as if I didn't see it coming you continue;

you...you poopybuttstinkyFACE!!!  rrrBUSH!mmmrrrREAGANggrrrrTEAPARTY!

Facts: The across-the-board Mellon tax cuts of the 20's increased revenue, Kennedy's tax cuts in the 60's increased revenue, the Reagan ERTA tax cuts of '81 increased revenue, Clinton's tax cuts of '97 increased revenue, and Bush Jr's tax cuts increased revenue. High marginal tax rates do to work, savings, investment, and new startups what high taxes do to alcohol, cigarettes, and energy usage.

What you're complaining about is a spending problem and while you're complaining about Bush's wars of 10 years ago, we're fighting for the Afghani government's poppies revenue and losing to Gaddafi who remains in Libya. Stupidity and blindness to current events is not the Tea Party's problem.

Would you really like for me to respond to the Standard and Poor's link? While I appreciate the wake-up call of the downgrade, I can show you why increased taxes on the only people capable of avoiding the bulk of them is a dumb notion thrusted by the same morons who gave mortgage-backed securities a triple AAA+ rating along with the Isle of Man and for whatever reason can't stand the ideal of job creation in a market of abject uncertainty.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Professional Poster

Join Date: Aug 2007

Location: Just west of DC.

Status:

Offline

|

|

Originally Posted by OldManMac

They're absolutely right.

You're clueless to how businesses work. Your 'solution' still doesn't address the irresponsible spending. The political hacks will spend any tax increases to get votes.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Jan 2003

Location: Great White North

Status:

Offline

|

|

A lot of people here seem to fail to understand how business works.

No amount of tax breaks is going to keep some business here because labor is cheaper in China. What can be done in China and India will be because of labor which is the highest cost for any business. Service based businesses and those that actually have to operate here are not going to pack up their doors and shutdown business if taxes are to high. This only happens if they can't make profit and thus go out of business. They instead will either eat the tax increase or raise prices slightly on products and services to cover the taxes. If neither is a option they may reduce labor. Labor will only be reduced if the demands on the business allows for it.

If its a market still full of real competition then prices won't change for the consumer. If its a duopoly or a monopoly then consumers will get screwed. As long as there is money to be made a business will operate even in a high tax environment to make money.

Targeted Tax breaks for fluid businesses like the movie production industry is a good tax break because they can go anywhere they want to make a production. If BC is cheaper then LA they come to BC. Targeted one off breaks to attract things like smelters and such are good things. But across the board tax breaks for everything including the wal-marts and mcdonalds is not.

When it comes to employment, the only thing that decides if a business is going to hire people is demand. If they have a lot of consumers and require another body to keep up with demand they hire. If they don't have a lot of consumers they will not pay a guy to stand around, they reduce the work force.

The only way the employment numbers are going to go up is if every one that is currently employed starts spending again. This isn't going to happen any time soon because every one is worried about there own debt levels. If every one spends the next 5 years reducing debt, our employment numbers are going to be pathetic for the next 5 years. Once people start spending again, businesses picks up they start hiring people and the economy runs at full speed. It really comes down to the consumers. Its supply and demand. Low consumer demand means low job numbers. High consumer demand means high job numbers. The more money removed from consumers through fees and taxes means less money being wasted on stuff. Catering to Businesses demands for lower taxes is useless except to line share holder pockets with more money.

|

|

Blandine Bureau 1940 - 2011

Missed 2012 by 3 days, RIP Grandma :-(

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

Originally Posted by ebuddy

For the benefit of the forum, I ripped the little "factcheck" chart to shreds and your response is; "what about the Standard and Poor's link?!?"

When you quote someone, everyone sees it, no need to "For the benefit of the forum"bit.

You didn't rip anything to shreds.

What you did was show a downward trend of the deficit after Clinton raised taxes and when the trend was sustainable in a good economy, cut taxes.

How you got my response is the S&P link is strange.

