|

|

Deficit reduction (Page 2)

|

|

|

|

|

Mac Elite

Join Date: Apr 2003

Location: Hong Kong

Status:

Offline

|

|

Originally Posted by Chongo

Can someone name a country that has taxed itself into prosperity?

Hong Kong - by staying a duty free port and having low personal and company taxes.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Sep 2000

Location: Across from the wallpaper store.

Status:

Offline

|

|

Originally Posted by Andy8

Hong Kong - by staying a duty free port and having low personal and company taxes.

I think he meant by having lots of taxes, not few.

|

|

Being in debt and celebrating a lower deficit is like being on a diet and celebrating the fact you gained two pounds this week instead of five.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Sep 2000

Location: Madison, WI

Status:

Offline

|

|

Originally Posted by hyteckit

I think we should have a separate income tax for the National Defense budget and War spending.

All wars funding must be paid for with a tax hike. Every-time congress wants to fund the war, it must be accompany with a tax increase to pay for it.

Call it the War Tax.

W0W?!!??!!111?

I think this is the first time I have ever agreed with one of your posts.

Yes, war expenditures--apart from the massively bloated DoD expenditures--should be funded with a dedicated tax mechanism. This might give US citizens pause before they cheer on our "heroic" troops being sent into harms way.

|

|

One should never stop striving for clarity of thought and precision of expression.

I would prefer my humanity sullied with the tarnish of science rather than the gloss of religion.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Sep 2000

Location: Madison, WI

Status:

Offline

|

|

Originally Posted by chabig

It does no good for the government to get financially healthy if it's morally financially bankrupt.

Government should have NO say in our morals. Apart from that, I agree with you. Financial health has nothing to with morals and everything to do with our debt levels.

We need to cut spending for everything--including Defense, Social Security, Medicare--and keep the tax levels the same until our debt is down to just $2Trillion or $3Trillion. Once our debt is within a reasonable range--This should take 10-20 years to achieve--then we institute massive tax cuts linked to "pay-as-you-go" spending plans.

In other words, cut spending now, use the tax revenue to pay down the National Debt, and then--in a decade or two--cut taxes with a requirement that any increases in spending is accompanied with a tax increase. If our politicians know that their pet projects will come with a tax increase they will be a lot less likely to pass funding legislation with pork in it.

(

Last edited by dcmacdaddy; Sep 4, 2010 at 01:03 AM.

)

|

|

One should never stop striving for clarity of thought and precision of expression.

I would prefer my humanity sullied with the tarnish of science rather than the gloss of religion.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Chongo

Can someone name a country that has taxed itself into prosperity?

The USA.

During the Great Depression.

•Taxes. The top income tax rate in 1929 was 24%, starting at $100,000 — which is the equivalent of $1.3 million today. The top rate rose sharply in 1932 to 63%, but it was levied on income above an inflation-adjusted $15.8 million. By 1944, however, the top rate soared to 94%, starting at today's equivalent of $2.4 million.

The lowest tax rate also rose sharply, from 4% in 1929 to 23% in 1944.

June 6th, Revenue Act of 1932 passed, the largest peacetime tax increase in the nation’s history to that date.

Employment started going up in 1933.

(

Last edited by hyteckit; Sep 4, 2010 at 04:43 AM.

)

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Newt Gingrich said we should copy China if we want to create jobs.

1. Government run banking system.

2. Starve out a recession by injection money into the economy through a $586 US billion stimulus package.

3. VAT introduce in 1984 and revised in 1994 to include many other items up to the rate of 17%. It makes up about 40% of China's tax revenue.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

|

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Aug 2007

Location: Phoenix, Arizona

Status:

Offline

|

|

Originally Posted by hyteckit

The USA.

During the Great Depression.

•Taxes. The top income tax rate in 1929 was 24%, starting at $100,000 — which is the equivalent of $1.3 million today. The top rate rose sharply in 1932 to 63%, but it was levied on income above an inflation-adjusted $15.8 million. By 1944, however, the top rate soared to 94%, starting at today's equivalent of $2.4 million.

The lowest tax rate also rose sharply, from 4% in 1929 to 23% in 1944.

June 6th, Revenue Act of 1932 passed, the largest peacetime tax increase in the nation’s history to that date.

Employment started going up in 1933.

Ehhh It was WWII that ended the great depression.

the "increase" in employment was due to make work programs like the Civilian Conservation Corps.

How Government Prolonged the Depression - WSJ.com

(

Last edited by Chongo; Sep 4, 2010 at 07:18 AM.

)

|

|

45/47

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Location: Zip, Boom, Bam

Status:

Offline

|

|

It's funny how the government cheerleaders credit EVERYTHING to their beloved government.

Seriously, what form of mental disorder causes this level of sycophancy?

The logo of the Democrat party should just be changed to a pair of kneepads and lipstick already.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Chongo

You mean employment went up due to increase in taxes and a government welfare program called Civilian Conservation Corps?

You mean the Civilian Conservation Corps added 7 million jobs alone?

So ignore the facts and rely on a hypothetical opinion piece in the WSJ?

How did the WWII end the great depression?

Increase in government spending? Increase in manufacturing?

Oh right, Republicans already outsourced most of our manufacturing.

(

Last edited by hyteckit; Sep 4, 2010 at 07:24 PM.

)

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Chongo

The article suggest the government should better regulation of the banking industry, increase competition by targeting anti-competitve companies and markets, and a stimulus package to increase manufacturing.

So the article is Pro-SSI, pro Unemployment benefits, pro government regulations, pro FDIC, pro government stimulus, and anti big monopolistic corporations.

Okay, that I can agree.

Some New Deal policies certainly benefited the economy by establishing a basic social safety net through Social Security and unemployment benefits, and by stabilizing the financial system through deposit insurance and the Securities Exchange Commission.

The most damaging policies were those at the heart of the recovery plan, including The National Industrial Recovery Act (NIRA), which tossed aside the nation's antitrust acts and permitted industries to collusively raise prices provided that they shared their newfound monopoly rents with workers by substantially raising wages well above underlying productivity growth.

President Barack Obama and Congress have a great opportunity to produce reforms that do return Americans to work, and that provide a foundation for sustained long-run economic growth and the opportunity for all Americans to succeed. These reforms should include very specific plans that update banking regulations and address a manufacturing sector in which several large industries -- including autos and steel -- are no longer internationally competitive.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

How did the WWII end the great depression?

Increase in government spending? Increase in manufacturing?

Bombing all the other industrial powers back to the stone age?

