|

|

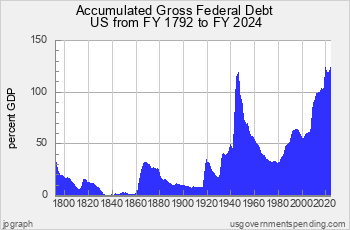

It's been almost 25 years since Reagan tripled the national debt... (Page 2)

|

|

|

|

|

Dedicated MacNNer

Join Date: Oct 2012

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

Maybe so, but we still have common sense, and mine is telling me that spending more than you make is going to be a ticking time bomb

I agree! It concerns me, too. But some things end up being counterintuitive, and perhaps this is one: some people like to make the argument that you can't run a household or a business the way we run our government. They are absolutely right, which is why the accompanying critique fails: it appears that we are indeed able to operate with a deficit indefinitely. Now, we may attempt to predict a point where that debt becomes critical, but those predictions should be taken with a very large grain of salt.

Originally Posted by Uncle Skeleton

FYI, you never did say what your conclusion is. If you wanted to, you should be more explicit.

You're right, I didn't have one, other than to say that in this area, I wouldn't give mathematical predictions much more value than a hunch. I don't know what the answer is: there may not be one. As for "doing better with what we have," I merely wanted to point out that a lot of people think most (or all) of those issues could be addressed not by raising taxes or increased deficit spending, but by changing our priorities in spending what we already have- more for education or infrastructure, or more loans for business startups, for example.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by raleur

Originally Posted by Uncle Skeleton

Maybe so, but we still have common sense, and mine is telling me that spending more than you make is going to be a ticking time bomb

I agree! It concerns me, too. But some things end up being counterintuitive, and perhaps this is one: some people like to make the argument that you can't run a household or a business the way we run our government. They are absolutely right, which is why the accompanying critique fails: it appears that we are indeed able to operate with a deficit indefinitely. Now, we may attempt to predict a point where that debt becomes critical, but those predictions should be taken with a very large grain of salt.

You're ok with concluding that we can indeed operate on a deficit indefinitely, with no evidence submitted and with only a single sample, half completed at best, in which the subject (usa) started off as literally the ONLY player in the game (of developed nations with working infrastructure after WWII), who proceeded to burn through that advantage until soon we will be struggling to hold on to last place. You're ok with that conclusion, but you feel the need to question the "common sense" or "thermodynamic" conclusion that you can't take more out than you put in? That's quite a double-standard you have there.

Originally Posted by Uncle Skeleton

FYI, you never did say what your conclusion is. If you wanted to, you should be more explicit.

You're right, I didn't have one, other than to say that in this area, I wouldn't give mathematical predictions much more value than a hunch. I don't know what the answer is: there may not be one. As for "doing better with what we have," I merely wanted to point out that a lot of people think most (or all) of those issues could be addressed not by raising taxes or increased deficit spending, but by changing our priorities in spending what we already have- more for education or infrastructure, or more loans for business startups, for example.

You dodged my question a second time now: what tools do we have other than mathematical ones (like taxation and debt)? I submit that we have none. One could argue that military action is an independent tool, to which I would reply that it would be even less effective at fixing the economy, if we wanted to make the sacrifices necessary to use it for that in the first place which we don't. I can't even think of any other options, let alone valid ones, can you? Given the fact that our only available tools are mathematical, I think your dismissal of mathematical analysis as just a hunch is preposterous. If these tools are good enough to be our only way to control the system, then they are good enough to analyze the system too. And if you're uncomfortable using them for analysis, then you should be raising holy hell against using them for control.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Oct 2012

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

That's quite a double-standard you have there.

I wonder if I missed your point, or even if we are talking about different things? I'm trying to examine the question of the original post, that is, what 'signs' we should look for that would indicate the consequences of Reagan's increasing the debt. I questioned the reliability of mathematical models, and suggested that those signs might be much more difficult to quantify, yet evident all the same. But it seems I expressed myself poorly. However, if you wish to characterize this as a double-standard, the burden of expression is yours: please explain why you see it that way.

Originally Posted by Uncle Skeleton

You dodged my question a second time now: what tools do we have other than mathematical ones (like taxation and debt)? I submit that we have none.