That was a separate thing, at the bottom of my post.

Originally Posted by ebuddy

Then, as if I didn't see it coming you continue;

you...you poopybuttstinkyFACE!!!  rrrBUSH!mmmrrrREAGANggrrrrTEAPARTY!

And I thought I was being pretty civil and you put out this.

Again, when you quote someone, everyone sees it, even those who have certain members on ignore.

No need to play to the choir.

Originally Posted by ebuddy

Facts: The across-the-board Mellon tax cuts of the 20's increased revenue, Kennedy's tax cuts in the 60's increased revenue, the Reagan ERTA tax cuts of '81 increased revenue, Clinton's tax cuts of '97 increased revenue, and Bush Jr's tax cuts increased revenue. High marginal tax rates do to work, savings, investment, and new startups what high taxes do to alcohol, cigarettes, and energy usage.

Kennedy's tax cut was 90% to 70% but included the closing of loopholes, which increased revenue until ways around it were found.

Totally ignored Reagan raising taxes and saying his biggest regret was the deficit, at the time making the US the worlds biggest debtor nation.

Totally ignoring Bush Sr's "read my lips"

Totally ignoring the Clinton tax increase which started the lowering of the deficit and setting up the later tax cut.

Bush Jr., well, here we are.

And no, I'm not an Obama fan, never was.

Hillary all the way.

Originally Posted by ebuddy

What you're complaining about is a spending problem and while you're complaining about Bush's wars of 10 years ago, we're fighting for the Afghani government's poppies revenue and losing to Gaddafi who remains in Libya. Stupidity and blindness to current events is not the Tea Party's problem.

Of course a big part is spending, but unlike the 90's when the republicans compromised on the increase while getting cuts, this new breed of the right isn't interested in compromise.

Originally Posted by ebuddy

Would you really like for me to respond to the Standard and Poor's link? While I appreciate the wake-up call of the downgrade, I can show you why increased taxes on the only people capable of avoiding the bulk of them is a dumb notion thrusted by the same morons who gave mortgage-backed securities a triple AAA+ rating along with the Isle of Man and for whatever reason can't stand the ideal of job creation in a market of abject uncertainty.

The wake up call was mostly the idiocy in Washington and the uncertainty it caused.

I believe the S&P statement about the rich wasn't the idea of massive amounts of revenue but to show the US is serious about getting their house in order.

The "morons" is what I meant about a gift and I agree.

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by screener

When you quote someone, everyone sees it, no need to "For the benefit of the forum"bit.

You didn't rip anything to shreds.

What you did was show a downward trend of the deficit after Clinton raised taxes and when the trend was sustainable in a good economy, cut taxes.

Incorrect. What I did was illustrate how the tax base generates tax revenue, not the tax rate. When you lower taxes, you decrease avoidance (it costs money to avoid), and increase new startups; in both cases producing a larger tax base from which to collect. Again, factcheck failed to check all the facts because they didn't support the fiction. (as usual)

How you got my response is the S&P link is strange.

That was a separate thing, at the bottom of my post.

Am I required to address every link, posted by every member of this forum no matter how fallacious and slanted?

And I thought I was being pretty civil and you put out this.

Again, when you quote someone, everyone sees it, even those who have certain members on ignore.

No need to play to the choir.

Honestly, I didn't think you were going to give my post more than 30 seconds worth of comprehension before responding. Seriously, I was out of line and I apologize. I get tired of seeing "the right" or "Tea Partiers", etc... because at the end of the day it is just deflection from terrible Fed money policy (escalated under Bush) doubling down on failures of the previous Administration under the guise of "hope" and "change". Some would rather you focus on the Bush/right-wing/Tea Party piece because to render this Administration to one term is unthinkable regardless of how abysmal their attempts at "fixing" things have manifest. Bush was the cause for the Tea Party everyone hates so much and they are the only ones with any real integrity in this, not toeing the line for this party or that.

