|

|

It's been almost 25 years since Reagan tripled the national debt...

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

This thread has amazing backfire potential, but no one said learning meant not revealing ignorance.

In the Romney fiscal policy thread, ebuddy commented he wanted to reduce the deficit because he had kids. I was a kid during the reagan administration, during which time the national debt tripled. From then until now, we've seen very few surplus years and zero dent put into reducing the national debt.

I'm an adult now. Therefore, I should be currently paying for the debt sins of our fathers from the 80s. My question is, how am I? What natural consequences of such spending are we seeing now?

|

|

|

| |

|

|

|

|

|

|

|

Professional Poster

Join Date: Aug 2007

Location: Just west of DC.

Status:

Offline

|

|

Blame congress, and everybody who voted for a senator or congressman.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

I have no factual knowledge of this topic, and I hope someone who does will post. But the question intrigues me enough to hazard a purely theoretical guess. Looking forward, one can presume that a large debt (A) would create a drag from interest expenses, taking away from our ability to provide services using the same money, (B) could reduce our financial credibility abroad, and (C) could create an air of lawlessness and lax enforcement, because after all there's no point in saving or sacrificing when the game is rigged.

Now looking backward to (A), are there any services we might expect government to start providing in this modern (compared to Reagan era) age? Health care? What if we could afford socialized medicine (like other nations are doing) if not for our crippling debt? (B) Has our international credit sunk? Was it directly attributable to our national debt and inability to manage it? (C) Has the disease of reckless indebtedness spread to the private sector? And how.

These might not be cause and effect, but I don't see any obvious reason to NOT suspect that our perpetual astronomical debt hasn't harmed us in significant ways.

|

|

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

But the question intrigues me enough to hazard a purely theoretical guess. Looking forward, one can presume that a large debt (A) would create a drag from interest expenses, taking away from our ability to provide services using the same money, (B) could reduce our financial credibility abroad, and (C) could create an air of lawlessness and lax enforcement, because after all there's no point in saving or sacrificing when the game is rigged.

I'm little confused with the looking forward because I'm thinking that seeing as its been 25 years, we should have some signs already.

Originally Posted by Uncle Skeleton

Now looking backward to (A), are there any services we might expect government to start providing in this modern (compared to Reagan era) age? Health care? What if we could afford socialized medicine (like other nations are doing) if not for our crippling debt? (B) Has our international credit sunk? Was it directly attributable to our national debt and inability to manage it? (C) Has the disease of reckless indebtedness spread to the private sector? And how.

These might not be cause and effect, but I don't see any obvious reason to NOT suspect that our perpetual astronomical debt hasn't harmed us in significant ways.

Some good stuff here. I'll wait to see some better educated people respond before I try weighing in.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by The Final Dakar

Originally Posted by Uncle Skeleton

But the question intrigues me enough to hazard a purely theoretical guess. Looking forward, one can presume that a large debt (A) would create a drag from interest expenses, taking away from our ability to provide services using the same money, (B) could reduce our financial credibility abroad, and (C) could create an air of lawlessness and lax enforcement, because after all there's no point in saving or sacrificing when the game is rigged.

I'm little confused with the looking forward because I'm thinking that seeing as its been 25 years, we should have some signs already.

Trying to sidestep the hindsight fallacy. You have to imagine what the 80s might have reasonably predicted for us, and what we can now reasonably predict for the 2040s, without the benefit of hindsight, in order to have a hope of answering whether it came true or not.

|

|

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

Trying to sidestep the hindsight fallacy.

Tried to google this, but not finding anything apparent, unless this is about IPOs and bubbles.

Originally Posted by Uncle Skeleton

You have to imagine what the 80s might have reasonably predicted for us, and what we can now reasonably predict for the 2040s, without the benefit of hindsight, in order to have a hope of answering whether it came true or not.

i.e., black and white text from the 80s and 90s making predictions? Seems rigorous but fair.

---

Since I was young, I have to ask (anyone) – was there concerns about debt and future generations during Reagan's presidency? I certainly know there was by the 90s.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: Chicago, Bang! Bang!

Status:

Offline

|

|

I'm thinking the fallacy is assuming you had foresight of something which is clear in hindsight.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Yeah sorry I'm not referencing anything, just trying to create an ad hoc shorthand for a bit of common sense. Thanks subego, that is an excellent summary of what I was trying to say.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by The Final Dakar

This thread has amazing backfire potential, but no one said learning meant not revealing ignorance.

In the Romney fiscal policy thread, ebuddy commented he wanted to reduce the deficit because he had kids. I was a kid during the reagan administration, during which time the national debt tripled. From then until now, we've seen very few surplus years and zero dent put into reducing the national debt.

I'm an adult now. Therefore, I should be currently paying for the debt sins of our fathers from the 80s. My question is, how am I? What natural consequences of such spending are we seeing now?

The main consequence of the national debt is that every tax dollar spent on the principal of the debt and the interest to service it is a tax dollar not spent on government programs or services. This is presently about 6% ... so essentially 6 cents of every tax dollar is spent on interest payments. The national debt increases when the government borrows money by issuing Treasury securities, and when interest is charged on them. The national debt decreases when Treasury securities are paid back when their term expires. Because the government doesn't have the money to pay off all the Treasure securities when they expire .... they issue more to raise the funds. What we call "Borrowing from Peter to pay Paul." Now generally this isn't much of an issue when the cost of borrowing (i.e. the interest charged on Treasury securities) is low. But it can become a huge problem if we get into a situation where we are paying off low-cost, expiring debt by issuing high-cost, new debt. The cost of of the national debt is a function of risk. The higher the risk ... real or perceived ... the higher the cost and vice versa. Risk can increase when the ratio of debt to GDP becomes too high. Risk can increase if scheduled payments are missed. Etc. So it's all about keep the level of debt and its servicing at a manageable level. If things start to get out of control you can have a situation like what's happening in Greece and Spain. If private investors abandon a government's debt issuance or demand incredible high interest rates to lend funds ... then you're looking a "austerity measures" like sharply higher taxes and dramatically reduced spending ... which in the short run only serves to make things worse. This hasn't happened to the US b/c at the end of the day we are still the world's largest economy. And we nearly brought a debt crisis like that on ourselves with the debt-ceilling debacle in summer 2011. We can think our good friends on the right for that foolishness. In any event, we are "paying for the debt sins of our fathers" in the form of reduced government programs/services that we would rather have ... or increased taxes that we would rather not pay ... b/c of the interest we MUST PAY on the national debt.

OAW

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Apr 2003

Location: 46 & 2

Status:

Offline

|

|

Blame both parties, rarely has one group held both houses and the presidency for long enough to cause much damage (except for the broken Healthcare reform thing).

|

|

"Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it."

- Thomas Paine

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by The Final Dakar

This thread has amazing backfire potential, but no one said learning meant not revealing ignorance.

In the Romney fiscal policy thread, ebuddy commented he wanted to reduce the deficit because he had kids. I was a kid during the reagan administration, during which time the national debt tripled. From then until now, we've seen very few surplus years and zero dent put into reducing the national debt.

I'm an adult now. Therefore, I should be currently paying for the debt sins of our fathers from the 80s. My question is, how am I? What natural consequences of such spending are we seeing now?

Others have provided valuable feedback so I'm not professing to be more educated, but hopefully my .02 will offer some additional perspective.

