|

|

No more federal income tax. No mroe IRS. Good? Bad? ...Possible?

|

|

|

|

|

Mac Elite

Join Date: Apr 2005

Location: Las Vegas, NV

Status:

Offline

|

|

Apparently there are two men, Neal Boortz and Congressman John Lender, who have teamed up to come up with a plan that would:

1) Eliminate all federal taxes

2) Eliminate the IRS

3) Be fair to the poor

4) Provide the government with adn equal amount of money they currently get from taxes.

I only listened to a short segment on it on Hannity & Colmes, but it seems to be very intruiging. If it is possible, it would have remarkable results. I mean, the amount of business it would create, and the jobs it could create, the increased investing, etc.

It definately sounds too good to be true, but I have yet to read the book. Mr. Hannity seemed quite convinced however (as one would expect) having read the book twice. I think the most convicing part of this is how willing these two guys were to stand behind their claims--if I interpreted what I was hearing properly, it seems that the book even has a section filled with questions that would refute what they are saying, as well as answers to them. (ie, wouldn't it be harder on the poor?)

Thoughts?

Link:

http://www.amazon.com/exec/obidos/tg...52916?v=glance

|

"In a world without walls or fences, what need have we for windows or gates?"

|

| |

|

|

|

|

|

|

|

Banned

Join Date: Jun 2005

Location: Indy.

Status:

Offline

|

|

Accountants will figure out someway to stop it. Beancounters are what really run the world these days. [/cynicalmode]

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Mar 2001

Location: The Rockies

Status:

Offline

|

|

I like the basic idea of sales taxes. We consume too much in the US (I saw an article yesterday that the savings rate is at an all-time low), and we should save more.

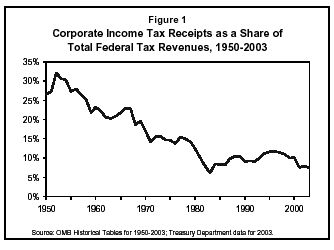

A couple of problems with this plan, IMO: Every analysis I've seen says that the 23% rate is way too low. In effect, it's a huge tax cut in addition to a reform. These authors might deny it, but I think the analyses of their plan are fair. (In addition, the 23% rate they cite is 23% of the price including the tax - the way normal people would calculate it would put it at 30% of the price.)

I also believe, though again they may deny it, that this would be a more regressive system than our current one. They'll come up with all kinds of numerical massaging to argue that it's fair to the poor, but really only one analysis counts: What happens to the overall tax burden. Again, I think fair analyses show that the wealthiest would be paying less for government and the rest would be paying more. I think exactly the opposite needs to happen, though of course that's a values issue rather than a factual one.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Apr 2005

Status:

Offline

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Professional Poster

Join Date: Mar 2002

Location: Boston

Status:

Offline

|

|

Not seeing the show nor did I read the book, Im at a disadvantage but that never stopped me from speaking up before

Anyways what steps/mechinisms is the author stating to avoid having the poor pay an inordinate amount of there cash towards the tax. To me its quite regressive in that the less money you have the higher percentge the "tax" is taken from your income.

Also what will stop the rich and upper middle class to start purchasing stuff over seas and paying shipping? if its a 23 - 30% tax I'm sure a number of foreign internet companies would be selling stuff for less.

Mike

|

|

|

| |

|

|

|

|

|

|

|

Professional Poster

Join Date: Oct 1999

Location: Always within bluetooth range

Status:

Offline

|

|

It sounds appealing in theory, but it practice it raises a couple of concerns in my mind:

1) Consumer spending is a huge element of the US economy (from Cars to iPods, clothes, you name it). A huge sales tax rate certainly wouldn't encourage purchasing, it would encourage thriftiness which, as good a thing as that might sound, could really have unknown catastrophic effects on the economy as a whole. Wouldn't we expect sales of non-essential items to drop and then job loss in the sectors that produce these items to follow ?

2) Consumer spending and consumer confidence are much more volatile than income. Wouldn't it be much harder to accurately predict tax revenue when it could be dramatically affected by the spending whims of the populace ? If people didn't buy as much as predicted, you'd have tax shortfallls requiring rate increases on the already high rate, which would further discourage purchasing, etc. What happens, for instance, during a major war ? Just as you need more income to fight it, you may have people tightening their belts and being cautious about spending ... causing revenue to drop exactly when you need it to increase. How do you make up the shortfall at that point ?

3) Prior to 1913, there was no Federal Income tax and revenue was generated by purchase taxes and tariffs. For whatever reasons, the government considered an income tax (going to the source of value) rather than a purchase taxes (basing it on what people bought) a good move. I don't have a definitive answer to why this move was made, but my off the cuff guess would be that it provides a more predictable income stream and encourages consumer purchasing. Getting rid of the IRS and income tax is essentially putting us back in a 19th century taxation model. If you look at what happened then, you'll see a flat living standard for average people and the rise of enormous wealth amongst industrialists (Rockefeller, Vanderbilt, et al) and essentially no regulation (environmental or otherwise) on anything.

4) What gets exempted exactly ? Subsitence items? How about stock purchases, real estate and other "investment" purchases ? If you don't tax those purchases, you are essentially relieving the wealthy of any real taxation at all as they would not pay taxes on the bulk of their purchases (investments) nor pay any income tax on the wealth those purchases generate. A person making $2.5 million/yr might only spend $50k on taxable items and shelter the rest in non-taxed purchases. What you'd end up with is either end of the spectrum (the very poor and the very wealthy) essentially pay nothing toward the common tax base while the people in the middle paying a relatively very high portion of taxes ... that is, as long as they continued to make non-exempt purchases on semi-luxury items as predicted. If they quit doing that, then we'd essentially be up Revenue Creek without a paddle.

I'm not saying the idea absolutely couldn't work, but on the surface it sound like a scam to exempt the very wealthy by co-opting the very poor and leaving the purchasers in the middle paying for everything.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Mar 2001

Location: The Rockies

Status:

Offline

|

|

Good post Krusty. One other thing that jumped to mind is that, although they say they're going to abolish the IRS, there has to be some enforcement method for collecting the taxes and making sure that people don't sell under the table. I'm sure the temptation to evade the sales taxes would be huge. The IRS itself might go away, but something else would have to take its place.

Your point 2 also makes me think that probably the best way to collect taxes is to apply a basic principle of personal finance: Diversification. I'd actually like to see more sales taxes in the federal mix. I know we have gas taxes and cigarette on the federal level, but more reliance on sales taxes would be a good thing. But I think you'd really need to increase the progressivity of the income tax in order to balance it out. How about a federal sales tax along with a flat income tax of 50% on millionaires.

|

|

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Apr 2005

Location: Las Vegas, NV

Status:

Offline

|

|

Originally Posted by Krusty

I'm not saying the idea absolutely couldn't work, but on the surface it sound like a scam to exempt the very wealthy by co-opting the very poor and leaving the purchasers in the middle paying for everything.

Ah, but don't all anti-tax type things? I personally have NO idea how it will be easier on the poor, but they sounded pretty confident that it would, so I definately want to read the book to get their angle on that issue.