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Aug 2007

Location: Phoenix, Arizona

Status:

Offline

|

|

In the run to the US to entering the war (09/39-12/41) The US was the Arsenal of Democracy and the put millions of people to work. After the war, the US was left unscathed, while Europe and the USSR was left to rebuild, with US companies making a fortune.

|

|

45/47

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Oct 2000

Location: Los Angeles

Status:

Offline

|

|

Originally Posted by besson3c

Is this correct?

"Our deficits are absolutely out-of-control, we need to pay the deficit"

"Okay, how about we repeal the Bush tax cuts which were never paid for which would save $300 billion/year?"

"Oh no, we must not let those tax cuts expire, but we need to get back to sound fiscal responsibility. This administration is bankrupting the country!"

besson, you often try to claim fairness and impartiality, but I seldom if ever see you go against any DNC talking point. What gives?

Revenues aren't the problem in the US, and trying to attack the problem by raising taxes in the midst of a very tepid economic recovery is just a sure-fire path to further disaster. The problem is decidedly with spending across the board, most especially the public and the government employee entitlements that are overwhelmingly responsible for the fiscal train wreck and impending national bankruptcy of the country. The Democrat recipe of soaking all those who are above just making it by financially isn't going to solve this problem, not by any stretch.

(

Last edited by Big Mac; Sep 5, 2010 at 12:31 AM.

)

|

"The natural progress of things is for liberty to yield and government to gain ground." TJ

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by Big Mac

besson, you often try to claim fairness and impartiality, but I seldom if ever see you go against any DNC talking point. What gives?

Having to attach constant and consistent disclaimers designed to be equally just to all groups can be tiresome. I call things the way I see it no matter whether it is a DNC or RNC talking point or a besson3c talking point, and try to remind people frequently of my philosophy of not giving a rat's ass whether anybody else employed by either party shares my talking point.

Revenues aren't the problem in the US, and trying to attack the problem by raising taxes in the midst of a very tepid economic recovery is just a sure-fire path to further disaster. The problem is decidedly with spending across the board, most especially the public and the government employee entitlements that are overwhelmingly responsible for the fiscal train wreck and impending national bankruptcy of the country. The Democrat recipe of soaking all those who are above just making it by financially isn't going to solve this problem, not by any stretch.

We've gone over this a gazillion times, I don't think I want to again in fairness to both of us.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Oct 2000

Location: Los Angeles

Status:

Offline

|

|

Originally Posted by besson3c

Having to attach constant and consistent disclaimers designed to be equally just to all groups can be tiresome. I call things the way I see it no matter whether it is a DNC or RNC talking point or a besson3c talking point, and try to remind people frequently of my philosophy of not giving a rat's ass whether anybody else employed by either party shares my talking point.

It certainly seems like you're going for the Democratic line almost 90% of the time, but I could be wrong.

We've gone over this a gazillion times, I don't think I want to again in fairness to both of us.

It's interesting - you say that but I don't think we really have gone over it. You've told me multiple times you've already responded to me, but I never see much substance in any of those responses. Maybe I'm just tone deaf when it comes to your replies in this regard, but I think I try to honestly assess most of what you write.

And besides that, besson, that reply from you is really not much more than a cop out. Wouldn't you agree? If you could indulge me, write two substantive paragraphs in response to what I wrote, and then I'll credit you with having made the old college try.

(

Last edited by Big Mac; Sep 5, 2010 at 01:34 AM.

)

|

"The natural progress of things is for liberty to yield and government to gain ground." TJ

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by Big Mac

It certainly seems like you're going the Democratic line almost 90% of the time, but I could be wrong.

It's interesting - you say that but I don't think we really have gone over it. You've told me multiple times you've already responded to me, but I never see much substance in any of those responses. Maybe I'm just tone deaf when it comes to your replies in that regard, but I think I try to honestly assess most of what you write.

And besides that, besson, that reply from you is really not much more than a cop out. Wouldn't you agree? If you could indulge me, write two substantive paragraphs in response to what I wrote, and then I'll credit you with having made the old college try.

Why don't you start by summarizing my position on government entitlements in two substantive paragraphs, without any narrative and/or spin and/or commentary?

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Oct 2000

Location: Los Angeles

Status:

Offline

|

|

I honestly have no idea what your position is, so how can I be expected to summarize it?

I promise I'll do my utmost to be respectful.

|

"The natural progress of things is for liberty to yield and government to gain ground." TJ

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by Big Mac

I honestly have no idea what your position is, so how can I be expected to summarize it?

I promise I'll do my utmost to be respectful.

Okay, I'll give this another go... But please, when/if you pick apart this post, please respond to my actual positions, not what you think they are if you aren't sure, what the left's position is, or whatever. I know that you are passionate about this stuff and I appreciate that, but just as it is annoying for you to have to put up with all of these sorts of proxy arguments where people rant and rave about Sarah Palin (for instance) and project this upon the right being so stoooopid as a whole, it is annoying when the reverse is done, or one side lectures at the other without attempting to really understand the other person's position. In fairness to you, this is all standard here in the PWL in general, but since we are both long time members I'm hoping to break this cycle because it is really old and repetitive, not to mention probably a waste of time. I'll keep this simple and general...

My position on entitlements relates entirely to economic practicality, and not really with morality, what is "right", philosophy or constitutional argument about what government was designed to do, etc.

My position is simply that having people have to visit the ER because they can't afford health care, having starvation, crime, unwanted pregnancies, uneducated people, homelessness, and all of the other crud that often comes with poverty is a major expense that affects us all directly or indirectly and should not be underestimated. My response to this is *not* that we should be writing blank government checks, that unlimited or even partial welfare necessarily is a good thing, or any of that, but simply that we should sit down and explore the costs of doing/providing *nothing*, the ramifications of this economically, socially, and culturally, and compare this to the costs of providing a service with adequate resources, and try to find the best balance weighing all of these factors.

The best balance in some cases might be to let people fend for themselves, let the market pick winners and losers and all of that, and I accept that, the best balance in other cases might be otherwise. I don't have all of the answers or know where the balance is in all cases, but I think that we need to look at each area case by case and figure out what needs to be done that would have the best impact at the least cost. Like I said, in some cases it may literally cost us more to do nothing than to provide a basic safety net. The reason why insurance policies that you can purchase (auto, fire, etc.) exist is because there is an economic practicality and stability in spreading risk, just the same way as there is probably an economic practicality in offering a fire prevention service in a city/town.