- First, general hardship in all its historic fashion. Considering how difficult it is to merely balance an annual budget, we of course have been accumulating debt from the Reagan era. With growing debt comes growing interest, exponentially. The interest eventually becomes so much a share of gdp on its own that it becomes burdensome. This, combined with ongoing government deficits creates a new, higher baseline in future obligations to merely function as a nation. Disturbances in the ratio of obligations to gdp triggers the Fed to action. The problem is, there isn't much more for the Fed to do at this point. You can either borrow more, print more, or take more and there is less headroom for responding to special causes overall. We can only use government funds to ease symptoms for so long. If conditions get bad enough, you have to do all of the above. This leads to stagflation and worse. This doesn't mean we don't exist at the same time as our kids, but we would be the ones with the responsibility to try to address it. In this regard it's not what Reagan's debt alone has meant to you, but the accumulation of failed monetary policies and debt. Naturally, if we have less, our kids have less. What Reagan did right that would stave some of the blow of debt is target policy more favorable to economic growth while spending some hostile global elements into compliance. Simply put; if you owe $50k and earn $73k/yr, you're in much better shape across the board than someone who owes $50k and earns $50k/yr or less.

- Geopolitical dependence; sustaining high levels of debt at these new baselines in obligation results in a degree of dependence upon global players we may not want to finance. Not only does our debtor status hamper our geopolitical leverage on matters of human rights, defense strategy, or lop-sided monetary policy, a well-timed pull of this plug at current levels would have a substantial impact on the US' ability to keep up with the daily, monetary demands of a nation. We don't have a lot of room for lowering interest rates to stimulate outside investment so we engage one of the three means above and face the subsequent challenges. Not to mention cuts that would have folks collecting in the streets, not unlike what we're seeing abroad. Of course I don't want to live in such an environment and I want even less for my kids to live in such an environment.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by subego

I'm thinking the fallacy is assuming you had foresight of something which is clear in hindsight.

Am I wording something to claim we should have seen something coming 25 years ago that we didn't?

---

Oww... more paragraphs, please. Huddler makes this stuff difficult to read without glazing over.

Originally Posted by OAW

The main consequence of the national debt is that every tax dollar spent on the principal of the debt and the interest to service it is a tax dollar not spent on government programs or services. This is presently about 6% ... so essentially 6 cents of every tax dollar is spent on interest payments. The national debt increases when the government borrows money by issuing Treasury securities, and when interest is charged on them. The national debt decreases when Treasury securities are paid back when their term expires. Because the government doesn't have the money to pay off all the Treasure securities when they expire .... they issue more to raise the funds. What we call "Borrowing from Peter to pay Paul." Now generally this isn't much of an issue when the cost of borrowing (i.e. the interest charged on Treasury securities) is low. But it can become a huge problem if we get into a situation where we are paying off low-cost, expiring debt by issuing high-cost, new debt. The cost of of the national debt is a function of risk. The higher the risk ... real or perceived ... the higher the cost and vice versa. Risk can increase when the ratio of debt to GDP becomes too high. Risk can increase if scheduled payments are missed. Etc. So it's all about keep the level of debt and its servicing at a manageable level. If things start to get out of control you can have a situation like what's happening in Greece and Spain. If private investors abandon a government's debt issuance or demand incredible high interest rates to lend funds ... then you're looking a "austerity measures" like sharply higher taxes and dramatically reduced spending ... which in the short run only serves to make things worse. This hasn't happened to the US b/c at the end of the day we are still the world's largest economy. And we nearly brought a debt crisis like that on ourselves with the debt-ceilling debacle in summer 2011. We can think our good friends on the right for that foolishness. In any event, we are "paying for the debt sins of our fathers" in the form of reduced government programs/services that we would rather have ... or increased taxes that we would rather not pay ... b/c of the interest we MUST PAY on the national debt.

OAW

I think I get the basic gist of this... say I have student loans I have to repay at a lower percentage come due, but since I don't have the funds, I take out a loan with a shark at a worse rate. That's what you're saying, right?

Where does our ability to print money fall into this?

Originally Posted by ebuddy

Others have provided valuable feedback so I'm not professing to be more educated, but hopefully my .02 will offer some additional perspective. - First, general hardship in all its historic fashion. Considering how difficult it is to merely balance an annual budget, we of course have been accumulating debt from the Reagan era. With growing debt comes growing interest, exponentially. The interest eventually becomes so much a share of gdp on its own that it becomes burdensome. This, combined with ongoing government deficits creates a new, higher baseline in future obligations to merely function as a nation. Disturbances in the ratio of obligations to gdp triggers the Fed to action. The problem is, there isn't much more for the Fed to do at this point. You can either borrow more, print more, or take more and there is less headroom for responding to special causes overall.

- With you so far, makes sense.

Originally Posted by ebuddy

We can only use government funds to ease symptoms for so long. If conditions get bad enough, you have to do all of the above. This leads to stagflation and worse. This doesn't mean we don't exist at the same time as our kids, but we would be the ones with the responsibility to try to address it. In this regard it's not what Reagan's debt alone has meant to you, but the accumulation of failed monetary policies and debt. Naturally, if we have less, our kids have less.

I think this gets to what I'm asking – what are the symptoms that we're seeing? I don't think I'd know most if they slapped me in the face.

Originally Posted by ebuddy

What Reagan did right that would stave some of the blow of debt is target policy more favorable to economic growth while spending some hostile global elements into compliance. Simply put; if you owe $50k and earn $73k/yr, you're in much better shape across the board than someone who owes $50k and earns $50k/yr or less.

If this is referencing trickle-down, nothing supports it. If it references some other policy, please elaborate. I'd be curious if its stuff we're doing or can do today.

Originally Posted by ebuddy

- Geopolitical dependence; sustaining high levels of debt at these new baselines in obligation results in a degree of dependence upon global players we may not want to finance. Not only does our debtor status hamper our geopolitical leverage on matters of human rights, defense strategy, or lop-sided monetary policy, a well-timed pull of this plug at current levels would have a substantial impact on the US' ability to keep up with the daily, monetary demands of a nation. We don't have a lot of room for lowering interest rates to stimulate outside investment so we engage one of the three means above and face the subsequent challenges. Not to mention cuts that would have folks collecting in the streets, not unlike what we're seeing abroad. Of course I don't want to live in such an environment and I want even less for my kids to live in such an environment.

This references China, right?

Out of curiosity, does anyone know if we hold some other nation's debt?

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by The Final Dakar

Originally Posted by subego

I'm thinking the fallacy is assuming you had foresight of something which is clear in hindsight.

Am I wording something to claim we should have seen something coming 25 years ago that we didn't?

What's the point of ever analyzing the past, if not to improve our foresight for the future?

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by The Final Dakar

I think this gets to what I'm asking – what are the symptoms that we're seeing? I don't think I'd know most if they slapped me in the face.

First, money. In short, we've been fortunate. We've been carrying and growing this debt all along, but to owe $50k is not as bad for someone producing more than $70k (GDP) as it is for one producing only $50k (obligations @ 100% of GDP) The debt may be invisible to you at present, but it's an albatross that hangs around the neck of the US Treasury. You may have heard the term "austerity" with regard to our friends overseas. What's happening is that they cannot keep apace with the new baselines in obligation I mentioned earlier; a major factor of this problem is their growing debt. At some point, massive cuts in services become inevitable. According to the Census Bureau, 49% of Americans live in households that receive government aid be it Medicaid or Medicare, EBT/food stamps, disability, Social Security, or housing-assistance programs. Massive cuts here may not affect you, but it'd have a substantial impact on nearly half of us.