I'm not dodging any questions, but perhaps I missed your point? Since I clearly did not provide you with any useful examples, please define what you mean by "tools"- for all I know, I may agree with you.

Or, better yet, given the condescending tone, maybe take a shower to cool off?

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by raleur

Originally Posted by Uncle Skeleton

That's quite a double-standard you have there.

I wonder if I missed your point, or even if we are talking about different things? I'm trying to examine the question of the original post, that is, what 'signs' we should look for that would indicate the consequences of Reagan's increasing the debt. I questioned the reliability of mathematical models, and suggested that those signs might be much more difficult to quantify, yet evident all the same. But it seems I expressed myself poorly. However, if you wish to characterize this as a double-standard, the burden of expression is yours: please explain why you see it that way.

Simply put, one side says we are on borrowed time and the other shoe will some day drop, and the other side says if the shoe hasn't dropped by now then it never will and we're safe. You criticize the first side for having evidence that's too weak for you, yet you endorse the second side without any evidence weak or strong. That's a double-standard.

In short, I object to your statement that "we are indeed able to operate with a deficit indefinitely." That is unfounded; it certainly has less foundation than the conclusions based on mere "math."

Originally Posted by Uncle Skeleton

You dodged my question a second time now: what tools do we have other than mathematical ones (like taxation and debt)? I submit that we have none.

I'm not dodging any questions, but perhaps I missed your point? Since I clearly did not provide you with any useful examples, please define what you mean by "tools"- for all I know, I may agree with you.

Policy. Presume for a moment we have perfect knowledge of the economy, and presume that this knowledge tells us we need to make changes. What do you propose we change in order to improve the economy, in a way that's not "just math?"

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Oct 2012

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

Simply put, one side says we are on borrowed time and the other shoe will some day drop, and the other side says if the shoe hasn't dropped by now then it never will and we're safe. You criticize the first side for having evidence that's too weak for you, yet you endorse the second side without any evidence weak or strong. That's a double-standard.

Thanks for explaining it to me. I think you presume too much, or wish to pigenohole me as belonging to one side or the other. I hope that I am wrong in both cases. Yes, it is true that I believe "the other shoe will drop" side is weak- not only because I know that economics is highly imperfect when it tries to deal with economies of such scale and complexity, but also because that argument's been around for over two hundred years, and the shoe has yet to show up. So, in this sense at least, I do endorse the second side: despite two centuries of warning about government borrowing, the nation has in fact grown and prospered. We've been in debt for a very long time, but we're still here: there exists no stronger evidence. If you believe that amounts to a double standard, then I stand guilty.

But I think that you neglected my statements about other, less quantifiable warning signs- signs that have been put forward by both sides of the spectrum. As I mentioned before, the debt does concern me, and I believe that some of these less quantifiable signs point to a reckoning. However, I do not have any mathematical models that would demonstrate this- but I don't think I need any.

Originally Posted by Uncle Skeleton

In short, I object to your statement that "we are indeed able to operate with a deficit indefinitely." That is unfounded; it certainly has less foundation than the conclusions based on mere "math."

To the contrary: we are, and have been, operating with a deficit for quite some time. That is our current status, and it has has not ended- therefore, by definition, we are indeed operating under a deficit indefinitely. Until that changes, my statement is hardly unfounded.

Originally Posted by Uncle Skeleton

IPresume for a moment we have perfect knowledge of the economy, and presume that this knowledge tells us we need to make changes. What do you propose we change in order to improve the economy, in a way that's not "just math?"

Sorry, but I won't make such presumptions because, as I have argued above, I believe there is no such thing as "perfect knowledge of the economy," so any such predictions would be foolish.

As regards policy, you want to boil it down to a binary argument: we increase the deficit, or we raise taxes. Now, before I can reply, I need some clarification from you: by "increase the deficit," do you mean "keep spending at its current level," since that is technically an increase in deficit, or do you mean "increase spending from its current levels"? It can mean both, so I want a clearer distinction before I try to give you a satisfactory answer.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by raleur

Originally Posted by Uncle Skeleton

Simply put, one side says we are on borrowed time and the other shoe will some day drop, and the other side says if the shoe hasn't dropped by now then it never will and we're safe. You criticize the first side for having evidence that's too weak for you, yet you endorse the second side without any evidence weak or strong. That's a double-standard.