About consumer spending going down, I do not think this would occur. According to them (IIRC), the prices of goods would essentially be the same. Once again, I don't really understand how this could be. (I suppose that since the producers are not paying income tax on their courporations, they have more money to deal with, and can price lower, and then the sales tax plus the decreased price would equal out to about what it is now. But that's just my speculation, I would have to read the book.) Furthermore, because there would be no income tax, people would have more money to spend, and be much less intimidated by a high sales tax.

About reverting to the time of the Robber Barons, I also do not think this could occur. The Robber Barons could run free doing all the mean stuff that got them that nickname because no laws prevented them from doing so. Now we have OSHA, the EPA, and of course Antitrust laws.

I think what is actually most intruiging about this theory is that it is fundamentally Demand-Side; it puts money in the pockets of consumers. But at the same time, it is very business-friendly, at least to corporations.

My biggest concern right now is that I don't see exactly how small business owners would benefit. I mean, as it stands right now, business revenue from partnerships and proprietorships are not taxed, as such a business is not considered a "person." Because corporations are considered "people" their income is taxed, and then the income of the people who own the corporation are also taxed. (So essentially they get double taxed) This plan would elimiate the double tax thingie, helping corporations, which is all fine and dandy, but I'm not seeing how it would give small businesses an edge, and really, I know it sounds cliche, but small businesses are the backbone of the American economy.

|

"In a world without walls or fences, what need have we for windows or gates?"

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Mar 2002

Location: Alexandria, VA

Status:

Offline

|

|

Originally Posted by Krusty

It sounds appealing in theory, but it practice it raises a couple of concerns in my mind:

1) Consumer spending is a huge element of the US economy (from Cars to iPods, clothes, you name it). A huge sales tax rate certainly wouldn't encourage purchasing, it would encourage thriftiness which, as good a thing as that might sound, could really have unknown catastrophic effects on the economy as a whole. Wouldn't we expect sales of non-essential items to drop and then job loss in the sectors that produce these items to follow ?

2) Consumer spending and consumer confidence are much more volatile than income. Wouldn't it be much harder to accurately predict tax revenue when it could be dramatically affected by the spending whims of the populace ? If people didn't buy as much as predicted, you'd have tax shortfallls requiring rate increases on the already high rate, which would further discourage purchasing, etc. What happens, for instance, during a major war ? Just as you need more income to fight it, you may have people tightening their belts and being cautious about spending ... causing revenue to drop exactly when you need it to increase. How do you make up the shortfall at that point ?

3) Prior to 1913, there was no Federal Income tax and revenue was generated by purchase taxes and tariffs. For whatever reasons, the government considered an income tax (going to the source of value) rather than a purchase taxes (basing it on what people bought) a good move. I don't have a definitive answer to why this move was made, but my off the cuff guess would be that it provides a more predictable income stream and encourages consumer purchasing. Getting rid of the IRS and income tax is essentially putting us back in a 19th century taxation model. If you look at what happened then, you'll see a flat living standard for average people and the rise of enormous wealth amongst industrialists (Rockefeller, Vanderbilt, et al) and essentially no regulation (environmental or otherwise) on anything.

4) What gets exempted exactly ? Subsitence items? How about stock purchases, real estate and other "investment" purchases ? If you don't tax those purchases, you are essentially relieving the wealthy of any real taxation at all as they would not pay taxes on the bulk of their purchases (investments) nor pay any income tax on the wealth those purchases generate. A person making $2.5 million/yr might only spend $50k on taxable items and shelter the rest in non-taxed purchases. What you'd end up with is either end of the spectrum (the very poor and the very wealthy) essentially pay nothing toward the common tax base while the people in the middle paying a relatively very high portion of taxes ... that is, as long as they continued to make non-exempt purchases on semi-luxury items as predicted. If they quit doing that, then we'd essentially be up Revenue Creek without a paddle.

I'm not saying the idea absolutely couldn't work, but on the surface it sound like a scam to exempt the very wealthy by co-opting the very poor and leaving the purchasers in the middle paying for everything.

I agree with your broad thrust. I'd add that it would tremendously slow corporate consumption as well. Right now we encourage businesses to invest in equipment by allowing them to deduct the expense against their income taxes. It's an incentive for businesses to buy from other businesses, which keeps the wheels moving. If you suddenly took that incentive away, there would be dislocations. As you point out, the economy is driven by consumption. Is it really worth causing a recession, or even a depression for this?

In addition, while I agree that the authors probably have in mind some kind of tax cut, or revenue neutral change, I think that is politically unrealistic. The 16th Amendment would still exist, which means the government could always resurrect a national income tax. Even without one of your shortfalls, there would be massive temptation to go back to an income tax without lowering a sales tax. Government never gets smaller, and taxes always reach deeper and deeper into the economy. Look at the income tax. It started out with rates ranging between one and seven percent, and was only supposed to be paid by the wealthy. The same goes for the Alternative Minimum Tax. That was supposed only to be for millionaires. Government is inherently greedy.

You can predict how it would go. A couple of years after the change goes through, someone will propose a "small" income tax "only on the wealthy." Next thing you know we'll be like Europe with full income taxes and a double digit national sales tax. It's best just to head that trend off.

In any case, there are so many vested interests (legitimate, or otherwise) in the current tax code that I don't think anything this radical has a snowball's chance in hell of becoming law.

|

|

|

| |

|

|

|

|

|

|

|

Professional Poster

Join Date: Feb 2001

Status:

Offline

|

|

Originally Posted by loki74

Apparently there are two men, Neal Boortz and Congressman John Lender, who have teamed up to come up with a plan that would:

1) Eliminate all federal taxes

2) Eliminate the IRS

3) Be fair to the poor

4) Provide the government with adn equal amount of money they currently get from taxes.

I only listened to a short segment on it on Hannity & Colmes, but it seems to be very intruiging. If it is possible, it would have remarkable results. I mean, the amount of business it would create, and the jobs it could create, the increased investing, etc.

It definately sounds too good to be true, but I have yet to read the book. Mr. Hannity seemed quite convinced however (as one would expect) having read the book twice. I think the most convicing part of this is how willing these two guys were to stand behind their claims--if I interpreted what I was hearing properly, it seems that the book even has a section filled with questions that would refute what they are saying, as well as answers to them. (ie, wouldn't it be harder on the poor?)

Thoughts?

Wow, a 40% sales tax sounds like such an improvement! It would certainly increase investing. Don't see how it would create more jobs.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Mar 2001

Location: The Rockies

Status:

Offline

|

|

It's interesting that this has come up right now. Bush created a Tax Reform commission, like his Social Security Reform commission, and it was supposed to be done and make its recommendations by July 31. I wonder what's going on with it.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

It's amazing. All of you commenting while knowing nothing about the proposal. All you have to do is google it: http://www.myfairtax.org/faq.html It's nice to see that class warfare is alive and well. Have you ever gotten paid by a poor person? Do you understand the concept of capitalism? I would guess that you also do not run a business. Your views are naive.