You and I, at present, may be fortunate, but I wouldn't let that perpetuate a false sense of security or a lack of respect for a $16 trillion debt. Consider the downgrade of our national credit rating; international markets use these indices to gauge the relative ability of a country to meet its financial obligations -- i.e. their debt. A credit downgrade sends up a red flag to those invested or planning to invest in the US economy which becomes another factor that chokes the money supply. As the annual deficits, debt, and related interest continue to compound exponentially, we increasingly cannot keep apace with the increasing obligations, and those engaged in commerce who watch the actions of our Fed closely, lose confidence and stop taking financial risks and spending. Consumers, less confident in their own budgets, begin to pull back expenditures. We see this problem more immediately with the increased obligatory expenditures on perpetual unemployment benefit extensions and more people requiring government aid in growing the welfare rolls, but there are also other signs of trouble. Labor force participation rates at a 30-year low. Fed monetary policy trying desperately to keep apace with the economy through quantitative easing and maintaining zero interest rates are quickly running out of ideas, increases in long-term investments and hedging are all choking the money supply, making it more difficult to lend to smaller start-ups, less employment, lower GDP to debt ratio, rinse/repeat.

If this is referencing trickle-down, nothing supports it. If it references some other policy, please elaborate. I'd be curious if its stuff we're doing or can do today.

Of all the numerous debates among economists on supply-side economics, you pop in to state unequivocally there's nothing to support it? By this logic, there is nothing to support any economic theory. Laffer based this philosophy in the early 80's on the history of monetary behaviors under numerous tax environments and the data showing the stimulus of tax cuts. Nearly everyone on both sides of the aisle have acknowledged the merit of this principle at one time or another including Obama. There is actually a great deal of evidence to support the ideal from Kennedy-on. No one is arguing whether or not people who have more, spend more as this behavior is absolutely beyond question. The contention has always been the threshold at which returns diminish. Where you have a point is that changes in the tax code have never occurred in a vacuum as there have always been other factors including other Fed activities and spending. What we know is that "trickle-up" is physically impossible. That's what we know.

What we also know is the history of giving laterally to a centralized authority and waiting for that resource to trickle-down through the masses. It has never been a solvent model; hence the $16 trillion debt. Worse, while Federal outlays continue to increase and Federal revenue continues to increase, so also does wealth disparity, the number of children born into poverty, stagnating wages, decreasing incomes and valuation, increasing welfare rolls, etc...

This references China, right?

Out of curiosity, does anyone know if we hold some other nation's debt?

We do including many entities throughout the Middle East. We also meddle in their affairs early and often by granting debt forgiveness or threatening to withhold the resource. There are many factors that constrain China's leverage against the US, but as we become more needy, they become more emboldened. It should be noted however, that China has a wealth of monetary problems on the horizon as well. The problems I've been citing for you on the US are certainly not unique to the US.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

What's the point of ever analyzing the past, if not to improve our foresight for the future?

You two make my head hurt.

|

|

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by ebuddy

First, money. In short, we've been fortunate. We've been carrying and growing this debt all along, but to owe $50k is not as bad for someone producing more than $70k (GDP) as it is for one producing only $50k (obligations @ 100% of GDP) The debt may be invisible to you at present, but it's an albatross that hangs around the neck of the US Treasury.

See, this is what I mean. 25 years of debt and the symptoms are "invisible"?

Originally Posted by ebuddy

You may have heard the term "austerity" with regard to our friends overseas. What's happening is that they cannot keep apace with the new baselines in obligation I mentioned earlier; a major factor of this problem is their growing debt. At some point, massive cuts in services become inevitable. According to the Census Bureau, 49% of Americans live in households that receive government aid be it Medicaid or Medicare, EBT/food stamps, disability, Social Security, or housing-assistance programs. Massive cuts here may not affect you, but it'd have a substantial impact on nearly half of us.

Is this not selective stat quoting? Is that 49% pre or post economic downturn? Also, is this the "47%" that Mitt Romney alluded to?

Originally Posted by ebuddy

You and I, at present, may be fortunate, but I wouldn't let that perpetuate a false sense of security or a lack of respect for a $16 trillion debt.

But why are we fortunate? That's what I'm asking. 25 years and the chicken has not come home to roost. Why?

Also, why can't we theoretically maintain deficit spending at an average of the previous 25 years since we've seen no real negative repercussions. (Allowing for a stable economy)

Originally Posted by ebuddy

Consider the downgrade of our national credit rating; international markets use these indices to gauge the relative ability of a country to meet its financial obligations -- i.e. their debt. A credit downgrade sends up a red flag to those invested or planning to invest in the US economy which becomes another factor that chokes the money supply.

Was this not a result of political theater regarding the debt ceiling?

Originally Posted by ebuddy

As the annual deficits, debt, and related interest continue to compound exponentially, we increasingly cannot keep apace with the increasing obligations, and those engaged in commerce who watch the actions of our Fed closely, lose confidence and stop taking financial risks and spending. Consumers, less confident in their own budgets, begin to pull back expenditures. We see this problem more immediately with the increased obligatory expenditures on perpetual unemployment benefit extensions and more people requiring government aid in growing the welfare rolls, but there are also other signs of trouble. Labor force participation rates at a 30-year low. Fed monetary policy trying desperately to keep apace with the economy through quantitative easing and maintaining zero interest rates are quickly running out of ideas, increases in long-term investments and hedging are all choking the money supply, making it more difficult to lend to smaller start-ups, less employment, lower GDP to debt ratio, rinse/repeat.

How much of this is a result of the economic downturn, rather than deficit? A few of the ones I comprehend sound economy related, not deficit.

Originally Posted by ebuddy

Of all the numerous debates among economists on supply-side economics, you pop in to state unequivocally there's nothing to support it? By this logic, there is nothing to support any economic theory. Laffer based this philosophy in the early 80's on the history of monetary behaviors under numerous tax environments and the data showing the stimulus of tax cuts. Nearly everyone on both sides of the aisle have acknowledged the merit of this principle at one time or another including Obama. There is actually a great deal of evidence to support the ideal from Kennedy-on.

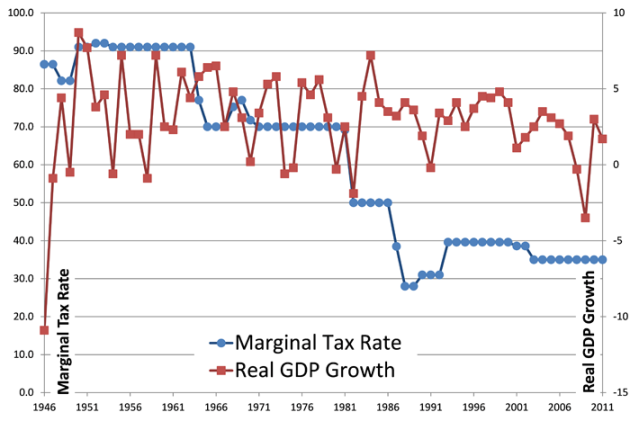

Feel free to post some. In the meantime, this is what I've seen (but perhaps not really understood):

I see absolutely no correlation between tax rates and GDP. Is GDP an incorrect measure to use for comparison?

A different measure:

Here's something scary:

There does seem to be a slight correlation there, to my layman eyes.