Thanks for explaining it to me. I think you presume too much, or wish to pigenohole me as belonging to one side or the other. I hope that I am wrong in both cases. Yes, it is true that I believe "the other shoe will drop" side is weak- not only because I know that economics is highly imperfect when it tries to deal with economies of such scale and complexity, but also because that argument's been around for over two hundred years, and the shoe has yet to show up.

First of all, 200 years isn't that long a time. If I say that no one in my family has died of skin cancer in 200 years, that doesn't mean I can assume my family is immune from skin cancer. It might just mean we're due. If there is "just math" evidence that skin cancer is still a danger, that evidence will out-weigh my wishful thinking evidence that I am secure. Otherwise I am relying on a double-standard.

Secondly, the historical debt was generally a lot smaller than what we have in the last 25 years (you know, the first half of the title of this thread):

And the previous peak was negated by both austerity measures in the US citizenry, and the fact that every other industrialized nation on earth had just been flattened, leaving us in a uniquely privileged position.

The fact that we've skirted skin cancer for 200 years doesn't mean it's perfectly safe to increase our sun exposure over historical levels by 5-10 times, and assume there will be no consequences.

So, in this sense at least, I do endorse the second side: despite two centuries of warning about government borrowing, the nation has in fact grown and prospered. We've been in debt for a very long time, but we're still here: there exists no stronger evidence. If you believe that amounts to a double standard, then I stand guilty.

Small sample size, survivorship bias, and cherry picking. Numerous other countries have collapsed under their debts, but the fact that we haven't yet means that we won't... yeah good point.

But I think that you neglected my statements about other, less quantifiable warning signs- signs that have been put forward by both sides of the spectrum. As I mentioned before, the debt does concern me, and I believe that some of these less quantifiable signs point to a reckoning. However, I do not have any mathematical models that would demonstrate this- but I don't think I need any.

You didn't make statements about less-quantifiable warning signs. You asked questions about if they were warning signs. Are you Glenn Beck?

Originally Posted by Uncle Skeleton

In short, I object to your statement that "we are indeed able to operate with a deficit indefinitely." That is unfounded; it certainly has less foundation than the conclusions based on mere "math."

To the contrary: we are, and have been, operating with a deficit for quite some time. That is our current status, and it has has not ended- therefore, by definition, we are indeed operating under a deficit indefinitely. Until that changes, my statement is hardly unfounded.

That's not what "indefinitely" means

Originally Posted by Uncle Skeleton

IPresume for a moment we have perfect knowledge of the economy, and presume that this knowledge tells us we need to make changes. What do you propose we change in order to improve the economy, in a way that's not "just math?"

Sorry, but I won't make such presumptions because, as I have argued above, I believe there is no such thing as "perfect knowledge of the economy," so any such predictions would be foolish.

As regards policy, you want to boil it down to a binary argument: we increase the deficit, or we raise taxes. Now, before I can reply, I need some clarification from you: by "increase the deficit," do you mean "keep spending at its current level," since that is technically an increase in deficit, or do you mean "increase spending from its current levels"? It can mean both, so I want a clearer distinction before I try to give you a satisfactory answer.

It doesn't matter unless you are saying that either of those is anything other than just "math." Are you?

Look it's a simple question, what could the government possibly ever do to influence the economy that doesn't constitute "just math?"

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Oct 2012

Status:

Offline

|

|

I am sorry to have wasted your time- but then, if 200 years is not a long time, you apparently have a great deal to waste.

On the other hand, you have shown yourself to be quite adept at hairsplitting and condescension- signs of a good internet debater.

I see that further explanation will fall on deaf ears, so I have no reason to continue: congratulations, you win the thread, and the internet.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Hey I'm still asking the same question since before your first post. It's not my fault if you can't answer it.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Apr 2003

Location: 46 & 2

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

You didn't make statements about less-quantifiable warning signs. You asked questions about if they were warning signs. Are you Glenn Beck?

Cheap shot!

|

|

"Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it."

- Thomas Paine

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forum Rules

|

|

|

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

|

HTML code is Off

|

|

|

|

|

|

|

|

|

|

|

|