Kennedy's tax cut was 90% to 70% but included the closing of loopholes, which increased revenue until ways around it were found.

Loopholes are "compromises" screener. I for one have been calling for less compromise because this is exactly what you get. You get the tax increases some wanted while getting the loopholes others wanted; all pandering to enter constituency here. Loopholes are a means of increasing taxes while trying to maintain a low, overall corporate tax rate and it's a woefully sloppy way of going about it. I'm with you in eliminating loopholes because I'm for simplifying the code entirely, but doing so without an across the board tax cut is destructive to the economy by punishing the ones who employ people and invest in new ventures/startups. This is what people don't get. We're not talking about the same companies hiring more or less people. The population-pool is expanding and the growth segment of the economy must expand along with it. This means you need new businesses started up every day. You need more people employed today than yesterday, every day. Small businesses drive the US economy along with consumer spending/confidence- they are the ones we need to get off the dollar. They are more reluctant to spend when the market is so uncertain over Fed policy increasingly hostile toward growth. Notwithstanding the 800lb gorilla in the room; Obamacare. If you're a business owner and you're expanding without regard for what this labor is going to cost you in 2014, you've got no business running a company. This is the problem. No one is expanding because they have no idea what this expansion will cost in the long run.

Totally ignored Reagan raising taxes and saying his biggest regret was the deficit, at the time making the US the worlds biggest debtor nation.

The drivers of debt were no different in Reagan's time than they are today; spending. It was compromise with a Democratic-controlled Congress screener. What Reaganomics did was create 20 million new jobs, dropped inflation from 13.5% to 4.1%, unemployment fell from 7.6% to 5.5%, the economy grew by 40%, and the net-worth of the middle income family grew by 27% annually. Reagan was nothing if not a shrewd politician and by appeasing the spending appetite of Congressional pets from the left created the new voting bloc known as "Reagan-Democrats" while at the same time maintaining a strong economy with sound, supply-side methodology. i.e. you can spend more when the books and budget-projections support it. When the books don't support it, there is no sense behind a sustained, high level of spending which is what we have today.

Totally ignoring Bush Sr's "read my lips"

Read my lips... no new taxes. He was appropriately derided for this having ushered in new taxes. You can refer back to your article's spreadsheet for the years preceding Clinton's inauguration to see how effective those were at generating revenue by the way. Don't take my word for it.

Totally ignoring the Clinton tax increase which started the lowering of the deficit and setting up the later tax cut.

There was modest growth realized by an entirely new venture of capital, the .com boom. Lowering taxes unleashed the productivity of this segment and lead to several years of sustained economic expansion. IMO, based on the data I've already seen and bolstered by the data you've provided, a lower rate throughout would've seen an even greater economic environment. The 1993 tax hikes hindered what could have been a more explosive growth.

Bush Jr., well, here we are.

And no, I'm not an Obama fan, never was.

Hillary all the way.

- Hillary Clinton supported the invasion of Iraq

- Hillary Clinton supported the invasion of Afghanistan.

- As Secretary of State, Hillary Clinton is behind action against sovereign Libya without Congressional vote, without WMDs, and really without any reason for starting it or way out of it at all.

- Hillary Clinton supported the $700 billion Wall Street bailout - TARP

- Hillary Clinton supported Medicare Part D, only opposing the means-tested portion of it, the only fiscally-sound principle within it.

- Hillary Clinton supported the Bush tax cuts, only opposed to the tax treatment on the "rich".

Your abject hatred for Bush and appreciation for Hillary Clinton comes down to raising taxes on the rich? Otherwise, when it comes to economic calamity Hillary Clinton appears to be Bush III; a much scarier, more expensive version of the other two.

Of course a big part is spending, but unlike the 90's when the republicans compromised on the increase while getting cuts, this new breed of the right isn't interested in compromise.