Originally Posted by ebuddy

What we know is that "trickle-up" is physically impossible. That's what we know.

How do you define trickle-up?

If it's an increasing income gap, then it's been happening for 50 years.

If you're talking decreasing income value, well that's been happening for the last 10:

Selective stat quoting?

However, regarding my assertion that trickle down doesn't work:

http://www.cnbc.com/id/49059989/Stud..._t_Spur_Growth

A study from the Congressional Research Service — the non-partisan research office for Congress — shows that “there is little evidence over the past 65 years that tax cuts for the highest earners are associated with savings, investment or productivity growth."

In fact, the study found that higher tax rates for the wealthy are statistically associated with higher levels of growth.

Lowering these rates for the wealthy, the study found, isn't aligned with significant improvement in any of the areas it examined. Pushing tax rates down had a "negligible effect" on private saving, and while it does note a relationship between investing and capital gains rates, the correlations “are not statistically significant,” the study says.

Do higher taxes on the rich lead to faster economic growth? Not necessarily. The paper says that while growth accelerated with higher taxes on the rich, the relationship is “not strong” and may be “coincidental,” since broader economic factors may be responsible for that growth.

There is one part of the economy, however, that is changed by tax cuts for the rich: inequality. The study says that the biggest change in the distribution of U.S. income has been with the top 0.1 percent of earners — not the one percent. (Read more: Salaries of Top Earners Tumbling)

The share of total income going to the top 0.1 percent hovered around 4 percent during the 1950s, 1960s and 1970s, then rose to 12 percent by the mid-2000s. During this period, the average tax rate paid by the 0.1 percent fell from more than 40 percent to below 25 percent.

The study said that “as top tax rates are reduced, the share of income accruing to the top of the income distribution increases” and that “these relationships are statistically significant.”

This was something I theorized in another thread, and it turns out I may be right. If the US is indeed a middle class driven economy as I was taught growing up, this would be detrimental to the health of the economy, wouldn't it?

Originally Posted by ebuddy

What we also know is the history of giving laterally to a centralized authority and waiting for that resource to trickle-down through the masses. It has never been a solvent model; hence the $16 trillion debt. Worse, while Federal outlays continue to increase and Federal revenue continues to increase, so also does wealth disparity, the number of children born into poverty, stagnating wages, decreasing incomes and valuation, increasing welfare rolls, etc...

Are you arguing government debt contributed to the income gap?

Apologies for the bessoneque, "Every ****ing answer to a question is a question." I tried to back up my reasoning where I could.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by The Final Dakar

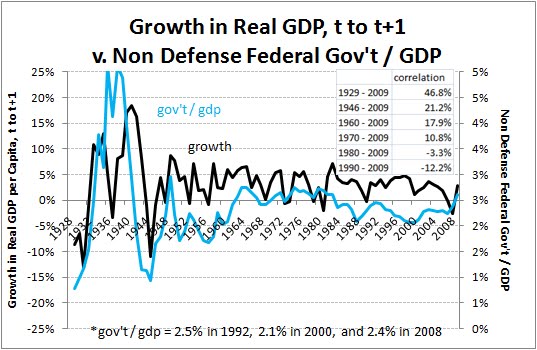

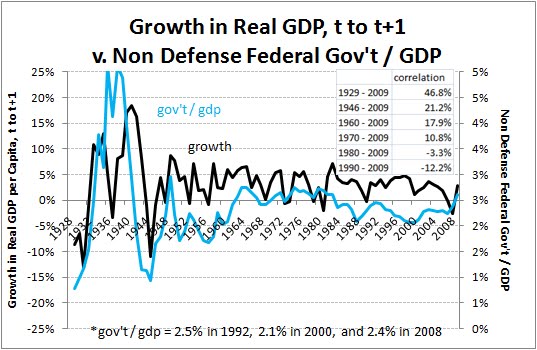

Here's something scary:

There does seem to be a slight correlation there, to my layman eyes.

That one is tautological. GDP = private consumption + gross investment + government spending + (exports − imports)

Of course there is going to be a correlation, but that correlation is mathematical, not sociological.

Originally Posted by The Final Dakar

Originally Posted by Uncle Skeleton

What's the point of ever analyzing the past, if not to improve our foresight for the future?

You two make my head hurt.

I thought it was a pretty straightforward question

|

|

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

That one is tautological. GDP = private consumption + gross investment + government spending + (exports − imports)

Of course there is going to be a correlation, but that correlation is mathematical, not sociological.

I think I semi-realized that, but then lost the train of thought as I went back to deal with other questions. Your point seems obvious in retrospect.

Edit: I think I found it noteworthy because it excluded defense spending, and hey, stimulus.

Originally Posted by Uncle Skeleton

I thought it was a pretty straightforward question

You answered my question with a question that doesn't relate to mine. Hence, PAIN.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by The Final Dakar

Originally Posted by Uncle Skeleton

That one is tautological. GDP = private consumption + gross investment + government spending + (exports − imports)

Of course there is going to be a correlation, but that correlation is mathematical, not sociological.

I think I semi-realized that, but then lost the train of thought as I went back to deal with other questions. Your point seems obvious in retrospect.

Edit: I think I found it noteworthy because it excluded defense spending, and hey, stimulus.

It's a pretty good control graph for the others you posted. Otherwise we might start to wonder if any correlation can be detected against GDP. I'm not convinced it's a good context, but at least it doesn't seem to be totally unusable.

Originally Posted by Uncle Skeleton

I thought it was a pretty straightforward question

You answered my question with a question that doesn't relate to mine. Hence, PAIN.

Would you be happier if I simply said "yes."

? My unsolicited advice is that you stop letting yourself be upset by something as harmless as answering a question with a question.

|

|

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

Would you be happier if I simply said "yes."

? My unsolicited advice is that you stop letting yourself be upset by something as harmless as answering a question with a question.

Not really. My melodramatic tone aside, it's hard for me to understand what I'm wording wrong if no one will point out exactly what it is I'm doing.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by The Final Dakar

Originally Posted by Uncle Skeleton

Would you be happier if I simply said "yes."

? My unsolicited advice is that you stop letting yourself be upset by something as harmless as answering a question with a question.

Not really. My melodramatic tone aside, it's hard for me to understand what I'm wording wrong if no one will point out exactly what it is I'm doing.

I'm having a hard time with your premise that something has gone wrong at all.

|

|

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Ok. I'll chalk this up to the typical misunderstanding that occurs if subego and I are in too close proximity to one another.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: Chicago, Bang! Bang!

Status:

Offline

|

|

I like to call it the "Comprehension Distortion Field".

It's a gift.

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by The Final Dakar

See, this is what I mean. 25 years of debt and the symptoms are "invisible"?

They've not been invisible, they've been sustainable. This is why leaders on both sides of the aisle including Cheney have marginalized the urgency. At an assumed level of growth, (while absurd IMO) the debt can grow. The problem is, this attitude to justify spending (from 25 years of bad policy) leaves little room for special causes such as sustained periods of anemic growth or disasters of other kinds. There becomes a point at which the debt becomes unsustainable; the point I mentioned earlier where the interest on the debt alone becomes a severe, scheduled burden on your bottom line. It's mathematical. That's why I said it's not so much Reagan's debt as it has been failed policy this entire time. We've all run deficits. We just have to pay the bills and of course, how is where many differ. I think it's very "visible" and with regard to my own finances, probably about the time I'd say "holy shit, it's go time".