I also tend to think that my basic position of not being firmly anti-safety net is really essentially shared on both sides by most people (e.g. having some sort of social security-like service, whether it is private or public), we just disagree on what, how much, and the balance. I generally disagree with people that say that the government should not be providing safety nets on the grounds that our founding fathers didn't want this, that the government sucks at this stuff, that we shouldn't be helping people on moral grounds, freedom this, freedom that, as I often see these sorts of arguments as being impractical and not providing a concrete and actionable direction - sort of like sitting in a meeting in a big company where people just talk to hear themselves talk and nothing is actually decided

That being said, I'm not opposed to replacing some government programs with private ones, but only if it makes sense to do this in keeping with all of the factors outlined above (economic practicality, economic/social/cultural ramifications, etc.), not just because. In making sense it also has to account for the real possibilities of their being negative ramifications of privatizing something. There is no just-add-water make-everything-private-everything-is-great sort of formula. Some services make more sense to be offered privately, some publicly... We need to be exploring which these are and why that account for these same factors rather than getting bogged down in political rhetoric.

I also happen to think this position is very much in keeping with the strengths and designs of our free market. As customers we ask ourselves:

- how much does it cost?

- how well will this thing work?

- is this a good choice?

really, this is no different than what I'm blabbing about, and again, what I'm sure is pretty much the same between both sides if we are able to cut through the rhetoric.

I could go on, but let's see how this goes as a starting place...

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Chongo

In the run to the US to entering the war (09/39-12/41) The US was the Arsenal of Democracy and the put millions of people to work. After the war, the US was left unscathed, while Europe and the USSR was left to rebuild, with US companies making a fortune.

In other words, the Federal Government did it.

In order words, massive deficit spending did it.

In other words, the Federal Government got us out of the great depression by increasing government spending in manufacturing in order to provide military weapons to allied countries, and by staying out of the war for a number of years.

Republicans today on the other hand, love to get into wars and outsource our manufacturing to countries like China. I wonder why China's economy is booming while USA is in a recession?

Let me see. How we got out of the great depression.

1. Increase taxes on the wealthy.

2. Create a welfare to work program to create million of jobs.

3. Massive deficit spending. Federal Government stimulated the economy by infusing money into manufacturing and ignoring the deficit.

Did New Deal end Depression? History says deficit spending works - DailyFinance

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

In other words, the Federal Government did it.

In order words, massive deficit spending did it.

In other words, the Federal Government got us out of the great depression by increasing government spending in manufacturing in order to provide military weapons to allied countries, and by staying out of the war for a number of years.

Republicans today on the other hand, love to get into wars and outsource our manufacturing to countries like China. I wonder why China's economy is booming while USA is in a recession?

Let me see. How we got out of the great depression.

1. Increase taxes on the wealthy.

2. Create a welfare to work program to create million of jobs.

3. Massive deficit spending. Federal Government stimulated the economy by infusing money into manufacturing and ignoring the deficit.

Did New Deal end Depression? History says deficit spending works - DailyFinance

It worked in WWII because of what was going on outside the US (everyone bought our stuff because they had all destroyed each other), not by shuffling money between public and private inside the US. Do you even comprehend the difference?

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by besson3c

I also tend to think that my basic position of not being firmly anti-safety net is really essentially shared on both sides by most people (e.g. having some sort of social security-like service, whether it is private or public), we just disagree on what, how much, and the balance.

...

As customers we ask ourselves:

- how much does it cost?

- how well will this thing work?

- is this a good choice?

I might be wrong, but I think a big part of the "other side's" motivation, one which "our side" likes to completely ignore, is whether the safety net is capable of discouraging its own use. You know, like "I'm going to save you this time, but you had better not do this again." It's not just a balance between cost vs utility, it's also a balance between rescuing vs enabling.

So add a fourth item to the list

- will it encourage people to do exactly the thing it's supposed to save them from?

I think if you can keep this "tough love" aspect in your mind, you will have a much easier time bridging the gap with people who agree with Big Mac. As always, I think analogy illustrates it best: It's just like how with terrorism, the brute force strategy carries a significant risk of actually increasing terrorism (by validating their hatred of us); the brute force strategy of welfare also carries a significant risk of actually increasing poverty (by incentivizing joblessness and waste). I don't know maybe that analogy doesn't work for you, but it works for me.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

I might be wrong, but I think a big part of the "other side's" motivation, one which "our side" likes to completely ignore, is whether the safety net is capable of discouraging its own use. You know, like "I'm going to save you this time, but you had better not do this again." It's not just a balance between cost vs utility, it's also a balance between rescuing vs enabling.

So add a fourth item to the list

- will it encourage people to do exactly the thing it's supposed to save them from?

I think if you can keep this "tough love" aspect in your mind, you will have a much easier time bridging the gap with people who agree with Big Mac. As always, I think analogy illustrates it best: It's just like how with terrorism, the brute force strategy carries a significant risk of actually increasing terrorism (by validating their hatred of us); the brute force strategy of welfare also carries a significant risk of actually increasing poverty (by incentivizing joblessness and waste). I don't know maybe that analogy doesn't work for you, but it works for me.

This is an excellent addendum, and I agree with this, despite not thinking of it when I wrote up my post. Thank you!

I'm not sure how expansive welfare is "brute force", but I get your point... There is definitely a balance between a really generous amount of welfare and none at all, both having very real direct and specific consequences and ramifications.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

It worked in WWII because of what was going on outside the US (everyone bought our stuff because they had all destroyed each other), not by shuffling money between public and private inside the US. Do you even comprehend the difference?

Yes, I do understand the difference. Do you?