And it shouldn't be. For more than 4 years the Democrats owned the House and the Senate and additional two years the Presidency and our country is saddled with unprecedented debt. Prior to all the Republican "obstructionism", there was literally zero talk of decreasing the debt, having not even made the list of concerns uttered by our President during his most recent State of the Union.

The wake up call was mostly the idiocy in Washington and the uncertainty it caused.

I believe the S&P statement about the rich wasn't the idea of massive amounts of revenue but to show the US is serious about getting their house in order.

Paul Ryan's plan was serious about the debt. There are obstructionists on both sides of the aisle. There were three proposals offered by the right, none taken.

The "morons" is what I meant about a gift and I agree.

This is why I personally, cannot take Standard and Poor's seriously.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by ebuddy

So... what response from the right were you hoping for, thanks for the chart?

Let's assume your other argument is that tax increases are necessary to increase revenue. After all, your article even says; "The current situation is a marked change from the booming 1990s. In those years revenues increased, due to a 1993 tax increase, which fell most heavily on those making more than $200,000 a year." Let's also pretend for a moment the article isn't riddled with adjectives for Bush's spending and justifications for Obama's.

In your article, they tell you where they're getting the data with a link that loads an excel spreadsheet of historical budget data provided by the OMB and CBO. Did you download that spreadsheet? You should.

Interesting read.

As usual, "factcheck" forgot to check all the facts like the Taxpayer Relief Act signed into law by Clinton in 1997. I've performed subtle formatting to make the spreadsheet easier for you to look at. See the little minus signs before the numbers in the Surplus or Deficit column? The little minus sign is bad, the years 1993 through 1997. See the little numbers without the minus signs? Those are good, the years 1998 through 2001.

Selective reasoning.

You are ignoring Clinton's tax rate increase in 1993 actually increase tax revenues every year and decrease deficits every year before the Taxpayer Relief Act of 1997.

Let's just assume you believe tax cuts was responsible for revenue increases.

So what happen when Pres. Bush cut taxes in 2001? Revenues went down, down, down during Pres. Bush first term.

Code:

2000 20.6 18.2 2.4

2001 19.5 18.2 1.3

2002 17.6 19.1 -1.5

2003 16.2 19.7 -3.4

2004 16.1 19.6 -3.5

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Apr 2000

Location: Denville, NJ.

Status:

Offline

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Jul 2001

Location: I don't know anymore!

Status:

Offline

|

|

|

|

|

Why is there always money for war, but none for education?

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

Originally Posted by ebuddy

Incorrect. What I did was illustrate how the tax base generates tax revenue, not the tax rate. When you lower taxes, you decrease avoidance (it costs money to avoid), and increase new startups; in both cases producing a larger tax base from which to collect.(as usual)

Really?, you posted a spreadsheet that you "performed subtle formatting " to that says nothing about the tax base nor is the tax base mentioned in your post.

Wouldn't this be called moving the goal posts?

What your chart shows, like I said earlier, is an increase in receipts when the tax rate was raised.

When the deficit was moving in the right direction, tax relief.

Why you can't see that I don't get, the numbers are there.

Originally Posted by ebuddy

Loopholes are "compromises" screener. I for one have been calling for less compromise because this is exactly what you get. You get the tax increases some wanted while getting the loopholes others wanted; all pandering to enter constituency here. Loopholes are a means of increasing taxes while trying to maintain a low, overall corporate tax rate and it's a woefully sloppy way of going about it.

You mean closing loopholes.

Originally Posted by ebuddy

I'm with you in eliminating loopholes because I'm for simplifying the code entirely, but doing so without an across the board tax cut is destructive to the economy by punishing the ones who employ people and invest in new ventures/startups.

Wouldn't that necessitate a compromise which, in the above quote you're against.

Originally Posted by ebuddy

Notwithstanding the 800lb gorilla in the room; Obamacare. If you're a business owner and you're expanding without regard for what this labor is going to cost you in 2014, you've got no business running a company.]No one is expanding because they have no idea what this expansion will cost in the long run.