Oh, yes, the one comment about the Social Security proposal. You should rail against it. You'll enjoy your benefits at retirement. Why would you choose a 400% gain with market investment? You'd be much better off with the present system of less than 1% appreciation, if there is anything left at that time.

<sigh>

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Mar 2002

Location: Alexandria, VA

Status:

Offline

|

|

Originally Posted by medicineman

It's amazing. All of you commenting while knowing nothing about the proposal. All you have to do is google it: http://www.myfairtax.org/faq.html It's nice to see that class warfare is alive and well. Have you ever gotten paid by a poor person? Do you understand the concept of capitalism? I would guess that you also do not run a business. Your views are naive.

Oh, yes, the one comment about the Social Security proposal. You should rail against it. You'll enjoy your benefits at retirement. Why would you choose a 400% gain with market investment? You'd be much better off with the present system of less than 1% appreciation, if there is anything left at that time.

<sigh>

The problem is that we know enough about economics and the current tax code to ask questions that your FAQ doesn't really answer. For example, click on the link about mortgage interest in your site. It glosses over the fact that every homeowner would lose that benefit. It blithely assures us that mortgage interest isn't as valuable as we suppose -- only we suppose nothing of the sort. It makes a mistatement about how 70% of taxpayers aren't eligible to deduct mortgage interest, which is misleading because homeowners are generally in the brackets who do itemize and who get considerable benefit from doing so. And it makes an assertion that homeowners will be better off because interest rates will decline. There's no explanation of really why that will be except an assertion about lender overhead from tax compliance. That's not very convincing considering interest rates are at very low levels already. There is only so much declining that is possible.

All in all, a lot of "headlines" and assertions, but very little substance to evaluate. So don't be surprised that we aren't leaping on the bandwagon of what looks very much like a high-risk radical change.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by SimeyTheLimey

The problem is that we know enough about economics and the current tax code to ask questions that your FAQ doesn't really answer. For example, click on the link about mortgage interest in your site. It glosses over the fact that every homeowner would lose that benefit. It blithely assures us that mortgage interest isn't as valuable as we suppose -- only we suppose nothing of the sort. It makes a mistatement about how 70% of taxpayers aren't eligible to deduct mortgage interest, which is misleading because homeowners are generally in the brackets who do itemize and who get considerable benefit from doing so. And it makes an assertion that homeowners will be better off because interest rates will decline. There's no explanation of really why that will be except an assertion about lender overhead from tax compliance. That's not very convincing considering interest rates are at very low levels already. There is only so much declining that is possible.

All in all, a lot of "headlines" and assertions, but very little substance to evaluate. So don't be surprised that we aren't leaping on the bandwagon of what looks very much like a high-risk radical change.

I guess I read differently than you do. The FAQ says that 70% of tax filers do not itemize their taxes, therefore they do not take advantage of that deduction. And that deduction is not the interest that is paid, but the tax upon that interest. The projection of a 25% decrease in rates as a result of lower business costs, I cannot comment on. Those are economic projections, and I do not have that data.

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Mar 2002

Location: Alexandria, VA

Status:

Offline

|

|

Originally Posted by medicineman

I guess I read differently than you do. The FAQ says that 70% of tax filers do not itemize their taxes, therefore they do not take advantage of that deduction.

Assuming the 70% of filers statistic is true, here is how it works. You only take itemized deductions if those separate deductions are less than the standard deduction, which right now is just under $10,000 a year for a married couple filing jointly. If you rent, the standard deduction is likely to be higher than itemized deduction, so you will take the standard deduction. That's a good chunk of that 70%. If you live as a student, or otherwise don't own, you will take the standard deduction. That's some more of the 70%. If you own your own home, but have paid off most (or all) of the mortgage, then the standard deduction is likely to be higher than your itemized deductions. You aren't paying much or any mortgage interest, so there is little or nothing to deduct. So those people will be part of the 70% taking the standard deduction. But if you are paying off a significant mortgage, your itemized deductions are likely to be higher than the standard deduction. Those people will be in the 30% who will itemize.

That statistic is therefore misleading. It makes it seem as though only 30% of people who could benefit from the mortgage deduction actually can benefit from it. That's got it backwards. In fact, it is more accurate to say that 70% don't need it, but that 30% do need it, and get it. If you buy a home, you will almost certainly fall into the 30% for whom itemizing pays dividends. It's very important indeed, contrary to the FAQ site's argument. Most of us at some point in time plan on being in that 30% as we buy and pay off our homes. To make it seem like that isn't important is just wrong.

I'm afraid slippery misrepresentations like that make me distrust these people pushing this reform. It's one thing to give something a positive spin. Quite another to mislead people.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by SimeyTheLimey

Assuming the 70% of filers statistic is true, here is how it works. You only take itemized deductions if those separate deductions are less than the standard deduction, which right now is just under $10,000 a year for a married couple filing jointly. If you rent, the standard deduction is likely to be higher than itemized deduction, so you will take the standard deduction. That's a good chunk of that 70%. If you live as a student, or otherwise don't own, you will take the standard deduction. That's some more of the 70%. If you own your own home, but have paid off most (or all) of the mortgage, then the standard deduction is likely to be higher than your itemized deductions. You aren't paying much or any mortgage interest, so there is little or nothing to deduct. So those people will be part of the 70% taking the standard deduction. But if you are paying off a significant mortgage, your itemized deductions are likely to be higher than the standard deduction. Those people will be in the 30% who will itemize.

That statistic is therefore misleading. It makes it seem as though only 30% of people who could benefit from the mortgage deduction actually can benefit from it. That's got it backwards. In fact, it is more accurate to say that 70% don't need it, but that 30% do need it, and get it. If you buy a home, you will almost certainly fall into the 30% for whom itemizing pays dividends. It's very important indeed, contrary to the FAQ site's argument. Most of us at some point in time plan on being in that 30% as we buy and pay off our homes. To make it seem like that isn't important is just wrong.

I'm afraid slippery misrepresentations like that make me distrust these people pushing this reform. It's one thing to give something a positive spin. Quite another to mislead people.

I didn't bring up the 70% number, you did. I'm not trying to mislead anyone. One part of the proposal, which is not on that site, is that, should you prefer, you can file using the standard tax tables as they now exist.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Location: Zip, Boom, Bam

Status:

Offline

|

|

Taxing consumption is the worst idea. I honestly can’t fathom why otherwise intelligent people keep coming up with this. Especially people that are always crowing on about the rich ‘not paying their fair share’. Under such a consumption scheme, the rich would laugh all the way to the bank.

As much as the IRS and taxes may suck, taxing income is the only thing that makes any kind of sense. People can futz the income they declare, but at least enforcing compliance is somewhat manageable. Taxing consumption on the other hand is pure insanity, and enforcing compliance is all but impossible. What, do people envision ‘point of sale’ agents or something? If you no longer have a reporting of how much people earn, and only go by what they allow you to know they consume… DUH… the rich will save themselves untold fortunes making themselves merely APPEAR to consume next to nothing.