Is this not selective stat quoting? Is that 49% pre or post economic downturn? Also, is this the "47%" that Mitt Romney alluded to?

For the record; any statistic that does not include all statistics before or after it, is likely a selective statistic. I believe the number is post-economic downturn, but I have no reason to ignore substantial growth in government services in general. This happens for a reason and I believe it comes at a cost that can only increase. I think it's an important message that Romney botched out of desperation to convince the well-endowed, potential donors in attendance at that event that he would not spend their money pandering to bases he couldn't hope to win over. That the number could be anywhere in the 40's is not only sloppily cynical, but if true wouldn't justify him spending their money trying.

But why are we fortunate? That's what I'm asking. 25 years and the chicken has not come home to roost. Why?

A little water in the basement is bad, but you can pump it out as it comes in. Too much water coming into the basement, if not addressed at some point, will eventually exceed your ability to pump it out.

Also, why can't we theoretically maintain deficit spending at an average of the previous 25 years since we've seen no real negative repercussions. (Allowing for a stable economy)

You just answered your question. The truth is, we've seen a slow, negative repercussion that an assumed level of growth increasingly cannot address let alone sustained periods of no or anemic growth.

Was this not a result of political theater regarding the debt ceiling?

Some of it sure, to the extent that all things political are theatrical. The debt ceiling is going to be raised because the debt itself requires it. If the budget calls for so much money, more often than not, it'll be allowed that money. It's political theatre in that they are required to give it some semblance of focus for their constituency and to some degree, themselves. The problem of course is, and always has been, the level of spending itself. There was no debt ceiling debate in the numerous Euro members that had been downgraded. It's a real number, with real consequences.

How much of this is a result of the economic downturn, rather than deficit? A few of the ones I comprehend sound economy related, not deficit.

Spending is a choice when times are good, it's an obligation and albatross when times are bad.

Feel free to post some. In the meantime, this is what I've seen (but perhaps not really understood)

I see absolutely no correlation between tax rates and GDP. Is GDP an incorrect measure to use for comparison?

To be clear, you're suggesting that because GDP has remained relatively static while the marginal tax rate has fluctuated wildly in a downward trend, that there is no correlation between the two. What you might have missed is government spending.

6260/width/350/height/700[/IMG]

With continued increases in government spending, (included in GDP) you have a situation where the GDP is essentially being artificially propped up by government spending. There are some important differences to consider. First, you're showing only the top, marginal tax rate which in many respects echoes the sentiment of many conservatives here that decry the class warfare behind a meaningless proposal to increase taxes on the wealthy and fails to consider the fluctuation in the numbers of this bloc of taxpayers and how resourced they are to avoid the increases. We're also not dealing with a decade-long recession, a World War that destroys the economy and infrastructure of the rest of the world's superpowers leaving the US as the only major industrial nation, and a global labor shortage. Otherwise, the logic works both ways and the only reason to raise taxes would be -- just because. Notions such as consumption taxes on energy, alcohol, and tobacco would be passé . I wouldn't say GDP is an incorrect gauge necessarily, just sort of a simpleton one.

In light of this chart, my question to you would be -- why raise taxes at all then, on anyone?

How do you define trickle-up?

With regard to taxation (not a matter of choice, but a compulsory contribution), trickling would be money that comes from people and is distributed to other people. You're making a causal argument from correlative data. In other words, you don't explain how the money is being taken from one group of people and distributed to the other.

If it's an increasing income gap, then it's been happening for 50 years.

Again, this is correlative, not causal because you've not indicated how money is being taken from one and distributed through to the others.

If you're talking decreasing income value, well that's been happening for the last 10. Selective stat quoting?

See above. I wouldn't call it as much a selective stat as a dubious assumption.

However, regarding my assertion that trickle down doesn't work:

http://www.cnbc.com/id/49059989/Stud..._t_Spur_Growth

This was something I theorized in another thread, and it turns out I may be right. If the US is indeed a middle class driven economy as I was taught growing up, this would be detrimental to the health of the economy, wouldn't it?

Not in my view. The periods of the slimmest wealth disparity were characterized by the poor remaining poor and the wealthy simply having -- less wealth. Why is this a good thing? It seems cynical to me to somehow conclude that "income" is an expendable commodity such that if you get a raise this year Dakar, it must be coming off of someone's paycheck that earns less than you. Income does not work this way and your cited article does not make the connection between correlative and causal here. Instead of "knocking those rich people back a peg", shouldn't the goal be to elevate the achievement and financial stewardship of those at the bottom, not retard the growth of those at the top? In an ideal situation, everyone is in the position of effectively managing their wealth; one of the primary advantages of those who network with others of wealth. By merely taxing "the rich" more, we're hoping to decrease wealth disparity, but shouldn't this be reflected somewhere within the incredible growth of revenue into the Federal government?

6261/width/350/height/700[/IMG]

IMO, using the Federal government as the source of distributing wealth is a horrible idea.

Are you arguing government debt contributed to the income gap?

Yes, but in a more roundabout way. The problem all along has been spending - the debt is a symptom of bad policy. While federal revenue continues to grow and government outlays continue to grow, we have greater wealth disparity, the number of children born into poverty increases, stagnating wages, decreasing incomes and valuation, increasing welfare rolls, etc. What I've been arguing is the moral hazard of easing symptoms in merely perpetuating a dependency class. And it's obviously not working.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Sep 2000

Location: The Rock

Status:

Offline

|

|

Originally Posted by ebuddy

6260/width/350/height/700[/IMG]

With continued increases in government spending, (included in GDP) you have a situation where the GDP is essentially being artificially propped up by government spending.

[same old argument]

Other countries that are considered economically successful - including Canada and Germany - have higher government spending as a percentage of GDP than does the US.

Of course, they also have higher tax collection as a percentage of GDP, too. Way higher. So maybe it's not just the federal spending that's the problem?

[/same old argument]

|

|

Mankind's only chance is to harness the power of stupid.

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by ShortcutToMoncton

[same old argument]

Other countries that are considered economically successful - including Canada and Germany - have higher government spending as a percentage of GDP than does the US.

Of course, they also have higher tax collection as a percentage of GDP, too. Way higher. So maybe it's not just the federal spending that's the problem?

[/same old argument]

If you can convince The Final Dakar to cut the US Corporate tax rate in half, increase our lowest tax rate by 5%, lower our highest rate by 7%, and impose a massive consumption tax on all to accomodate the code; more power to you. I don't want to speak for him, but he likely won't appreciate the Canadian model, for example.

You just may be the glue that binds Dakar and I.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Sep 2000

Location: The Rock

Status:

Offline

|

|

Well, we can let Dakar opine on that one, I suppose.

I can't say if other countries use the same taxation model we do. I would hazard to guess that we're still considered undertaxed in both personal and corporate sectors by economically successful countries like Germany and Norway, for example. So: I'm sure you can keep your high-ish corporate tax rates and still raise the personal ones too, if that's what y'all like.

All I'm saying is the same refrain: you guys don't bring in enough taxation revenue, and there is no likely way to cut spending enough to make up your deficit. Period. No ifs, ands or buts.

(Your comment on the percentage figures, of course, ignores stuff like our government-funded universal health care. I believe once you factor that yearly expense into personal tax rates, we actually pay lower taxes overall for all brackets. But that's another story....)