The Real Lesson Of The New Deal - Forbes.com

year GDP

1929 103.6

1930 91.2

1931 76.5

1932 58.7

1933 56.4 New Deal enacted

1934 66.0

1935 73.3

1936 83.8

1937 91.9

1939 WWII Started

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

|

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

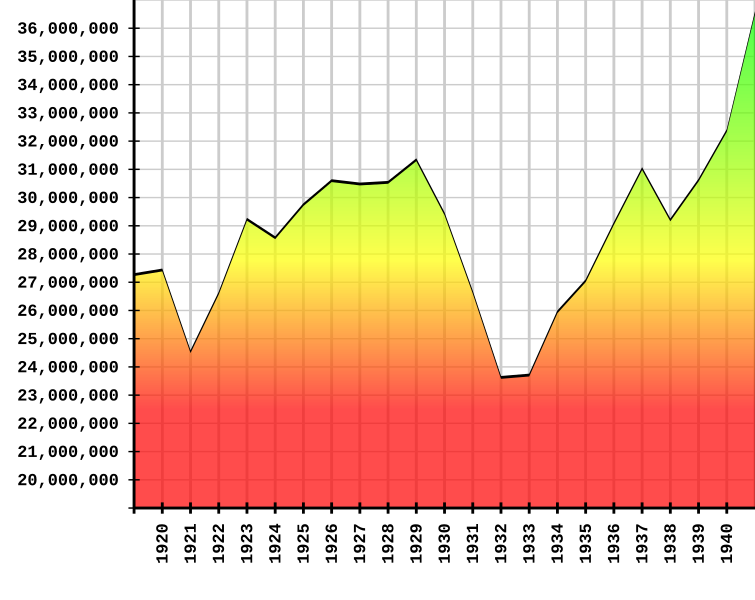

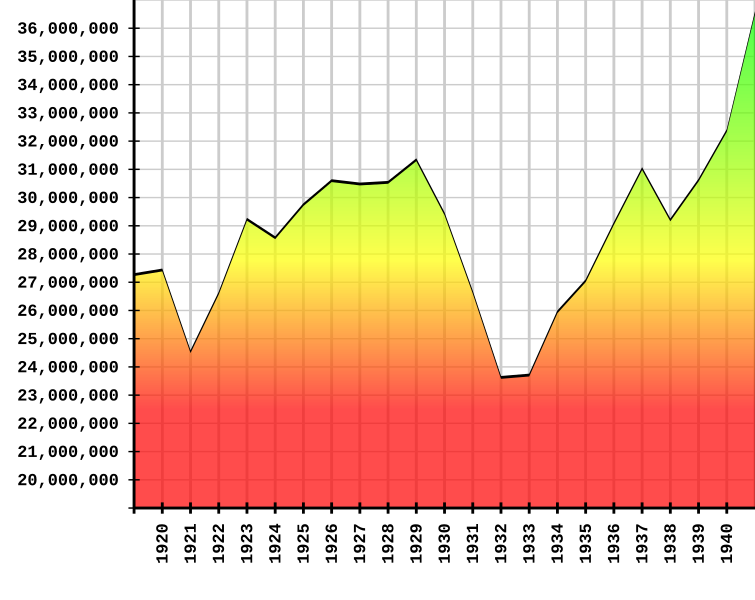

Deficits from the Great Depression to the end of WWII.

Government - Historical Debt Outstanding - Annual 1900 - 1949

06/28/1946 269,422,099,173.26

06/30/1945 258,682,187,409.93

06/30/1944 201,003,387,221.13

06/30/1943 136,696,090,329.90

06/30/1942 72,422,445,116.22

06/30/1941 48,961,443,535.71 US enter WWII

06/29/1940 42,967,531,037.68

06/30/1939 40,439,532,411.11

06/30/1938 37,164,740,315.45

06/30/1937 36,424,613,732.29

06/30/1936 33,778,543,493.73

06/29/1935 28,700,892,624.53

06/30/1934 27,053,141,414.48

06/30/1933 22,538,672,560.15 New Deal

06/30/1932 19,487,002,444.13

06/30/1931 16,801,281,491.71

06/30/1930 16,185,309,831.43

06/29/1929 16,931,088,484.10 Stock market collapse. start of the great depression.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

Yes, I do understand the difference.

Obviously you don't, because your follow-up is 3 posts that have nothing to do with international events and only focus doggedly on domestic policy.

You failed to state what it is you think that's relevant to, so I can only guess it is you think that rising GDP indicates success, before the war? The question isn't whether we can juice the GDP (like a parent propping up a child on their first bicycle), the question is whether it will maintain after the intervention ends (like a child staying upright on the bike after the parent lets go). Who knows whether that would have happened in the 40s if the US was not the only industrial power in the world, with no competition?

Do you have any historical example of Keynesian success that isn't tainted by the annihilation of international competitors?

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

I might be wrong, but I think a big part of the "other side's" motivation, one which "our side" likes to completely ignore, is whether the safety net is capable of discouraging its own use. You know, like "I'm going to save you this time, but you had better not do this again." It's not just a balance between cost vs utility, it's also a balance between rescuing vs enabling.

So add a fourth item to the list

- will it encourage people to do exactly the thing it's supposed to save them from?

I think if you can keep this "tough love" aspect in your mind, you will have a much easier time bridging the gap with people who agree with Big Mac. As always, I think analogy illustrates it best: It's just like how with terrorism, the brute force strategy carries a significant risk of actually increasing terrorism (by validating their hatred of us); the brute force strategy of welfare also carries a significant risk of actually increasing poverty (by incentivizing joblessness and waste). I don't know maybe that analogy doesn't work for you, but it works for me.

This goes for auto-manufacturers who return to the government multiple times for hand-outs, banks, etc... Safety nets are just that, nets. They are not trampolines and they do not generally lead to increased fiscal responsibility, least of which the government's.

To besson's point, I understand the desire to offer a helping hand for those in need. You offered some examples and I'm sorry besson, but I've gotta parse 'em out. - visit the ER because they can't afford health care - You'll recall the government response to this was a massive reform bill that includes all kinds of measures that have little to do with someone having to visit the ER. I won't bore you with the conversations we've had prior about allowing people to shop across state lines, HSAs and compatible plans, state charters for health insurance as opposed to state monopolies on them etc..., but these speak to the fundamental differences you outline above. The massive healthcare bill is comprised of safety nets that take more from you and "catch" others instead of encouraging them to lift themselves up into the system. To Uncle's point, this does nothing for encouraging a responsible use of one's own resources, but exacerbates the careless use of someone else's resource. I've broken out all those things we spend more money on such as vehicles, eating out and entertainment and believe it or not, these expenditures dwarf the amount of money spent on healthcare. Instead of saving to "catch" ourselves, we spend then ask that someone else catch us by going to the ER. There are manageable plans, even now, even for the self-employed, but there are a multitude of ways we can decrease the cost of health care without leaving a huge burden on ourselves and future generations.

- having starvation - Approximately 3% of US households report being hungry and/or having to skip meals. The ol' adage it is better to teach a man to fish than to hand him a fish applies here. If we gave less to the capable, we could afford more for the incapable.

- unwanted pregnancies - abortions, while legal should be taxed at the same rate as alcohol and tobacco and a man unwilling to help pay should be liable for damages in court. Ultimately, this is a "family problem" that is not easily addressed by any government program.

Teen Pregnancy statistics, signs, facts teenage pregnancy prevention

The primary reason that teenage girls who have never had intercourse give for abstaining from sex is that having sex would be against their religious or moral values. Other reasons cited include desire to avoid pregnancy, fear of contracting a sexually transmitted disease (STD), and not having met the appropriate partner. Three of four girls and over half of boys report that girls who have sex do so because their boyfriends want them to.

Teenagers who have strong emotional attachments to their parents are much less likely to become sexually active at an early age and less likely to have a teen pregnancy.

Most people say teens should remain abstinent but should have access to contraception. Ninety-four percent of adults in the United States-and 91 percent of teenagers-think it important that school-aged children and teenagers be given a strong message from society that they should abstain from sex until they are out of high school. Seventy-eight percent of adults also think that sexually active teenagers should have access to contraception to prevent teen pregnancy.