The wealthy can afford to skirt consumption taxes because they have far greater consumer options than the poor. That’s half the benefit of being rich. Merely stepping across a border, acquiring everything through a corporation, or having things shipped from a tax-free source would be no-brainers. With the insane money to be made catering to these people, tax-free black markets are all but guaranteed.

The rich would amass huge, untaxed fortunes that afford them ever more tax-free consumption options, while the poor and Joe Schmoe middle class who can’t just jet off to get what they need are left stuck paying the “poor schmuck” tax bill. And with the wealthy skipping out left and right, the amount that would have to be soaked from the poor and middle class would snowball.

Income taxes are the only way to go, as sucky as they are. They should be kept low, never used in a punitive fashion, and politicians should be forced to become efficient with the money they collect (PLENTY), not be allowed to keep raising the tab after squandering what they have.

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Mar 2002

Location: Alexandria, VA

Status:

Offline

|

|

Originally Posted by medicineman

I didn't bring up the 70% number, you did. I'm not trying to mislead anyone.

No, but you linked to that site, which is designed to build support and does mislead in the manner I pointed out.

There is also another problem I just thought of. No interest deductions for business investment. So now all business investment will be a cash expense. The result will be less business investment, less business activity, and at a minimum, a significant recession. Maybe a permanent contraction of the economy.

Really stupid.

(

Last edited by SimeyTheLimey; Aug 5, 2005 at 06:24 AM.

)

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by BRussell

I like the basic idea of sales taxes. We consume too much in the US (I saw an article yesterday that the savings rate is at an all-time low), and we should save more.

A couple of problems with this plan, IMO: Every analysis I've seen says that the 23% rate is way too low. In effect, it's a huge tax cut in addition to a reform. These authors might deny it, but I think the analyses of their plan are fair. (In addition, the 23% rate they cite is 23% of the price including the tax - the way normal people would calculate it would put it at 30% of the price.)

I also believe, though again they may deny it, that this would be a more regressive system than our current one. They'll come up with all kinds of numerical massaging to argue that it's fair to the poor, but really only one analysis counts: What happens to the overall tax burden. Again, I think fair analyses show that the wealthiest would be paying less for government and the rest would be paying more. I think exactly the opposite needs to happen, though of course that's a values issue rather than a factual one.

Your math is in error. Think of it as a simple proffit/markup problem. You have an item which cost you $1.00. You sell that item for $1.30. How much profit is there? Ans. 30 cents. 30 cents is 23% of $1.30. That is the proper 'normal' way to calculate markup.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by CRASH HARDDRIVE

Taxing consumption is the worst idea. I honestly can’t fathom why otherwise intelligent people keep coming up with this. Especially people that are always crowing on about the rich ‘not paying their fair share’. Under such a consumption scheme, the rich would laugh all the way to the bank.

As much as the IRS and taxes may suck, taxing income is the only thing that makes any kind of sense. People can futz the income they declare, but at least enforcing compliance is somewhat manageable. Taxing consumption on the other hand is pure insanity, and enforcing compliance is all but impossible. What, do people envision ‘point of sale’ agents or something? If you no longer have a reporting of how much people earn, and only go by what they allow you to know they consume… DUH… the rich will save themselves untold fortunes making themselves merely APPEAR to consume next to nothing.

The wealthy can afford to skirt consumption taxes because they have far greater consumer options than the poor. That’s half the benefit of being rich. Merely stepping across a border, acquiring everything through a corporation, or having things shipped from a tax-free source would be no-brainers. With the insane money to be made catering to these people, tax-free black markets are all but guaranteed.

The rich would amass huge, untaxed fortunes that afford them ever more tax-free consumption options, while the poor and Joe Schmoe middle class who can’t just jet off to get what they need are left stuck paying the “poor schmuck” tax bill. And with the wealthy skipping out left and right, the amount that would have to be soaked from the poor and middle class would snowball.

Income taxes are the only way to go, as sucky as they are. They should be kept low, never used in a punitive fashion, and politicians should be forced to become efficient with the money they collect (PLENTY), not be allowed to keep raising the tab after squandering what they have.

I'll use your post to answer more than just your questions. First, you really should research the proposal. The math behind it does this: It removes all taxes and fees associtated with bringing a product to its final sale. They total about 23%. So, a $4 box of cereal would not be sold at $4 + 23% tax, it would be sold at $3.08 + 23% (tax) to bring the item back to $4.00. There is no advantage, then, to shop over the border for goods. Business investment is not driven by the urge to avoid taxes. Investment is predicated on making a profit. Using tax codes, creating networks, subcontracting, and any other activity you can name is how the business 'game' is played. I listented to the man for an hour. His proposal seemed very well founded. The one area not addressed well, or that I did not understand well, was the pricing of services. But this is in its infancy. We shall see what comes of it.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Mar 2001

Location: The Rockies

Status:

Offline

|

|

Originally Posted by medicineman

Your math is in error. Think of it as a simple proffit/markup problem. You have an item which cost you $1.00. You sell that item for $1.30. How much profit is there? Ans. 30 cents. 30 cents is 23% of $1.30. That is the proper 'normal' way to calculate markup.

A 5% sales tax usually means you add 5% to the price of the product. A $100 product would cost $105. This 23% is 23% of the price of the product after the tax has been added in, or what would usually be called 30%. Rather than a $100 product costing $123, it would cost $130, but they call it 23% because 30 is 23% of 130. I looked in your faq and it confirms what I'm saying. That's just dishonesty to make it sound better than it is. Sales taxes are never expressed that way.

And I doubt it would be revenue neutral at their 30%. Other neutral analyses show it would have to be closer to 50%. There's just too much money to make up when you lose the income tax.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by BRussell

A 5% sales tax usually means you add 5% to the price of the product. A $100 product would cost $105. This 23% is 23% of the price of the product after the tax has been added in, or what would usually be called 30%. Rather than a $100 product costing $123, it would cost $130, but they call it 23% because 30 is 23% of 130. I looked in your faq and it confirms what I'm saying. That's just dishonesty to make it sound better than it is. Sales taxes are never expressed that way.

And I doubt it would be revenue neutral at their 30%. Other neutral analyses show it would have to be closer to 50%. There's just too much money to make up when you lose the income tax.

I'm sorry, but that is not being dishonest. That is the way markup/profit is expressed. It is not meant to make it sound 'better' or 'worse'. At the end of the day, you look in your cash drawer and tally total sales. You deduct your cost of goods, and gross profit remains. That profit is then divided by total sales to determine its percentage. So, a $1.50 sale, where 50 cents is profit, is expressed as a 1/3rd markup or 33-1/3%. One-third of the money in the cash box is profit (or tax, or whatever unit you happen to be in). That is standard accounting procedure.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Mar 2001

Location: The Rockies

Status:

Offline

|

|

That's the way profit is expressed, and it makes sense to express it that way. You're right, if I get $1.50, and $.50 is profit, I have 33% profit, not 50%.