(Also, our lower top rate is deceptive. We don't yet have the large super-rich class class that you do. I understand it's a much larger portion of lost tax income in the States, relatively speaking, than it is in Canada. So far, anyway....)

(Another edit: your corporate tax rates aren't high, either. They're only high on paper. I understand that your effective rate is actually average compared to most developed countries. So there's that.)

|

|

Mankind's only chance is to harness the power of stupid.

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by ebuddy

They've not been invisible, they've been sustainable.

Maybe I haven't been paying attention, but this feels unprecedented. I mean, not that it's a bad thing but the 90s was dedicated to getting to a balanced budget and that was before some of the deficits we're seeing now. Just saying sustainable feels like crazy liberal position compared to all the political rhetoric I've heard.

Originally Posted by ebuddy

This is why leaders on both sides of the aisle including Cheney have marginalized the urgency.

I feel like this is a misrepresentation of Cheney. He flat out said they don't matter. At best, he was being a selfish prick in regards to the short-term and relating to the Bush administration. At worst, he meant completely (Considering he referenced Reagan, feels like the latter).

Originally Posted by ebuddy

At an assumed level of growth, (while absurd IMO) the debt can grow. The problem is, this attitude to justify spending (from 25 years of bad policy) leaves little room for special causes such as sustained periods of anemic growth or disasters of other kinds. There becomes a point at which the debt becomes unsustainable; the point I mentioned earlier where the interest on the debt alone becomes a severe, scheduled burden on your bottom line. It's mathematical.

This sounds reasonable and logical. I do not advocate spending ad infinitum.

Originally Posted by ebuddy

That's why I said it's not so much Reagan's debt as it has been failed policy this entire time.

I think Reagan gets referenced because he gets a pass from conservatives yet he's the one who kick-started the entire thing. I suppose it's important to discern between spending like Reagan and increasing spending like Reagan.

Originally Posted by ebuddy

For the record; any statistic that does not include all statistics before or after it, is likely a selective statistic.

Because of context, ebuddy. Same as the gasoline prices that I pointed out were as high as now just months before Obama took office. Taking a snapshot during an economic downturn is all but guaranteed to give an unfavorable statistic. Now, if you showed some type or range over the past 25 years for context, or showed a correlation with deficits, then we've got some information to debate around

(And this doesn't even consider the entire SS, Military, disabled aspect of the 47%)

Originally Posted by ebuddy

A little water in the basement is bad, but you can pump it out as it comes in. Too much water coming into the basement, if not addressed at some point, will eventually exceed your ability to pump it out.

This goes back to sustainable. Fair enough.

Originally Posted by ebuddy

You just answered your question. The truth is, we've seen a slow, negative repercussion that an assumed level of growth increasingly cannot address let alone sustained periods of no or anemic growth.

Doesn't this contradict sustainable? Also what is this "negative repercussion" we're seeing? Isn't that what I've been asking for all along?

Originally Posted by ebuddy

Some of it sure, to the extent that all things political are theatrical. The debt ceiling is going to be raised because the debt itself requires it. If the budget calls for so much money, more often than not, it'll be allowed that money. It's political theatre in that they are required to give it some semblance of focus for their constituency and to some degree, themselves. The problem of course is, and always has been, the level of spending itself. There was no debt ceiling debate in the numerous Euro members that had been downgraded. It's a real number, with real consequences.

They're also worse off than us, so not exactly apples-for apples.

Originally Posted by ebuddy

To be clear, you're suggesting that because GDP has remained relatively static while the marginal tax rate has fluctuated wildly in a downward trend, that there is no correlation between the two. What you might have missed is government spending.

6260/width/350/height/700[/IMG]

With continued increases in government spending, (included in GDP) you have a situation where the GDP is essentially being artificially propped up by government spending.

This may be semantical bullshit, but I'm going to take issue with the term artificial. Reality is that the government has a real part of the economy, and short of eliminating all the government jobs and the military, it has no choice but to be.

First, is there some theoretical target number we should be aiming for?

Second, I'm not sure what I should be concerned by in this graph, as I'm sure the GDP tanked in '08, and between lost revenues the bailouts, and stimulus, of course the % will spike. It's worth noting that it's also spiking downwards after 2011(?).

Third, why is that a portion of europe survives with higher government spending as a % of GDP?

Originally Posted by ebuddy

There are some important differences to consider. First, you're showing only the top, marginal tax rate which in many respects echoes the sentiment of many conservatives here that decry the class warfare behind a meaningless proposal to increase taxes on the wealthy and fails to consider the fluctuation in the numbers of this bloc of taxpayers and how resourced they are to avoid the increases.

Fair enough on this criticism. Quite honestly, it's difficult to find info where the top marginal rate isn't the only reference. These people are referenced as "job creators" and given the % of wealth they control, shouldn't there be some discernible effect?

Originally Posted by ebuddy

In light of this chart, my question to you would be -- why raise taxes at all then, on anyone?

To appease deficit hawks, of course.

Originally Posted by ebuddy

With regard to taxation (not a matter of choice, but a compulsory contribution), trickling would be money that comes from people and is distributed to other people. You're making a causal argument from correlative data. In other words, you don't explain how the money is being taken from one group of people and distributed to the other.

Here's where we enter the portion of the debate I completely unqualified for.

I apologize, but my best response is a another graph:

For bonus points, the split occurs right around the time Nixon starts slashing the top rates.

Originally Posted by ebuddy

Again, this is correlative, not causal because you've not indicated how money is being taken from one and distributed through to the others.

I have feeling we might quibble over the "taken". It's the natural progression of an economy, right? Person A spends money at Company B and then Company B redistributes it – to overhead (Company C), taxes, employees, CEO, and shareholders. The general idea being that reducing the taxes burden would see Company B hiring more employees, but in reality its just going to the CEO and shareholders. Hence growing wealth disparity.

Originally Posted by ebuddy

Not in my view. The periods of the slimmest wealth disparity were characterized by the poor remaining poor and the wealthy simply having -- less wealth. Why is this a good thing? It seems cynical to me to somehow conclude that "income" is an expendable commodity such that if you get a raise this year Dakar, it must be coming off of someone's paycheck that earns less than you. Income does not work this way and your cited article does not make the connection between correlative and causal here.

See above. Company A paying me more means the shareholders get less. If the shareholders get less, maybe they'll fire CEO A. So what's CEO A's incentive to pay me more? That I'll go to Company B where the same shit will occur?

Two thirds of the economy is made up by consumer spending. Unless the wealthy increase their spending in direct proportion to their increased slice of the pie, that's money leaving that portion of the economy. Which I'm sure then costs lower end jobs which then impacts that portion of the economy further.

Originally Posted by ebuddy

Instead of "knocking those rich people back a peg", shouldn't the goal be to elevate the achievement and financial stewardship of those at the bottom, not retard the growth of those at the top?

Not if the growth at the top is coming at the cost of the bottom.

Originally Posted by ebuddy

In an ideal situation, everyone is in the position of effectively managing their wealth; one of the primary advantages of those who network with others of wealth. By merely taxing "the rich" more, we're hoping to decrease wealth disparity, but shouldn't this be reflected somewhere within the incredible growth of revenue into the Federal government?

6261/width/350/height/700[/IMG]

Nope. Government revenue doesn't affect what slice of the pie they get. (Also: Source?)

Originally Posted by ebuddy

IMO, using the Federal government as the source of distributing wealth is a horrible idea.