Those that wanted to expand couldn't get the loans from those that helped cause the "crash".

The Real Reason For Banks Not Lending - The Small Business Authority - - Forbes

Obamacare has nothing to do with it.

Originally Posted by ebuddy

The drivers of debt were no different in Reagan's time than they are today; spending. It was compromise with a Democratic-controlled Congress screener. What Reaganomics did was create 20 million new jobs, dropped inflation from 13.5% to 4.1%, unemployment fell from 7.6% to 5.5%, the economy grew by 40%, and the net-worth of the middle income family grew by 27% annually. Reagan was nothing if not a shrewd politician and by appeasing the spending appetite of Congressional pets from the left created the new voting bloc known as "Reagan-Democrats" while at the same time maintaining a strong economy with sound, supply-side methodology. i.e. you can spend more when the books and budget-projections support it. When the books don't support it, there is no sense behind a sustained, high level of spending which is what we have today.

There's that word compromise that you don't like but credit Reaganomics as the be all.

Originally Posted by ebuddy

Read my lips... no new taxes. He was appropriately derided for this having ushered in new taxes. You can refer back to your article's spreadsheet for the years preceding Clinton's inauguration to see how effective those were at generating revenue by the way. Don't take my word for it.

Reagan admitted his biggest regret was the deficit he left for his successor to deal with.

It made the US the worlds largest debtor nation.

Nice.

George H. W. Bush - Wikipedia, the free encyclopedia

In the wake of a struggle with Congress, Bush was forced by the Democratic majority to raise tax revenues; as a result, many Republicans felt betrayed because Bush had promised "no new taxes" in his 1988 campaign.[11] Perceiving a means of revenge, Republican congressmen defeated Bush's proposal which would enact spending cuts and tax increases that would reduce the deficit by $500 billion over five years.

Did you forget this?

Originally Posted by ebuddy

There was modest growth realized by an entirely new venture of capital, the .com boom. Lowering taxes unleashed the productivity of this segment and lead to several years of sustained economic expansion. IMO, based on the data I've already seen and bolstered by the data you've provided, a lower rate throughout would've seen an even greater economic environment. The 1993 tax hikes hindered what could have been a more explosive growth.

Seriously?

Wow, shown you're wrong and you still believe this is just, wow.

Originally Posted by ebuddy

Your abject hatred for Bush and appreciation for Hillary Clinton comes down to raising taxes on the rich? Otherwise, when it comes to economic calamity Hillary Clinton appears to be Bush III; a much scarier, more expensive version of the other two.

I think she would have made a better president that Obama has been.

The appeasing with a lack of cojones contributed to the position the US is in now.

The lack of leadership is astounding.

Originally Posted by ebuddy

And it shouldn't be. For more than 4 years the Democrats owned the House and the Senate and additional two years the Presidency and our country is saddled with unprecedented debt. Prior to all the Republican "obstructionism", there was literally zero talk of decreasing the debt, having not even made the list of concerns uttered by our President during his most recent State of the Union.

See my above post.

Originally Posted by ebuddy

Paul Ryan's plan was serious about the debt. There are obstructionists on both sides of the aisle. There were three proposals offered by the right, none taken.

Why?

Originally Posted by ebuddy

This is why I personally, cannot take Standard and Poor's seriously.

Doesn't matter does it.

|

|

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

Originally Posted by OldManMac

You know that article is all lies perpetrated by the left wing media right?

|

|

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Apr 2003

Location: 46 & 2

Status:

Offline

|

|

Not sure if this was mentioned, I don't care to go rummaging through all the posts in this thread.

I saw this on CNN earlier. Repealing all the Bush tax cuts from 2001, 2003, and 2009 would bring in a "whopping"... $98B in 2011 (page 9 of the CBO report), and a combined increase in revenues for 2011-2014 of only $326B. Yup, that's all. Read it for yourselves: http://www.cbo.gov/ftpdocs/120xx/doc...011Outlook.pdf

|

|

"Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it."