Contraceptive use among sexually active teens has increased but remains inconsistent. Three-quarters of teens use some method of contraception (usually a condom) the first time they have sex. A sexually active teen who does not use contraception has a 90 percent chance of teen pregnancy within one year.

Parents rate high among many adolescents as trustworthy and preferred information sources on birth control. One in two teens say they "trust" their parents most for reliable and complete information about birth control, only 12 percent say a friend.

Teens who have been raised by both parents (biological or adoptive) from birth, have lower probabilities of having sex than youths who grew up in any other family situation. At age 16, 22 percent of girls from intact families and 44 percent of other girls have had sex at least once. Similarly, teens from intact, two-parent families are less likely to give birth in their teens than girls from other family backgrounds.

How to fix this? There's no panacea, but I think some of the stuff Beck is derided for in another thread may help.

- uneducated people - While we spend more than multiple industrialized nations combined, we rank dismally low among them in math and science for example. We spend millions on schools that are failing, bloated administrations, and failed educators. A lot of this crud comes through the NEA, but we'll leave that for another thread.

- homelessness - The primary determinant of homelessness is mental illness. If we spend less on the capable, we'd have more for the incapable.

Granted, I know you didn't want each one parsed from the other and addressed, but this speaks to fundamental differences in philosophy. There is the easy road which says; "my gosh man - give them something to eat" and the tough road that suggests other means of improvement. Right now, we've taken the easy road on so many matters, not just for those in poverty, but for auto-manufacturers, banks, etc... that we simply cannot sustain the current level of spending. Any serious effort to reduce the deficit has got to consider the road less traveled.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Professional Poster

Join Date: Aug 2007

Location: Just west of DC.

Status:

Offline

|

|

Before we actually got into WWII, we were making war goods for the UK. Lend-Lease turned out to be Give-Give, as we got into the conflict ourselves. As far back as 1938, we were providing more materials and bulk goods to them. This is the beginnings of the increase in jobs before WWII.

How many of FDR's programs were overturned by the courts?

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by ebuddy

- visit the ER because they can't afford health care - You'll recall the government response to this was a massive reform bill that includes all kinds of measures that have little to do with someone having to visit the ER. I won't bore you with the conversations we've had prior about allowing people to shop across state lines, HSAs and compatible plans, state charters for health insurance as opposed to state monopolies on them etc..., but these speak to the fundamental differences you outline above. The massive healthcare bill is comprised of safety nets that take more from you and "catch" others instead of encouraging them to lift themselves up into the system. To Uncle's point, this does nothing for encouraging a responsible use of one's own resources, but exacerbates the careless use of someone else's resource. I've broken out all those things we spend more money on such as vehicles, eating out and entertainment and believe it or not, these expenditures dwarf the amount of money spent on healthcare. Instead of saving to "catch" ourselves, we spend then ask that someone else catch us by going to the ER. There are manageable plans, even now, even for the self-employed, but there are a multitude of ways we can decrease the cost of health care without leaving a huge burden on ourselves and future generations.

My points had nothing to do with the government response to health care. Agreed?

- having starvation - Approximately 3% of US households report being hungry and/or having to skip meals. The ol' adage it is better to teach a man to fish than to hand him a fish applies here. If we gave less to the capable, we could afford more for the incapable.

- unwanted pregnancies - abortions, while legal should be taxed at the same rate as alcohol and tobacco and a man unwilling to help pay should be liable for damages in court. Ultimately, this is a "family problem" that is not easily addressed by any government program.

Teen Pregnancy statistics, signs, facts teenage pregnancy prevention

My points also had nothing to do with solutions to these individual problems. My point was simply that these problems exist when the lower class is under duress, and they affect us all directly or indirectly. Do you recognize this point?

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

Obviously you don't, because your follow-up is 3 posts that have nothing to do with international events and only focus doggedly on domestic policy.

Actually, you don't.

Show me the numbers.

How much was our exports during the time of the great depression and WWII.

Don't make blanket statements like WWII got us out of the great depression without backing it up with facts and numbers.

Originally Posted by Uncle Skeleton

You failed to state what it is you think that's relevant to, so I can only guess it is you think that rising GDP indicates success, before the war? The question isn't whether we can juice the GDP (like a parent propping up a child on their first bicycle), the question is whether it will maintain after the intervention ends (like a child staying upright on the bike after the parent lets go). Who knows whether that would have happened in the 40s if the US was not the only industrial power in the world, with no competition?

Do you have any historical example of Keynesian success that isn't tainted by the annihilation of international competitors?

What do you mean how it is relevant?

What's a depression? How is that related to GDP? Look it up.

Annihilation of international competitors? How about before WWII got started. New Deal seem to be working fine. GDP up dramatically. Employment up dramatically. Nothing to do with the annihilation of international competitors. Seems that tax increases on the rich didn't kill the economy and the job market as some conservatives here claim.

year GDP

1929 103.6

1930 91.2

1931 76.5

1932 58.7

1933 56.4 New Deal enacted

1934 66.0

1935 73.3

1936 83.8

1937 91.9

1939 WWII Started

I say it's the New Deal along with the massive deficit spending the got us out of the great depression. The New Deal was already improving our GDP and employment numbers dramatically.

The US entering the war lead to a massive increase in deficit spending.

Before entering the War

06/30/1941 48,961,443,535.71

After the end of the War

06/28/1946 269,422,099,173.26

Our national deficit grew 550% in 5 years.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by besson3c

My points also had nothing to do with solutions to these individual problems. My point was simply that these problems exist when the lower class is under duress, and they affect us all directly or indirectly. Do you recognize this point?

I do besson, but I think an effective approach to poverty must address its cause more than its symptoms. I took your examples as those first to your mind in terms of "safety-nets" and evidence that your general focus seems to be on mitigating the signs of duress. I might be guilty of assuming a position for you, but I was going from what you had said earlier; I generally disagree with people that say that the government should not be providing safety nets on the grounds that our founding fathers didn't want this, that the government sucks at this stuff, that we shouldn't be helping people on moral grounds, freedom this, freedom that.

I mean, this essentially encompasses any argument to be made. There are concepts such as economic freedom, constitutionality, ethics, and a means of measuring the success or failure of an ideal. Because so much of the US economy is intertwined between entitlement and free market and limited in its overall resource, some ties will have to be cut for others to thrive. At cutting time, there is either less safety-net or more safety-net. When you look at the amount of resource going into safety-nets be it personal or corporate historically, you see an overall increase; people addressing symptoms over root causes. When there is more concern for symptoms than causes, we exacerbate the symptoms and bring more people under duress. Does that make sense?

If we're not talking about solutions then I guess I've jumped the gun. Let's revisit the "balance" idea then. When you talk about a balance, what do you mean?