I think it depends how its done. I'm not prepared do delve into that at the moment. I will agree there are good policies and bad policies.

Originally Posted by ebuddy

Yes, but in a more roundabout way. The problem all along has been spending - the debt is a symptom of bad policy. While federal revenue continues to grow and government outlays continue to grow, we have greater wealth disparity, the number of children born into poverty increases, stagnating wages, decreasing incomes and valuation, increasing welfare rolls, etc. What I've been arguing is the moral hazard of easing symptoms in merely perpetuating a dependency class. And it's obviously not working.

You're going to have to do a better job demonstrating this. In your own words, this is correlative, not causal because you've not indicated how government deficits have lead to the above sypmtoms.

|

|

|

| |

|

|

|

|

|

|

|

Games Meister  Join Date: Aug 2009

Location: Eternity

Status:

Offline

|

|

Originally Posted by ebuddy

If you can convince The Final Dakar to cut the US Corporate tax rate in half, increase our lowest tax rate by 5%, lower our highest rate by 7%, and impose a massive consumption tax on all to accomodate the code; more power to you. I don't want to speak for him, but he likely won't appreciate the Canadian model, for example.

You just may be the glue that binds Dakar and I.

Hey, hey, hey, don't be passing the buck to me here. While some of things might be hard for me to swallow, I've already said I'm okay with lowering corporate taxes if we close loopholes and reduce corporate welfare.

(How much corporate welfare does Canada have?)

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by The Final Dakar

Because of context, ebuddy. Same as the gasoline prices that I pointed out were as high as now just months before Obama took office. Taking a snapshot during an economic downturn is all but guaranteed to give an unfavorable statistic. Now, if you showed some type or range over the past 25 years for context, or showed a correlation with deficits, then we've got some information to debate around

(And this doesn't even consider the entire SS, Military, disabled aspect of the 47%)

I'm not sure how the above curiosities reconcile with your main issue. You seem to be suggesting that a growing debt doesn't matter and have asked how it affects you. You wouldn't need stats or facts because of course, you already have them from a broad, historical perspective. There is no other way to show you a problem that is decidedly growing. It's not clear to me that you consider a growing debt to be problematic which means parsing out charts and graphs is likely not going to be useful. I'll try to explain.

This goes back to sustainable. Fair enough.

Doesn't this contradict sustainable? Also what is this "negative repercussion" we're seeing? Isn't that what I've been asking for all along?

At some point you simply make a decision what you think on the available evidence. I'm not sure more facts are what you're waiting for as much as the most unfortunate, concrete of evidence possible including a complete fall-out of the US economy where a day's wages would eventually be required for a loaf of bread. It's difficult to come off diplomatic in the written word, but look to any economic collapse throughout history to see what we're up to here. The negative repercussion is the math; in this context indicating value around an interdependent monetary system that enables and defines commerce among mankind. At some point this math simply cannot be reconciled at which time it collapses and everything and everyone within it. You could essentially roll up our sentiment throughout this affair as follows -- not bad, not bad, not bad, hmm, collapse.

Simply put, the deficits continue adding to the debt, mathematically undeniable. The debt continues to grow, also, mathematically undeniable. The interest on that debt continues to compound exponentially, of course mathematically undeniable. It's a number; a sustainable number when an assumed level of growth can accommodate it, an eventual problem that everyone will feel when even a reasonable degree of growth cannot accommodate it. There's no chart or graph I could present that would make the point more clear. It's the ol' "you can lead a horse to water" phenomena.

Let me ask you this; what do you suppose would happen when our entire GDP is dedicated to merely paying the interest on our debt?

They're also worse off than us, so not exactly apples-for apples.

I don't have to see someone fall from 30 feet to know how badly it'd hurt to fall from 400 feet. You marginalized my concern here by suggesting it was little more than a dog and pony show. I indicated that it's not necessarily a dog and pony show, it's further evidence of a spending problem; a problem of math that exists abroad as well in spite of the lacking fanfare of their debt debates. Otherwise, why does it have to be an apples-to-apples comparison? We're following the same trend mathematically, we just deal in larger numbers.

This may be semantical bullshit, but I'm going to take issue with the term artificial. Reality is that the government has a real part of the economy, and short of eliminating all the government jobs and the military, it has no choice but to be.

Okay, but no one is arguing for anarchy.

First, is there some theoretical target number we should be aiming for?

Some economists have theorized that the debt becomes insurmountable at 120% of GDP. We're presently at 100% of GDP.

Second, I'm not sure what I should be concerned by in this graph, as I'm sure the GDP tanked in '08, and between lost revenues the bailouts, and stimulus, of course the % will spike. It's worth noting that it's also spiking downwards after 2011(?).

That chart is showing you a long, steady, upward trend in the amount of government outlays vs overall economic output, a percentage of which the government could ever hope to assume in revenue -- mathematically. When the two charts I provided are combined, you see government revenue increase overall, but outlays also increasing as a percent of what it could ever hope to assume in revenue going forward to pay for the outlays. Why? The spending problem... or phenomena if you will. The "spike downward" in 2011 is a dip from its own unprecedented high, to the former high. i.e. not a significant bump downward and so short-lived as to be essentially meaningless. With the deficits exceeding a trillion dollars projected through 2014, that little bump down will mean even less when we've moved on to new, unprecedented highs.

Third, why is that a portion of europe survives with higher government spending as a % of GDP?

A much broader tax base and a lower overall debt:GDP.

Fair enough on this criticism. Quite honestly, it's difficult to find info where the top marginal rate isn't the only reference. These people are referenced as "job creators" and given the % of wealth they control, shouldn't there be some discernible effect?

Not in the scheme of the entire base of taxation and how things are faring among the rest of that base as the result of government policy. As you've illustrated, taxing the rich more has not facilitated appreciable differences in overall GDP. We need more taxpayers in general. The difference in revenue between Obama's proposal of increasing taxes on those $250k or more and leaving the Bush tax cuts entirely intact is less than $50 billion. That only runs our government for a couple of weeks. Then what?

To appease deficit hawks, of course.

But that's not what the deficit hawks are proposing for addressing the deficit. Do you have another answer?

Here's where we enter the portion of the debate I completely unqualified for. I apologize, but my best response is a another graph: For bonus points, the split occurs right around the time Nixon starts slashing the top rates.

A graph showing a cumulative percent change in Productivity vs hourly compensation? First, you'd expect to see that incredible explosion in productivity reflected somewhere in GDP, but you don't. It's a percent, cumulative change which misses so much information I can only venture a guess as to what you were trying to illustrate. If the chart said what you're suggesting it says by even posting it in this conversation, there'd certainly be no reason to continue raising the minimum wage as they've stagnated from the 70's. Without digging into each of the innumerable factors at play in such data, what it's likely showing you is the birth of the computer age and technologies that replace people while modestly, and proportionally increasing productivity.

I have feeling we might quibble over the "taken". It's the natural progression of an economy, right? Person A spends money at Company B and then Company B redistributes it – to overhead (Company C), taxes, employees, CEO, and shareholders. The general idea being that reducing the taxes burden would see Company B hiring more employees, but in reality its just going to the CEO and shareholders. Hence growing wealth disparity. See above. Company A paying me more means the shareholders get less. If the shareholders get less, maybe they'll fire CEO A. So what's CEO A's incentive to pay me more? That I'll go to Company B where the same shit will occur?