- Thomas Paine

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

Don't you dare to provoke the "tax the rich" mob with facts.

-t

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Apr 2003

Location: 46 & 2

Status:

Offline

|

|

That's all the cuts, not just the ones on the "rich". I'm sure those are considerably less.

|

|

"Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it."

- Thomas Paine

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

O won't you stop it already. Everybody knows that the rich could contribute eleventy billion dallars to the Washington coffers.

-t

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Shaddim

Not sure if this was mentioned, I don't care to go rummaging through all the posts in this thread.

I saw this on CNN earlier. Repealing all the Bush tax cuts from 2001, 2003, and 2009 would bring in a "whopping"... $98B in 2011 (page 9 of the CBO report), and a combined increase in revenues for 2011-2014 of only $326B. Yup, that's all. Read it for yourselves: http://www.cbo.gov/ftpdocs/120xx/doc...011Outlook.pdf

Holy smokes.

Bush tax cuts cost $147 billion in just 2012 alone. $245 billion in just 2 years. Damn! Gotta get rid of the Bush tax cuts.

Luckily Pres. Obama only extended it for 2 years in 2010. Imagine is Pres. Obama extended more than 2 years. It would be hundreds of billions in lost revenue per year.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

The usual suspects spouting half, if that what S&P and Buffett were saying.

Not surprising, one track minds and all.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Apr 2003

Location: 46 & 2

Status:

Offline

|

|

Originally Posted by hyteckit

Holy smokes.

Bush tax cuts cost $147 billion in just 2012 alone. $245 billion in just 2 years. Damn! Gotta get rid of the Bush tax cuts.

Luckily Pres. Obama only extended it for 2 years in 2010. Imagine is Pres. Obama extended more than 2 years. It would be hundreds of billions in lost revenue per year.

Yeah, because that's such a massive part of our debt crisis.  Pay your creditors ~5 cents on the dollar and see how far that gets you, because that's the portion "the rich" get from the cuts. We're still going to have to slash entitlements and every other government program just to stay afloat. Hell, we can even start with Defense (cut by 40%), if you want, then we'll gut H&H Services (40%), disband the Dept of Education, and raise the SS retirement age to 70. That should just about turn us around.

Originally Posted by screener

The usual suspects spouting half, if that what S&P and Buffett were saying.

Not surprising, one track minds and all.

The CBO is a "usual suspect"?

|

|

"Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it."

- Thomas Paine

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by Shaddim

Yeah, because that's such a massive part of our debt crisis.

The extend of their contribution is virtually irrelevant. If they are hurting and not helping, isn't it kind of a no-brainer to advocate for them being abandoned if you are actually interested in making things better?

|

|

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

Originally Posted by Shaddim

The CBO is a "usual suspect"?

It says in the PDF that their figures are from 2010 and subject to change when legislation that's germane to their analysis.

|

|

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

Originally Posted by besson3c

The extend of their contribution is virtually irrelevant. If they are hurting and not helping, isn't it kind of a no-brainer to advocate for them being abandoned if you are actually interested in making things better?

The usual suspects missed the point.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Apr 2003

Location: 46 & 2

Status:

Offline

|

|

Originally Posted by screener

It says in the PDF that their figures are from 2010 and subject to change when legislation that's germane to their analysis.

Sure, repeal all the cuts, do it now. Doesn't bother me in the least. Better ask some of the middle class how they feel about that, though. Since it's going to hurt them much more than "my people". heh

Originally Posted by screener

The usual suspects missed the point.

No, this "usual suspect" didn't miss it.  You miss the point that "the rich" being taxed more isn't going to fix even a fraction of this problem. We have to gut everyone's pet projects and entitlements to solve this. I'm ready to do my part, are you?

|

|

"Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it."