But that's not the way sales taxes are described. If I pay $1.50, and $.50 was sales tax, that's always called a 50% sales tax on the product, not 33%.

|

|

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Nov 2001

Location: Northern VA - Just outside DC

Status:

Offline

|

|

Show me where in the constitution that taxation for all the BS is permitted! Especially welfare.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by Y3a

Show me where in the constitution that taxation for all the BS is permitted! Especially welfare.

Not that this was in any part of the discussion, please revisit the US Constitution, 16th Ammendment: The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.

|

|

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Nov 2001

Location: Northern VA - Just outside DC

Status:

Offline

|

|

Isn't it actually taking money from some people (not everyone PAYS TAXES) and GIVING it to others as in welfare? Where does it say that it's OK to give away government money to a select few?

|

|

|

| |

|

|

|

|

|

|

|

Moderator Emeritus

Join Date: Apr 2001

Location: Up In The Air

Status:

Offline

|

|

Originally Posted by medicineman

Not that this was in any part of the discussion, please revisit the US Constitution, 16th Ammendment: The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.

The 16th Amendment simply grants Congress the power to levy an INCOME tax.

The power to tax occurs much earlier. You may note that it is very specific about exactly on what Congress may spend any taxes it collects:

Article One, Section 8

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States;

To borrow Money on the credit of the United States;

To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes;

To establish an uniform Rule of Naturalization, and uniform Laws on the subject of Bankruptcies throughout the United States;

To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;

To provide for the Punishment of counterfeiting the Securities and current Coin of the United States;

To establish Post Offices and post Roads;

To promote the Progress of Science and useful Arts, by securing for limited Times to Authors and Inventors the exclusive Right to their respective Writings and Discoveries;

To constitute Tribunals inferior to the supreme Court;

To define and punish Piracies and Felonies committed on the high Seas, and Offences against the Law of Nations;

To declare War, grant Letters of Marque and Reprisal, and make Rules concerning Captures on Land and Water;

To raise and support Armies, but no Appropriation of Money to that Use shall be for a longer Term than two Years;

To provide and maintain a Navy;

To make Rules for the Government and Regulation of the land and naval Forces;

To provide for calling forth the Militia to execute the Laws of the Union, suppress Insurrections and repel Invasions;

To provide for organizing, arming, and disciplining, the Militia, and for governing such Part of them as may be employed in the Service of the United States, reserving to the States respectively, the Appointment of the Officers, and the Authority of training the Militia according to the discipline prescribed by Congress;

To exercise exclusive Legislation in all Cases whatsoever, over such District (not exceeding ten Miles square) as may, by Cession of Particular States, and the Acceptance of Congress, become the Seat of the Government of the United States, and to exercise like Authority over all Places purchased by the Consent of the Legislature of the State in which the Same shall be, for the Erection of Forts, Magazines, Arsenals, dock-Yards and other needful Buildings;--And

To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof.

|

|

If this post is in the Lounge forum, it is likely to be my own opinion, and not representative of the position of MacNN.com.

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by vmarks

The 16th Amendment simply grants Congress the power to levy an INCOME tax.

The power to tax occurs much earlier. You may note that it is very specific about exactly on what Congress may spend any taxes it collects:

Article One, Section 8

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States;

To borrow Money on the credit of the United States;

To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes;

To establish an uniform Rule of Naturalization, and uniform Laws on the subject of Bankruptcies throughout the United States;

To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;

To provide for the Punishment of counterfeiting the Securities and current Coin of the United States;

To establish Post Offices and post Roads;

To promote the Progress of Science and useful Arts, by securing for limited Times to Authors and Inventors the exclusive Right to their respective Writings and Discoveries;

To constitute Tribunals inferior to the supreme Court;

To define and punish Piracies and Felonies committed on the high Seas, and Offences against the Law of Nations;

To declare War, grant Letters of Marque and Reprisal, and make Rules concerning Captures on Land and Water;

To raise and support Armies, but no Appropriation of Money to that Use shall be for a longer Term than two Years;

To provide and maintain a Navy;

To make Rules for the Government and Regulation of the land and naval Forces;

To provide for calling forth the Militia to execute the Laws of the Union, suppress Insurrections and repel Invasions;

To provide for organizing, arming, and disciplining, the Militia, and for governing such Part of them as may be employed in the Service of the United States, reserving to the States respectively, the Appointment of the Officers, and the Authority of training the Militia according to the discipline prescribed by Congress;

To exercise exclusive Legislation in all Cases whatsoever, over such District (not exceeding ten Miles square) as may, by Cession of Particular States, and the Acceptance of Congress, become the Seat of the Government of the United States, and to exercise like Authority over all Places purchased by the Consent of the Legislature of the State in which the Same shall be, for the Erection of Forts, Magazines, Arsenals, dock-Yards and other needful Buildings;--And

To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof.

Thank you for expanding that. Although the thread was about reforming the current tax law, and not the odious subject of taxation in general.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Location: Zip, Boom, Bam

Status:

Offline

|

|

Originally Posted by medicineman

The math behind it does this: It removes all taxes and fees associtated with bringing a product to its final sale. They total about 23%. So, a $4 box of cereal would not be sold at $4 + 23% tax, it would be sold at $3.08 + 23% (tax) to bring the item back to $4.00.

This sounds like some of the most dubious figuring ever. The sale price of any item is a retail markup, not a wholesale cost. I’d love to see where it’s written that some mythical 23% could be shaved off the cost of every consumer item, and that it would be automagically reflected in the retail markup as opposed to just pocketed as greater profit. Most dubious of all: that’s 23% in lost tax revenue that must be accounted for somewhere else! If the goal is replacing income taxes, you can’t claim the 23% sales tax achieves that as well- you’re merely breaking even replacing the 23% of lost business revenues by (eech) shifting it completely onto the consumer.

There is no advantage, then, to shop over the border for goods.

There’s a clear advantage in a lower price, and crossing a border for it is just an extreme example. The price of an item becomes completely arbitrary in this equation. The fact is, this would set up a situation where a person has an incentive to avoid an extra 23% hit with every item purchased –all told, a HUGE incentive.

The individual wealthy consumer will care freakin’ less that the extra 23% (artificial) price is part of some shell game to replace another tax that would have been more logical to expect compliance with. All he’ll care about is the fact that he can (quite easily) skirt it and save himself the money!

I own a business, therefore I can purchase items wholesale. I could easily make a fortune in such a system by buying wholesale, and selling (under the table) anything my customers wanted at a minus sales tax price. No income taxes? No business taxes to get that 23%? GREAT! Then no need to account for how much money I’m making undercutting Uncle Sam. I’d only have to watch that my consumption outwardly appears frugal while I’m laughing all the way to the bank. That’d be child’s play to achieve vs. cooking books and income tax evasion.

Business investment is not driven by the urge to avoid taxes. Investment is predicated on making a profit.