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

New Deal seem to be working fine. GDP up dramatically. Employment up dramatically.

Government spending is a component of GDP. If you raise government spending, of course GDP will rise! The question is how do you pay it back (take a glance at the title of the thread).

Nothing to do with the annihilation of international competitors. Seems that tax increases on the rich didn't kill the economy and the job market as some conservatives here claim.

If you're the only industrial country left standing in the world, nothing would kill your economy.

I say it's the New Deal along with the massive deficit spending the got us out of the great depression. The New Deal was already improving our GDP and employment numbers dramatically.

At the cost of deficit spending.

The US entering the war lead to a massive increase in deficit spending.

Deficit spending was a cost, not a benefit.

Your strategy is akin to counting your mortgage balance as income. It's like taking a cash advance on your credit card and calling it your job and your paycheck. Of course there are legitimate uses for loans like that, but the legitimacy all boils down to whether it allows you to pay back the loan in a timely manner. It's not a windfall.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by ebuddy

I do besson, but I think an effective approach to poverty must address its cause more than its symptoms. I took your examples as those first to your mind in terms of "safety-nets" and evidence that your general focus seems to be on mitigating the signs of duress. I might be guilty of assuming a position for you, but I was going from what you had said earlier; I generally disagree with people that say that the government should not be providing safety nets on the grounds that our founding fathers didn't want this, that the government sucks at this stuff, that we shouldn't be helping people on moral grounds, freedom this, freedom that.

I mean, this essentially encompasses any argument to be made. There are concepts such as economic freedom, constitutionality, ethics, and a means of measuring the success or failure of an ideal. Because so much of the US economy is intertwined between entitlement and free market and limited in its overall resource, some ties will have to be cut for others to thrive. At cutting time, there is either less safety-net or more safety-net. When you look at the amount of resource going into safety-nets be it personal or corporate historically, you see an overall increase; people addressing symptoms over root causes. When there is more concern for symptoms than causes, we exacerbate the symptoms and bring more people under duress. Does that make sense?

If we're not talking about solutions then I guess I've jumped the gun. Let's revisit the "balance" idea then. When you talk about a balance, what do you mean?

Okay, I was just confused by you quoting me, as if this related directly to what I wrote. What I wrote did not relate specifically to solutions to the individual "symptoms" I listed. Of course it makes sense to address the root causes of these symptoms though, whatever they are. However, that list was just something I rattled off, not something I was intending to fixate on.

As far as "balance" goes, a sizable part of my post was about this very balance. What part was unclear to you?

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

Government spending is a component of GDP. If you raise government spending, of course GDP will rise! The question is how do you pay it back (take a glance at the title of the thread).

If you're the only industrial country left standing in the world, nothing would kill your economy.

At the cost of deficit spending.

Deficit spending was a cost, not a benefit.

Your strategy is akin to counting your mortgage balance as income. It's like taking a cash advance on your credit card and calling it your job and your paycheck. Of course there are legitimate uses for loans like that, but the legitimacy all boils down to whether it allows you to pay back the loan in a timely manner. It's not a windfall.

You are getting there.

Now, why don't you compare the GDP increase, job creation, unemployment rate, and increase in the national deficit between the policies under the New Deal and the presidency under Reagan and George W. Bush?

Government - Historical Debt Outstanding � Annual

Under New Deal

06/29/1940 42,967,531,037.68 (190% increase)

06/30/1939 40,439,532,411.11

06/30/1938 37,164,740,315.45

06/30/1937 36,424,613,732.29

06/30/1936 33,778,543,493.73

06/29/1935 28,700,892,624.53

06/30/1934 27,053,141,414.48

06/30/1933 22,538,672,560.15 New Deal

Under Reagan

09/30/1988 2,602,337,712,041.16 (260% increase)

09/30/1987 2,350,276,890,953.00

09/30/1986 2,125,302,616,658.42

09/30/1985 * 1,823,103,000,000.00

09/30/1984 * 1,572,266,000,000.00

09/30/1983 * 1,377,210,000,000.00

09/30/1982 * 1,142,034,000,000.00

09/30/1981 * 997,855,000,000.00

Under George W. Bush

09/30/2008 10,024,724,896,912.49 (172% increase)

09/30/2007 9,007,653,372,262.48

09/30/2006 8,506,973,899,215.23

09/30/2005 7,932,709,661,723.50

09/30/2004 7,379,052,696,330.32

09/30/2003 6,783,231,062,743.62

09/30/2002 6,228,235,965,597.16

09/30/2001 5,807,463,412,200.06

Under Clinton

09/30/2000 5,674,178,209,886.86 (128% increase)

09/30/1999 5,656,270,901,615.43

09/30/1998 5,526,193,008,897.62

09/30/1997 5,413,146,011,397.34

09/30/1996 5,224,810,939,135.73

09/29/1995 4,973,982,900,709.39

09/30/1994 4,692,749,910,013.32

09/30/1993 4,411,488,883,139.38

Job Creation:

FDR

1st term: +5.3%

2nd term: +2.6%

3rd term: +5.2%

Reagan:

1st term: +1.5%

2nd term: +2.7%

Clinton:

1st term: +2.6%

2nd term: +2.3%

George W. Bush:

1st term: +2.2%

2nd term: +0.2%

Proof that Ronald Reagan is a crappy president?

According to conservatives, Ronald Reagan is the best president and Clinton is the worst president.

Or Carter was the worst president, then Clinton, now Obama.

As VP Dick Cheney said "ronald reagan proved that deficits don't matter."

Haha...

(

Last edited by hyteckit; Sep 9, 2010 at 08:47 AM.

)

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

For me, deficits do matter.

However, I do think deficit spending is necessary during a recession in order to increase GDP and lower the unemployment rate. It's a necessary stimulus for the economy, so we don't go into a depression.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Professional Poster

Join Date: Aug 2007

Location: Just west of DC.

Status:

Offline

|

|

Found this at:

CNSNews.com - Obama Added More to National Debt in First 19 Months Than All Presidents from Washington Through Reagan Combined, Says Gov’t Data

Might add to the discussion...........

Obama Added More to National Debt in First 19 Months Than All Presidents from Washington Through Reagan Combined, Says Gov’t Data

September 08, 2010

By Terence P. Jeffrey, Editor-in-Chief

(CNSNews.com) - In the first 19 months of the Obama administration, the federal debt held by the public increased by $2.5260 trillion, which is more than the cumulative total of the national debt held by the public that was amassed by all U.S. presidents from George Washington through Ronald Reagan.