When you're talking about CEO's and Shareholders, you're talking about the larger Corporations in the US. This is another trap of the class-warfare mentality unfortunately. The problem with this citation with regard to the US economy of course is that small businesses represent 99.7% of all employer firms in the US, generated approximately 65% of net new jobs over the past 17 years, and are 52% home-based; they are not the cigar-chomping suits in board meetings with shareholders and CEOs seeking new ways to rape the little guy- they maintain profitability to (above survival) qualify for loans when needed, that's it.

Two thirds of the economy is made up by consumer spending. Unless the wealthy increase their spending in direct proportion to their increased slice of the pie, that's money leaving that portion of the economy. Which I'm sure then costs lower end jobs which then impacts that portion of the economy further.

You have to look at it more holistically IMO. What drives small businesses in creation and sustenance, is access to liquidity. When banks and lending institutions are awash with cash, they can make that cash more readily available to the small businesses who want to grow their little empires. When the rich dudes hold their money (which is generally counterintuitive to personal greed/growth), they're not holding their money under a floorboard in the kitchen, they're socking it into accounts with banking institutions. The problem is when the market becomes so uncertain that otherwise natural market behaviors are distorted (lending/risk-taking), you begin to see a decided decline in overall commerce. It's not only corporations that are hedging market uncertainty by holding on to their assets as opposed to risking them, we're all hedging market uncertainty and it's taking a toll on the economy. i.e. someone will spend the money if it's available. It's counterintuitive that the money would be held back from usage, but it's happening because the market is distorted by Fed folly. Everyone does better during booms; household incomes rise, the number of employed people rises, people risk and spend more, more commerce, a broader tax base, more revenue, etc... the only thing that hasn't changed is out of control Federal spending and the compounding Fed actions to sustain it. At this time the most profound uncertainty is Obamacare, but that's a discussion for another thread. Or... multiple other threads as it were.

Not if the growth at the top is coming at the cost of the bottom.

If the labor market is not distorted, employers must compete with one another to grow their businesses. They'll need employees to do this. To maintain employees in a healthy economy, you have to pay them well and you have to offer them better benefits packages. Desperate times are the times when this distortion is most evident because people aren't moving around to find optimal relationships, they're holding. They're stagnant. The only reason one's growth at the top is coming from those at the bottom is if those at the bottom allow the bad relationship to continue. When there is less competition, there is less choice. I've not once worked for a firm that wasn't interested in "growing the business". What you're seeing today isn't greed at play because in reality, nothing would be better for the economy. By nature, greed has to accomodate all to perpetuate itself. What you have today is caution, fear, and uncertainty resulting not only in decreased consumer confidence (what drives commerce/the economy), but decreased confidence in the private sector across the board. Everyone's holding. It's distorted. People don't hold unless they're scared. People are scared because they don't like that look on their bosses' faces and their brother is unemployed.

Nope. Government revenue doesn't affect what slice of the pie they get. (Also: Source?)

That's what I'm saying. More money into the Fed means zero for your targeted beneficiary. All it does is cut into liquidity, alienate the very base of taxpayers, and discourage the behaviors you're increasingly relying on for funding the spending problem. Instead of expanding the taxpaying base, it's relying on the same, unreliable base of taxpayers that per all of our charts are not having an appreciable impact on the overall economy.

I think it depends how its done. I'm not prepared do delve into that at the moment. I will agree there are good policies and bad policies.

You're going to have to do a better job demonstrating this. In your own words, this is correlative, not causal because you've not indicated how government deficits have lead to the above sypmtoms.

I'm not an expert. I've done as good a job demonstrating this as I possibly can. I'm not going to change your mind. The posts were more for the benefit of those who haven't made up their minds yet and they will determine whether or not the math means anything to them personally.

|

|

ebuddy

|

| |

|

|

|

|

|

|

|

Registered User

Join Date: Mar 2000

Location: Garden of Paradise Motel, Suite 3D

Status:

Offline

|

|

Reagan no more tripled the national debt than did Tip O'Neil. Congress refused to reduce dependency on government and lower entitlement spending, and therefore the revenue reductions weren't followed with spending reductions. If anything, it was Congress's fault. The "fix" for this was supposed to be Gramm-Ruddman-Hollings, but then THAT got shoved to the side.

The secondary mortgage markets grew in the 1980s because of the cheap(er) money, as did state/local government. Because rates were artificially lower, the Federal government issued more debt too. So you could also blame the buildup of Fannie and Freddie on the easy money of the 1980s, which wasn't really the fault of the private sector. Then, early 90s Congress decided to raid the cookie jar and start mandating that HUD, FHA, FHLMC and FNMA promote subprime lending. The rest is history.

As for "paying for it now" you also have to count the fact that we don't have a nuclear apocalypse hanging over our heads anymore. That's kind of valuable I think. Al Queda was created by the CIA policy of aiding Afghanistan via Pakistan in the 1980s, but then Al Queda was emboldened to fight the US directly because of the example set by Carter in dealing with the hostage crisis. I'd suggest that most of our troubles in the Middle East started getting more difficult with the hostage crisis, or at least the fall of the Shah. Once it was shown that the US could and would back down and abandon its allies, that led the way for every tin pot dictator to press their own issues. To include Yassir Arafat in the PLO. This led to the proxy war vs. Iran, too, and the empowerment of Saddam.

That's how I saw it at the time, even BEFORE I realized that Jimmy Carter was completely incompetent as a president. History has strengthened my understanding of it. The Reagan military buildup was in part a response to this foreign policy screwup by Carter, but it was also designed to demonstrate to the Soviets that we weren't going to back down.

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Aug 2003

Location: midwest

Status:

Offline

|

|

Originally Posted by finboy

Reagan no more tripled the national debt than did Tip O'Neil. Congress refused to reduce dependency on government and lower entitlement spending, and therefore the revenue reductions weren't followed with spending reductions. If anything, it was Congress's fault. The "fix" for this was supposed to be Gramm-Ruddman-Hollings, but then THAT got shoved to the side.

The secondary mortgage markets grew in the 1980s because of the cheap(er) money, as did state/local government. Because rates were artificially lower, the Federal government issued more debt too. So you could also blame the buildup of Fannie and Freddie on the easy money of the 1980s, which wasn't really the fault of the private sector. Then, early 90s Congress decided to raid the cookie jar and start mandating that HUD, FHA, FHLMC and FNMA promote subprime lending. The rest is history.

As for "paying for it now" you also have to count the fact that we don't have a nuclear apocalypse hanging over our heads anymore. That's kind of valuable I think. Al Queda was created by the CIA policy of aiding Afghanistan via Pakistan in the 1980s, but then Al Queda was emboldened to fight the US directly because of the example set by Carter in dealing with the hostage crisis. I'd suggest that most of our troubles in the Middle East started getting more difficult with the hostage crisis, or at least the fall of the Shah. Once it was shown that the US could and would back down and abandon its allies, that led the way for every tin pot dictator to press their own issues. To include Yassir Arafat in the PLO. This led to the proxy war vs. Iran, too, and the empowerment of Saddam.

That's how I saw it at the time, even BEFORE I realized that Jimmy Carter was completely incompetent as a president. History has strengthened my understanding of it. The Reagan military buildup was in part a response to this foreign policy screwup by Carter, but it was also designed to demonstrate to the Soviets that we weren't going to back down.

Excellent points, all.

|

|

ebuddy

|

| |