We’re talking about a system where you’ve shifted the burden from business taxes to consumer based taxes. Yes Virginia, consumerism IS based on an urge to get the best price for a good or service possible. The incentive to avoid an extra 23% would be HUGE. The incentive to cater to all interested in avoiding the 23%, and the (untaxed, unaccounted for!) income to be made from doing so would be unstoppable.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by CRASH HARDDRIVE

This sounds like some of the most dubious figuring ever. The sale price of any item is a retail markup, not a wholesale cost. I’d love to see where it’s written that some mythical 23% could be shaved off the cost of every consumer item, and that it would be automagically reflected in the retail markup as opposed to just pocketed as greater profit. Most dubious of all: that’s 23% in lost tax revenue that must be accounted for somewhere else! If the goal is replacing income taxes, you can’t claim the 23% sales tax achieves that as well- you’re merely breaking even replacing the 23% of lost business revenues by (eech) shifting it completely onto the consumer.

There’s a clear advantage in a lower price, and crossing a border for it is just an extreme example. The price of an item becomes completely arbitrary in this equation. The fact is, this would set up a situation where a person has an incentive to avoid an extra 23% hit with every item purchased –all told, a HUGE incentive.

The individual wealthy consumer will care freakin’ less that the extra 23% (artificial) price is part of some shell game to replace another tax that would have been more logical to expect compliance with. All he’ll care about is the fact that he can (quite easily) skirt it and save himself the money!

I own a business, therefore I can purchase items wholesale. I could easily make a fortune in such a system by buying wholesale, and selling (under the table) anything my customers wanted at a minus sales tax price. No income taxes? No business taxes to get that 23%? GREAT! Then no need to account for how much money I’m making undercutting Uncle Sam. I’d only have to watch that my consumption outwardly appears frugal while I’m laughing all the way to the bank. That’d be child’s play to achieve vs. cooking books and income tax evasion.

We’re talking about a system where you’ve shifted the burden from business taxes to consumer based taxes. Yes Virginia, consumerism IS based on an urge to get the best price for a good or service possible. The incentive to avoid an extra 23% would be HUGE. The incentive to cater to all interested in avoiding the 23%, and the (untaxed, unaccounted for!) income to be made from doing so would be unstoppable.

Don't know what kind of business you run. I did not understand your 2nd sentence. The 23% figure is not written anywhere. You're banging your head on the wall with this. That is a number the authors of this calculated. The last sentence of the 1st paragraph makes little sense. All taxes accumulated along the stream of product is passed to the consumer. You finally get a product to retail and it includes all those costs.

Eveidently you didn't understand the thrust of the argument. The final price would be the same as it is now. As for owning your own business and sandbagging the money, good luck to you. As your suppliers report their sales to the feds, you report your inventory and sales... I'd love to see how you pocket a few million under the radar (if you are any size business). Nevertheless, the idea of a flat tax intrigues me. I'll wait to see what materializes from it.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Location: Zip, Boom, Bam

Status:

Offline

|

|

Originally Posted by medicineman

Don't know what kind of business you run. I did not understand your 2nd sentence. The 23% figure is not written anywhere. You're banging your head on the wall with this. That is a number the authors of this calculated. The last sentence of the 1st paragraph makes little sense. All taxes accumulated along the stream of product is passed to the consumer. You finally get a product to retail and it includes all those costs.

Of course tax costs are passed to the consumer, that’s not the point. You’re talking about removing 23% of those costs in order to get to the mythical 23% phantom-savings in the final retail cost of the product. This is just a silly shell game. It’s the same cost, the same tax revenue, IE: it doesn’t replace INCOME TAX REVENUE! Isn’t that the point?

Also, contrary to the author’s whims, there’s no guarantee that a business will reduce the price of a product by 23%, an industry could just as easily keep the price where it is, and consider the 23% reduction in taxes as profit.

Yes, a business passes its tax costs onto the consumer- but this half-baked sales tax scheme passes them to the consumer directly, and completely fails to take into consideration the fact that many consumers (the wealthy in particular) can easily CHOOSE not to comply simply by altering consumption.

This doesn't even begin to get into the problems that will crop up when a product doesn't sell very well.

In the end, the govt. will be hurting to recoup even the initial amount it used to levy in manufacturing, and will end up hammering the consumer to make up for it. I have no friggen idea then where you think replacing INCOME tax revenues on top of that is going to come from.

Eveidently you didn't understand the thrust of the argument. The final price would be the same as it is now.

It’s a weak argument, and based on pure fantasy. There’s no way to assure that prices remain the same. A business could elect to keep the price the same as it was, plus add the 23%- IE- take the reduced manufacturing costs as profit.

And you’re also missing the whole point- the price with 23% added on top of it is an ARTIFICIAL PRICE to begin with. If it were just 8 to 10% there’s not much incentive to skirt taxes (even though people do that, by crossing state lines or using the Internet) but 23%? Please. The incentive to skirt an amount that high is huge. The wholesale price won’t change- actually if the reduction in business taxes is to be believed, it will drop; therefore a black market or simple offshore would lose NOTHING by selling products at the actual retail cost, minus the 23%.

As for owning your own business and sandbagging the money, good luck to you. As your suppliers report their sales to the feds, you report your inventory and sales... I'd love to see how you pocket a few million under the radar (if you are any size business). Nevertheless, the idea of a flat tax intrigues me. I'll wait to see what materializes from it.

You seem to be unaware of the fact that my suppliers don’t charge me taxes. They’ve also received their payment from me for their goods- they charge me WHOLESALE not retail. So under this scheme, what exactly are they reporting, to whom, and why? To make this silly system work, do we eliminate business wholesale licenses and charge businesses sales taxes on inventory?

And I’d only report above the board sales subject to sales taxes, which of course I’d balance out to hide what’s off the books. And in this crazy system, what books?

I hate to break it to you, but all sorts of variations on this already exist, buying private use items through a company to avoid individual income taxes is common place. If my income is no longer be taxed who’s watching the millions pile up?

|

|

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Nov 1999

Status:

Offline

|

|

"To me its quite regressive in that the less money you have the higher percentge the "tax" is taken from your income.

Also what will stop the rich and upper middle class to start purchasing stuff over seas and paying shipping?"

According to the bill, the poor (people who fall below a pre-set income limit, receive reimbursement checks for the taxes they pay on essential goods.

What you don't seem to grasp is the fact that if you BUY a good overseas and ship it back to the US, guess what... US Customs makes you pay the tax before they let you have it back.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Location: Zip, Boom, Bam

Status:

Offline

|

|

Originally Posted by Mac Guru

According to the bill, the poor (people who fall below a pre-set income limit, receive reimbursement checks for the taxes they pay on essential goods.

Then the rich would merely hire the poor to make purchases for them, or find ways to appear 'poor' enough to get the reimbursement themselves. Enforcing compliance with this beast would require a total police state.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Mar 2001

Location: The Rockies

Status:

Offline

|

|

Originally Posted by CRASH HARDDRIVE

Then the rich would merely hire the poor to make purchases for them, or find ways to appear 'poor' enough to get the reimbursement themselves. Enforcing compliance with this beast would require a total police state.

The way most of these plans work is that everyone gets a check of the same amount every year or month, regardless of income. But, thinking about what happens with social security checks today, can you imagine the fraud that would be happening to get those checks?