The U.S. Treasury Department divides the federal debt into two categories. One is “debt held by the public,” which includes U.S. government securities owned by individuals, corporations, state or local governments, foreign governments and other entities outside the federal government itself. The other is “intragovernmental” debt, which includes I.O.U.s the federal government gives to itself when, for example, the Treasury borrows money out of the Social Security “trust fund” to pay for expenses other than Social Security.

At the end of fiscal year 1989, which ended eight months after President Reagan left office, the total federal debt held by the public was $2.1907 trillion, according to the Congressional Budget Office. That means all U.S. presidents from George Washington through Ronald Reagan had accumulated only that much publicly held debt on behalf of American taxpayers. That is $335.3 billion less than the $2.5260 trillion that was added to the federal debt held by the public just between Jan. 20, 2009, when President Obama was inaugurated, and Aug. 20, 2010, the 19-month anniversary of Obama's inauguration.

By contrast, President Reagan was sworn into office on Jan. 20, 1981 and left office eight years later on Jan. 20, 1989. At the end of fiscal 1980, four months before Reagan was inaugurated, the federal debt held by the public was $711.9 billion, according to CBO. At the end of fiscal 1989, eight months after Reagan left office, the federal debt held by the public was $2.1907 trillion. That means that in the nine-fiscal-year period of 1980-89--which included all of Reagan’s eight years in office--the federal debt held by the public increased $1.4788 trillion. That is in excess of a trillion dollars less than the $2.5260 increase in the debt held by the public during Obama’s first 19 months.

When President Barack Obama took the oath of office on Jan. 20, 2009, the total federal debt held by the public stood at 6.3073 trillion, according to the Bureau of the Public Debt, a division of the U.S. Treasury Department. As of Aug. 20, 2010, after the first nineteen months of President Obama’s 48-month term, the total federal debt held by the public had grown to a total of $8.8333 trillion, an increase of $2.5260 trillion.

In just the last four months (May through August), according to the CBO, the Obama administration has run cumulative deficits of $464 billion, more than the $458 billion deficit the Bush administration ran through the entirety of fiscal 2008.

The CBO predicted this week that the annual budget deficit for fiscal 2010, which ends on the last day of this month, will exceed $1.3 trillion.

The first two fiscal years in which Obama has served will see the two biggest federal deficits as a percentage of Gross Domestic Product since the end of World War II.

“CBO currently estimates that the deficit for 2010 will be about $70 billion below last year’s total but will still exceed $1.3 trillion,” said the CBO’s monthly budget review for September, which was released yesterday. “Relative to the size of the economy, this year’s deficit is expected to be the second-largest shortfall in the past 65 years: At 9.1 percent of gross domestic product (GDP), that deficit will be exceeded only by last year’s deficit of 9.9 percent of GDP.”

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

"hyteckit proved that imports and exports don't matter"

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

"hyteckit proved that imports and exports don't matter"

Show me the numbers.

I say God got us out of the Great Depression. Or maybe Lord Buddha.

Seriously. You keep repeating WWII. But you keep ignoring the fact that before WWII was even starting, GDP grew double digits and employment numbers will up because of the New Deal.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by besson3c

Okay, I was just confused by you quoting me, as if this related directly to what I wrote. What I wrote did not relate specifically to solutions to the individual "symptoms" I listed. Of course it makes sense to address the root causes of these symptoms though, whatever they are. However, that list was just something I rattled off, not something I was intending to fixate on.

As far as "balance" goes, a sizable part of my post was about this very balance. What part was unclear to you?

You discussed the idea that some things could be privatized, other things governmental, and that people should abandon rhetoric to sit down and discuss possibilities, but what possibilities? There have always been discussions both sober and passionate on the different ways of tackling an issue. Folks will compromise on some things, hold the line on others, but there are a couple of very basic, conflicting governing philosophies that inevitably come to a head. The reason we're even talking about all this is because we're governed by a hodge-podge of ideals crafted through compromise. i.e. sitting down minus the rhetoric and crafting legislation.

I think the altitude of your point might still be a tad high for me yet.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Apr 2003

Location: Hong Kong

Status:

Offline

|

|

Originally Posted by hyteckit

I say God got us out of the Great Depression. Or maybe Lord Buddha.

Treat churches as businesses and tax them accordingly.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

Seriously. You keep repeating WWII. But you keep ignoring the fact that before WWII was even starting, GDP grew double digits and employment numbers will up because of the New Deal.

GDP is just a metric for economic growth, not a synonym. The metric becomes distorted when deficit spending goes through the roof, because of the simple fact that government spending is a component of the metric. It is literally a linear relationship. You can raise GDP any time you want, just by jacking up government spending to an arbitrarily high amount. That doesn't mean you're fixing the economy, all it means is that the metric is becoming less informative. Show me that GDP stays high after the debt is paid back down and I'll be happy. But in the case of the 30s we can't see that because by the time the debt was paid back down, the whole picture was obscured by the war.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Mar 2001

Location: yes

Status:

Offline

|

|

Originally Posted by ebuddy

You discussed the idea that some things could be privatized, other things governmental, and that people should abandon rhetoric to sit down and discuss possibilities, but what possibilities? There have always been discussions both sober and passionate on the different ways of tackling an issue. Folks will compromise on some things, hold the line on others, but there are a couple of very basic, conflicting governing philosophies that inevitably come to a head. The reason we're even talking about all this is because we're governed by a hodge-podge of ideals crafted through compromise. i.e. sitting down minus the rhetoric and crafting legislation.

I think the altitude of your point might still be a tad high for me yet.

The altitude is high, but I think the only way to move forward is to confront those governing philosophies (which are also often very high altitude) and put them aside while the house is burning, metaphorically speaking.

Have you ever worked for a large company long enough to get a feel for its inner operations and efficiencies? Have you ever sat in a meeting where guys in suits and ties were proposing these high minded ideas that you thought were retarded, you had other people at the meeting debating this from a philosophical standpoint, and people leaving the meeting having accomplished nothing when you felt that you could probably get stuff done in a fraction of the time that you knew would work great if you were given the power and authority?

This sort of things happens because of philosophy, emotions, and politics (fussing over the control of power) enters the fray. Yes, there are some things that are very, very hard to work past because of human differences of various sorts, but there are also some things that are very practical and could get done and accomplish things if one could put this sort of stuff aside.

Sometimes the right solutions just don't coincide with philosophical ideals, but if you were to analyze the situation like a scientist might and look for the best solution once agreeing upon some basic objectives and assessments and completely disregarding philosophy, religion, all of that other stuff, I think you could ultimately find some very concrete, practical, and defendable solutions that could be rationalized. I don't think that we are that far apart on our basic objectives with many of the issues we have wrestled with such as health care, for instance. I would agree that it is impossible to *completely* put this stuff aside, but I think we can definitely tell it to **** off for a little while and keep it at bay so that we can be practical and get stuff done.