- Thomas Paine

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

Oh, look, you're arguing with screamer. You should put that dud on ignore, it'll prolongue your life by years.

-t

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jul 2005

Location: Vacation.

Status:

Offline

|

|

Originally Posted by turtle777

Oh, look, you're arguing with screamer. You should put that dud on ignore, it'll prolongue your life by years.

|

|

Been inclined to wander... off the beaten track.

That's where there's thunder... and the wind shouts back.

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Apr 2003

Location: 46 & 2

Status:

Offline

|

|

Originally Posted by turtle777

Oh, look, you're arguing with screamer. You should put that dud on ignore, it'll prolongue your life by years.

-t

He is, and so is besson, I just click on their messages every once in a while to see what they're babbling about.

|

|

"Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it."

- Thomas Paine

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

I think Shaddim is really quite charming and witty.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Jul 2001

Location: I don't know anymore!

Status:

Offline

|

|

|

|

|

Why is there always money for war, but none for education?

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

Warren is a hypocrit. Do you believe everything Warren says ?

-t

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Jul 2001

Location: I don't know anymore!

Status:

Offline

|

|

Originally Posted by turtle777

Warren is a hypocrit. Do you believe everything Warren says ?

-t

As always; can't refute the message, attack the messenger.

|

|

Why is there always money for war, but none for education?

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

Nah, I don't argue with old men.

-t

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Jul 2001

Location: I don't know anymore!

Status:

Offline

|

|

|

|

|

Why is there always money for war, but none for education?

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

Originally Posted by Shaddim

No, this "usual suspect" didn't miss it.  You miss the point that "the rich" being taxed more isn't going to fix even a fraction of this problem. We have to gut everyone's pet projects and entitlements to solve this. I'm ready to do my part, are you?

Yeah, you did because,

Originally Posted by Shaddim

I don't care to go rummaging through all the posts in this thread.

Originally Posted by Shaddim

He is, and so is besson, I just click on their messages every once in a while to see what they're babbling about.

That's why your replies here are just so lame.

Maybe you should take the turtles advice and prolong your life because your in over your head .

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Apr 2003

Location: 46 & 2

Status:

Offline

|

|

Originally Posted by screener

Yeah, you did because,

That's why your replies here are just so lame.

Maybe you should take the turtles advice and prolong your life because your [sic] in over your head .

I just showed how what I'm saying is true. Just refute it, if you can, instead of acting like a fool. Now I remember why I have you on ignore, you're* truly fatuous.

*Yes, it is you're instead of your. Learn English, for God's sake.

|

|

"Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it."

- Thomas Paine

|

| |

|

|

|

|

|

|

|

Senior User

Join Date: May 2009

Status:

Offline

|

|

Originally Posted by Shaddim

I just showed how what I'm saying is true. Just refute it, if you can, instead of acting like a fool. Now I remember why I have you on ignore, you're* truly fatuous.

Right, you admit not bothering to read all the posts and respond to a headline without reading the article.

Knee jerk reaction and I'm the fool.

Priceless.

So is this,

Originally Posted by Shaddim

Sure, repeal all the cuts, do it now. Doesn't bother me in the least. Better ask some of the middle class how they feel about that, though. Since it's going to hurt them much more than "my people". heh

There's the rub, them and the "my people" crowd.

Originally Posted by Shaddim

You miss the point that "the rich" being taxed more isn't going to fix even a fraction of this problem. We have to gut everyone's pet projects and entitlements to solve this. I'm ready to do my part, are you?

Already agreed to, that you seemed to have missed by ignoring certain posts and not reading the links.

But hey, keep me on ignore and wear it like a badge of honor like the "turt" does.

Originally Posted by Shaddim

*Yes, it is you're instead of your. Learn English, for God's sake.

I believe that was a grammatical error.

Thanks anyway.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forum Rules

|

|

|

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

|

HTML code is Off

|

|

|

|

|

|

|

|

|

|

|

|