One of the basic problems I have with this, aside from all the other issues, is that it would be such a massive change. I'm sure that if we had done this decades ago instead of the income tax, it would be working today. But to make such a drastic change overnight, with unpredictable economic and fiscal consequences, just doesn't seem like a good idea.

I could see a more humble version of this, say, a 5% national sales tax, accompanied by some kind of income tax adjustment like an increase in the standard deduction. And underlying any tax reform is the problem that we simply aren't paying for our government right now. We either need a tax increase (yeah right) or we need to hear some serious proposals to really cut spending from those who wanted the tax cuts (yeah right).

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: May 2001

Location: Portland, OR

Status:

Offline

|

|

Wow. Here in Washington where we have a nearly %10 state sales tax, it'll bump total tax up to %33.

That's not going to encourage spending at all... I don't see what advantages this has over the current system at all.

|

|

8 Core 2.8 ghz Mac Pro/GF8800/2 23" Cinema Displays, 3.06 ghz Macbook Pro

Once you wanted revolution, now you're the institution, how's it feel to be the man?

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Mar 2001

Location: The Rockies

Status:

Offline

|

|

Originally Posted by goMac

Wow. Here in Washington where we have a nearly %10 state sales tax, it'll bump total tax up to %33.

Just to reiterate a point I was making above, this plan would make the sales tax go from 10% to 40%, not 33%, because of the tricksy way they do their math. That would mean a $2000 Mac would really be $2800.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Nov 1999

Status:

Offline

|

|

Even if you eliminate the federal income tax, you can't get rid of the IRS as long as there is some form of federal taxation. After all, someone has to process collecting whatever taxes exist. The IRS certainly may be changed radically, but its functions will still be necessary.

Ahem. What I'd like to see is to have more -if not all- of the tax burden shifted to corporations and other business entities. In other words, tax wealth at its source. The way I'd do it is to tax corporate income at a high rate, with the following deductions: - Legitimate business expenses (effectively turning a tax on income into a tax on profits, in an attempt to keep from driving companies out of business).

- All health and legal benefits, provided that all employees are offered the same package (or range of packages, if a choice is offered, provided that no penalty of any kind is levied on any employee for any choice). By rewarding this behavior with tax-deductibility, we move much closer to universal health insurance while keeping most of the system private, since the unemployed are already covered under current programs.

- All employee salaries under a limit to be determined by the 99th percentile of US citizen take-home wages, as determined by the census. Any portion of a salary over this amount is taxed to the corporation normally, but not the individual. This kind of limit smells uncomfortably like maximum-wage legislation -a concept I find abominable- but it is needed to prevent companies from simply dumping the profits into executive wages to escape taxation. Of course, a corporation could attempt to spread its profits out over all the employees. It may even be able to completely escape taxation in this way. However, in doing so it would raise the pay for all its employees, and I don't think anyone would consider this undesirable.

- All charitable donations. If a company wishes to 'contribute to society' through other means than taxation, this fact ought to be recognized, just as it is today.

Under this system, filing corporate taxes would not be handled through the IRS. Instead, the SEC would pass its filings (which are public, unlike IRS filings) through to the IRS. This would hopefully cut down on accounting fraud. No company in its right mind would overstate its profits or understate its expenses on a tax filing, because this would cause it to be taxed more. However, no company in its right mind would understate its expenses or overstate its expenses on a public filing, because this would hurt share values. By combining the two concepts, we get a system which punishes inaccuracy not through legal means, but through simple cause and effect, which cannot be so easily escaped.

The point of all this is to tax wealth at the point where it is created. It does not necessarily conflict with other forms of taxation, though it should obviate most of the need for other forms of it. Currently, only some 10% of the tax burden is shouldered by corporations; this would move it much closer to 100% (though probably not entirely). The biggest problems here deal with how to work with government grants (without which quite a few companies would die outright or never be formed in the first place, and no one wants this) and similar infusions of money. There is also a potential psychological aspect: if the majority of taxes are not paid by the people, does this undermine the government's accountability to the people?

(

Last edited by Millennium; Aug 7, 2005 at 06:29 PM.

)

|

|

You are in Soviet Russia. It is dark. Grue is likely to be eaten by YOU!

|

| |

|

|

|

|

|

|

|

Moderator Emeritus

Join Date: Apr 2001

Location: Up In The Air

Status:

Offline

|

|

Taxing corporations doesn't work:

When you tax a corporation you're really placing the burden on three groups of people.

1) Employees who pay the tax in the form of lower wages

2) Stockholders who pay the tax in form of lower value or dividend

3) Customers who pay the tax in the form of higher cost of goods.

The corporation simply passes the tax along as a cost of business, and you can't legislate against it in any reasonable way. The best recourse then is to lower or eliminate the tax so it can't be passed on to those other parties.

|

|

If this post is in the Lounge forum, it is likely to be my own opinion, and not representative of the position of MacNN.com.

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by Millennium

Even if you eliminate the federal income tax, you can't get rid of the IRS as long as there is some form of federal taxation. After all, someone has to process collecting whatever taxes exist. The IRS certainly may be changed radically, but its functions will still be necessary.

Ahem. What I'd like to see is to have more -if not all- of the tax burden shifted to corporations and other business entities. In other words, tax wealth at its source. The way I'd do it is to tax corporate income at a high rate, with the following deductions: - Legitimate business expenses (effectively turning a tax on income into a tax on profits, in an attempt to keep from driving companies out of business).

- All health and legal benefits, provided that all employees are offered the same package (or range of packages, if a choice is offered, provided that no penalty of any kind is levied on any employee for any choice). By rewarding this behavior with tax-deductibility, we move much closer to universal health insurance while keeping most of the system private, since the unemployed are already covered under current programs.

- All employee salaries under a limit to be determined by the 99th percentile of US citizen take-home wages, as determined by the census. Any portion of a salary over this amount is taxed to the corporation normally, but not the individual. This kind of limit smells uncomfortably like maximum-wage legislation -a concept I find abominable- but it is needed to prevent companies from simply dumping the profits into executive wages to escape taxation. Of course, a corporation could attempt to spread its profits out over all the employees. It may even be able to completely escape taxation in this way. However, in doing so it would raise the pay for all its employees, and I don't think anyone would consider this undesirable.

- All charitable donations. If a company wishes to 'contribute to society' through other means than taxation, this fact ought to be recognized, just as it is today.

Under this system, filing corporate taxes would not be handled through the IRS. Instead, the SEC would pass its filings (which are public, unlike IRS filings) through to the IRS. This would hopefully cut down on accounting fraud. No company in its right mind would overstate its profits or understate its expenses on a tax filing, because this would cause it to be taxed more. However, no company in its right mind would understate its expenses or overstate its expenses on a public filing, because this would hurt share values. By combining the two concepts, we get a system which punishes inaccuracy not through legal means, but through simple cause and effect, which cannot be so easily escaped.