It is high altitude stuff because we as people have a difficult time getting past all of this philosophical stuff and are extremely lethargic when it comes to act. However, like I said, I don't think we are going to get very far if we are fussing over high altitude concepts such as all of the aforementioned and somewhat distracting lines of debate. We aren't going to move forward unless we can return to simply the hard cold facts and analysis...

- Here is solution a, solution b, solution c

- Solution a is likely present these potential challenges

- Solution b is likely to cost this much

- Solution c may have these unintended consequences

- Measure the likelihood of x, y, z, tweak, refine, find the best balance, massage, add a hint of lime

This can't happen when we have politicians that can't agree on shit for reasons that have nothing to do with any of the above: balance of power, political parties, religion, putting philosophical ideals over practicalities, political careers, feelings, elections, reputations, media exposure, distrust/corruption, etc. This can't happen when our electorate is fixated on these very same things, on whether Obama is a Muslim or not, whether he eats the right hot dogs, whether this triggers certain emotions, etc.

Idealistic? Yes, but I don't see any way around this.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

If you are for deficit reduction, then you must hate Pres. Reagan.

Ronald Reagan is a big spending RINO.

taxes-what-people-forget-about-reagan: Personal Finance News from Yahoo! Finance

National Deficit Under Reagan

09/30/1988 2,602,337,712,041.16 (260% increase)

09/30/1987 2,350,276,890,953.00

09/30/1986 2,125,302,616,658.42

09/30/1985 * 1,823,103,000,000.00

09/30/1984 * 1,572,266,000,000.00

09/30/1983 * 1,377,210,000,000.00

09/30/1982 * 1,142,034,000,000.00

09/30/1981 * 997,855,000,000.00

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by besson3c

The altitude is high, but I think the only way to move forward is to confront those governing philosophies (which are also often very high altitude) and put them aside while the house is burning, metaphorically speaking.

Have you ever worked for a large company long enough to get a feel for its inner operations and efficiencies? Have you ever sat in a meeting where guys in suits and ties were proposing these high minded ideas that you thought were retarded, you had other people at the meeting debating this from a philosophical standpoint, and people leaving the meeting having accomplished nothing when you felt that you could probably get stuff done in a fraction of the time that you knew would work great if you were given the power and authority?

This sort of things happens because of philosophy, emotions, and politics (fussing over the control of power) enters the fray. Yes, there are some things that are very, very hard to work past because of human differences of various sorts, but there are also some things that are very practical and could get done and accomplish things if one could put this sort of stuff aside.

I feel the pangs of this frustration several times per week, this is actually a very good example. There aren't an infinite number of possibilities IMO, only a few key contributors to a problem. You see fundamental philosophies at play in problem management. Is the process broken? Are the people broken? Are their tools broken? Processes and tools are more tangible so we spend a great deal of time proposing process changes and/or investment in new tools. The people problem is the hard part. Is their leadership effective? Are the people happy? Are there enough people? Of the people problem, we'll spend a great deal of time discussing if the people are happy and if there are enough people, but effective leadership and/or accountability never made its way to the discussion. Accountability is the road less travelled, it is a buzz-kill, it is the work, and the confrontation; it is less popular. So instead of addressing Lucy's chronically low performance for example, we're back to talking about how to make the employees happier across the board. We'll invariably conclude that a process or tool is broken or that we don't have enough people and for good measure someone will work toward another tired employee recognition program that will have us all back at the table later wondering why our quality has not improved.

Sometimes the right solutions just don't coincide with philosophical ideals, but if you were to analyze the situation like a scientist might and look for the best solution once agreeing upon some basic objectives and assessments and completely disregarding philosophy, religion, all of that other stuff, I think you could ultimately find some very concrete, practical, and defendable solutions that could be rationalized. I don't think that we are that far apart on our basic objectives with many of the issues we have wrestled with such as health care, for instance. I would agree that it is impossible to *completely* put this stuff aside, but I think we can definitely tell it to **** off for a little while and keep it at bay so that we can be practical and get stuff done.

IMO there is no infinite array of possibilities, only a few. Most of it analysis paralysis that complicates a matter and enables poor decision-making and/or the easy path. In this it seems philosophies develop out of the trends in the facts and the facts are subject to differing interpretation. i.e. to "put this stuff aside" we must deny human nature.

It is high altitude stuff because we as people have a difficult time getting past all of this philosophical stuff and are extremely lethargic when it comes to act. However, like I said, I don't think we are going to get very far if we are fussing over high altitude concepts such as all of the aforementioned and somewhat distracting lines of debate. We aren't going to move forward unless we can return to simply the hard cold facts and analysis...

The problem is "facts" are rarely cold and hard.

- Here is solution a, solution b, solution c

- Solution a is likely present these potential challenges

- Solution b is likely to cost this much

- Solution c may have these unintended consequences

- Measure the likelihood of x, y, z, tweak, refine, find the best balance, massage, add a hint of lime

This can't happen when we have politicians that can't agree on shit for reasons that have nothing to do with any of the above: balance of power, political parties, religion, putting philosophical ideals over practicalities, political careers, feelings, elections, reputations, media exposure, distrust/corruption, etc. This can't happen when our electorate is fixated on these very same things, on whether Obama is a Muslim or not, whether he eats the right hot dogs, whether this triggers certain emotions, etc. Idealistic? Yes, but I don't see any way around this.

You might be surprised at how few are truly concerned of whether or not Obama is a muslim, what he eats, and where. This is popular for people with a differing philosophy to say; "hey look at how crazy those wingers are", but really very few care to discuss such trivial things. Most want what's good for everyone, they just interpret facts differently and as such have developed a contrarian philosophy. The rest is all just a human stress reaction to the obstacle of compromise. This doesn't mean compromise is always a good thing.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

|

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Don't you have to have recovery and job growth to kill them?

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by ebuddy

Don't you have to have recovery and job growth to kill them?

It depends on whether you believe jobs begin at conception

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by ebuddy

Don't you have to have recovery and job growth to kill them?

In case you didn't see it the first time.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by hyteckit

In case you didn't see it the first time.

But that's just a bar graph, do you have a link for it? Too bad we can't run a census every 2 months, we could employ these people FOREVER!

I'm also curious, are you a big fan of Reagan? In one post you're making fun of him for racking up a deficit, but then you're citing articles claiming 300 economists believe you need to rack up a deficit to protect economic recovery and job growth. Are deficits a bad thing in your view or not? Do tax cuts also rack up the deficit? Is this good or bad?

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forum Rules

|

|

|

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

|

HTML code is Off

|

|

|

|

|

|

|

|

|

|

|

|