The point of all this is to tax wealth at the point where it is created. It does not necessarily conflict with other forms of taxation, though it should obviate most of the need for other forms of it. Currently, only some 10% of the tax burden is shouldered by corporations; this would move it much closer to 100% (though probably not entirely). The biggest problems here deal with how to work with government grants (without which quite a few companies would die outright or never be formed in the first place, and no one wants this) and similar infusions of money. There is also a potential psychological aspect: if the majority of taxes are not paid by the people, does this undermine the government's accountability to the people?

Wow! Where did you learn economics? We should tax Mr. Motors of General Motors, or Mr. Electric of General Electric? Companies are not entities. They are comprised of the stockholders. Or, are you talking about small companies? The Sub S type? The mom and pop businesses? Yeah, that would be a great stimulus for starting a business and increasing employment. And adding to the 9 million word tax code is sure to make things easier.

|

|

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Apr 2005

Location: Las Vegas, NV

Status:

Offline

|

|

Originally Posted by medicineman

Companies are not entities.

umm... Yes, corporations are entities. Partnerships and sole proprietorships are not. If a corporation goes under, the corporation is tesponsible as an individual; they can't go after your home or car even if you own > 50% of shares. On the same token, however, they are taxed as individuals--the corporation as an entity has an income which is taxed. Sharholders' income/dividends come from the income of the corporation, and are taxes as well.

On the other hand, partnerships and sole proprietorships are not treated as individuals and thus have no "income" to tax. However, the parters' or proprietrors' are financially bound to the partnership or proprietorship and therefore their home can be forclosed and their stuff repossesed.

=====

vmarks's point is very good--taxes upon any business can be considered a cost of production, which get passed on to the price. All that happens is that the supply curve shifts left and market clearing price increases. Ultimately, consumers pay no matter what. When you tax businesses, it isnt a matter of rich or poor. its a matter of who's buying the product.

|

"In a world without walls or fences, what need have we for windows or gates?"

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Mar 2001

Location: The Rockies

Status:

Offline

|

|

In fairness to Millennium, I'm sure he's well aware of the fact that corporate taxes are "passed on." It's more a matter of the point at which they are collected than who pays.

I think it's probably a bad idea to only tax corporations, but it's also true that today we collect much less of our taxes from corporations than we used to. Many large companies pay no taxes and get net tax rebates, including many of the same highly profitable companies that just got more huge tax cuts in this energy bill.

(

Last edited by BRussell; Aug 7, 2005 at 10:35 PM.

)

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by loki74

umm... Yes, corporations are entities. Partnerships and sole proprietorships are not. If a corporation goes under, the corporation is tesponsible as an individual; they can't go after your home or car even if you own > 50% of shares. On the same token, however, they are taxed as individuals--the corporation as an entity has an income which is taxed. Sharholders' income/dividends come from the income of the corporation, and are taxes as well.

On the other hand, partnerships and sole proprietorships are not treated as individuals and thus have no "income" to tax. However, the parters' or proprietrors' are financially bound to the partnership or proprietorship and therefore their home can be forclosed and their stuff repossesed.

=====

vmarks's point is very good--taxes upon any business can be considered a cost of production, which get passed on to the price. All that happens is that the supply curve shifts left and market clearing price increases. Ultimately, consumers pay no matter what. When you tax businesses, it isnt a matter of rich or poor. its a matter of who's buying the product.

The word 'entity' is reserved to describe a single unit, something which exists separately from other things. Under law, a C Corp is considered a 'factive person', in that it can transact legal business in the name of its shareholders. In the realm of taxation that cannot be applied to C Corps. There is no single unit within a C Corp which is responsible for it's tax liability. A first portion of tax is paid by the whole of the stockhoders, directly from company receipts. That is again taxed as distsributions are made to those shareholders. So, in effect, they have been taxed twice on the same income. That falls to its number of shareholders. With other business organizations, from S Corps, Professional Partnership, LLC, etc, there is a tax passthrough to the individual principals. That tax liability is determined by the distribution methods of the various models. In the end, they are all persons which pay the taxes. But those taxes are passed to the consumer to make those companies whole.

I am not sure what you are advocating. That only business pay taxes, and the individual wage earner be exempt? Is that what you meant by 'fair share'? Should that ever occur, there would be a call for a constitutional amendment for a change in the voting law. Whereby only those who pay tax be allowed to vote, as the rest have no stake in the game, and can olny cause mischief.

|

|

|

| |

|

|

|

|

|

|

|

Dedicated MacNNer

Join Date: Jun 2004

Status:

Offline

|

|

Originally Posted by CRASH HARDDRIVE

Of course tax costs are passed to the consumer, that’s not the point. You’re talking about removing 23% of those costs in order to get to the mythical 23% phantom-savings in the final retail cost of the product. This is just a silly shell game. It’s the same cost, the same tax revenue, IE: it doesn’t replace INCOME TAX REVENUE! Isn’t that the point?

Also, contrary to the author’s whims, there’s no guarantee that a business will reduce the price of a product by 23%, an industry could just as easily keep the price where it is, and consider the 23% reduction in taxes as profit.

Yes, a business passes its tax costs onto the consumer- but this half-baked sales tax scheme passes them to the consumer directly, and completely fails to take into consideration the fact that many consumers (the wealthy in particular) can easily CHOOSE not to comply simply by altering consumption.

This doesn't even begin to get into the problems that will crop up when a product doesn't sell very well.

In the end, the govt. will be hurting to recoup even the initial amount it used to levy in manufacturing, and will end up hammering the consumer to make up for it. I have no friggen idea then where you think replacing INCOME tax revenues on top of that is going to come from.

It’s a weak argument, and based on pure fantasy. There’s no way to assure that prices remain the same. A business could elect to keep the price the same as it was, plus add the 23%- IE- take the reduced manufacturing costs as profit.

And you’re also missing the whole point- the price with 23% added on top of it is an ARTIFICIAL PRICE to begin with. If it were just 8 to 10% there’s not much incentive to skirt taxes (even though people do that, by crossing state lines or using the Internet) but 23%? Please. The incentive to skirt an amount that high is huge. The wholesale price won’t change- actually if the reduction in business taxes is to be believed, it will drop; therefore a black market or simple offshore would lose NOTHING by selling products at the actual retail cost, minus the 23%.

You seem to be unaware of the fact that my suppliers don’t charge me taxes. They’ve also received their payment from me for their goods- they charge me WHOLESALE not retail. So under this scheme, what exactly are they reporting, to whom, and why? To make this silly system work, do we eliminate business wholesale licenses and charge businesses sales taxes on inventory?

And I’d only report above the board sales subject to sales taxes, which of course I’d balance out to hide what’s off the books. And in this crazy system, what books?

I hate to break it to you, but all sorts of variations on this already exist, buying private use items through a company to avoid individual income taxes is common place. If my income is no longer be taxed who’s watching the millions pile up?

If you don't like this plan, perhaps you should study Mr. Forbes 17% flat tax initiative. The point of all these plans is to simplify the tax codes. Simple to the point that it's only collected at one place. The final resting place of the sale. And simple in that it can be accomplished with a postal card.

|

|

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Apr 2005

Location: Las Vegas, NV

Status:

Offline

|

|

Originally Posted by medicineman