|

|

Obama's making the economy worse (Page 3)

|

|

|

|

|

Clinically Insane

Join Date: Dec 1999

Status:

Offline

|

|

Originally Posted by turtle777

Read the link I posted, it explains the shenanigans that the BSL is doing.

Why would I read a Conservative blog oped when I can get the numbers from the Bureau of Labor and Statistics?

|

|

"…I contend that we are both atheists. I just believe in one fewer god than

you do. When you understand why you dismiss all the other possible gods,

you will understand why I dismiss yours." - Stephen F. Roberts

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Dec 1999

Status:

Offline

|

|

If you provided a credible source to evaluate the numbers, I might take your position a little more seriously.

|

|

"…I contend that we are both atheists. I just believe in one fewer god than

you do. When you understand why you dismiss all the other possible gods,

you will understand why I dismiss yours." - Stephen F. Roberts

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

Bullshit. Discuss the claims in the link on its merits, or shuddup.

-t

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by turtle777

Even the WSJ writes bullshit now and then.

This whole notion of "negative impact" from government austerity is a fig leaf.

What would unemployment be w/o all the non-value add government jobs that are funded by the $1.3T deficit ?

Exactly, MUCH higher. All those job are effectively funded by debt, anyways.

We could have 0% unemployment if we just decided to run a $5T deficit and "pay off" all those unemployable people.

-t

While your words and tone make it abundantly clear that you view public sector employees with disdain, the reality is that the people most affected by state and local government layoffs are teachers, police officers, firefighters, etc. But even if it were only the stereotypical rude and lazy DMV workers taking the hit, the fact remains that the paychecks public sector employees receive get spent in the private sector. Which at a minimum contributes to the employment of the private sector employees who you apparently deem are the only ones who "add value" ... because they service the demand that public sector employees generate. They get laid off and aggregate demand in the private sector decreases leading to sluggish job growth that barely keeps up with population growth. And on top of that the government still incurs more debt anyway due to the unemployment insurance and/or food stamps they end up utilizing.

This notion on the right that slashing government spending during an economic downturn ... which inevitably leads to mass layoffs ... is somehow going to make the Confidence Fairy appear and sprinkle the magic dust that will boost the economy in spite of the decreasing demand that ensues is nonsensical at best. What sane business owner is going to expand his/her operation and hire more employees in the face of a shrinking customer base?

But allow me to put this into an even clearer perspective ....

As of April 2012 the US economy has recovered all the PRIVATE SECTOR jobs lost since President Obama took office.

The reason why the unemployment rate remains above 8% is because the private sector lost millions of more jobs during the end of the Bush Administration when The Great Recession began .... well before President Obama took office and implemented his policies .... and because the PUBLIC SECTOR has lost over 600K jobs since Obama took office. The Stimulus Program delayed those public sector layoffs. But once those funds ran dry state and local governments, many of which are controlled by the GOP, started letting employees go rather than increase revenue. Because God forbid they actually address the problem by doing something sensible like tackling both sides of the equation. And naturally our good friends on the right insist upon these austerity policies that even Stevie Wonder could see will lead to higher unemployment ... but then turn around and criticize President Obama because of it.

My point here is that the policies of the Obama Administration has dug us about halfway out of the PRIVATE SECTOR job loss hole since the start of The Great Recession in three years. This despite intractable GOP opposition. Imagine how much further along we would be if the GOP's #1 priority was to support what is demonstrably working for the good of the overall economy instead of defeating President Obama in 2012? And it certainly isn't the Obama Administration pushing the austerity policies that are causing the PUBLIC SECTOR job losses we are currently experiencing. So for Mitt Romney to claim that President Obama is "making the economy worse" simply flies in the face of reality and basic mathematics. I await your dismissal ... because I dare say you will come up short with an actual rebuttal. It's kinda hard to argue with the trajectory of that blue line.

OAW

(

Last edited by OAW; May 8, 2012 at 07:25 PM.

)

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

I don't think that either DMV workers or teachers/police are paid by federal taxes, are they? There is a fundamental difference between local vs federal government spending, since the federal debt can be backstopped by (intentional) inflation. The point that turtle was trying to make is that government spending doesn't occur in a vacuum, and (all the more so at the local level) it comes at the expense of higher taxes, so you can't argue that government employees provide demand for private business, because that demand is just being taken out of those same private business's pockets on April 15th. One could argue that the private sector is only doing as well as it is because of the very cuts that required losing those government jobs, and without those, the private sector would be shrinking in advance of the necessary rise in taxes to pay those new artificial customers.

Is that graphic adjusted for inflation?

|

|

|

| |

|

|

|

|

|

|

|

Posting Junkie

Join Date: Oct 2005

Location: Houston, TX

Status:

Offline

|

|

Originally Posted by OAW

But allow me to put this into an even clearer perspective ....

As of April 2012 the US economy has recovered all the PRIVATE SECTOR jobs lost since President Obama took office.

The reason why the unemployment rate remains above 8% is because the private sector lost millions of more jobs

Number of jobs doesn't tell the whole unemployment story, there's also the size of the labor force.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Oh I guess I misread the graph, I thought it was enumerated in $, not # of jobs

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

I don't think that either DMV workers or teachers/police are paid by federal taxes, are they? There is a fundamental difference between local vs federal government spending, since the federal debt can be backstopped by (intentional) inflation.

Indeed. But state and local governments can receive federal funds which they then turn around to directly pay such workers. As was the case with the Stimulus Program. Bear in mind that many GOP governors would criticize the Stimulus Program in the media ... and then turn around and tout the "balanced budgets" they achieved while conveniently failing to mention that there was no way for them to pull that off without mass layoffs if it were not for the Stimulus Program funds shoring up their budgets.

Originally Posted by Uncle Skeleton

The point that turtle was trying to make is that government spending doesn't occur in a vacuum, and (all the more so at the local level) it comes at the expense of higher taxes, so you can't argue that government employees provide demand for private business, because that demand is just being taken out of those same private business's pockets on April 15th. One could argue that the private sector is only doing as well as it is because of the very cuts that required losing those government jobs, and without those, the private sector would be shrinking in advance of the necessary rise in taxes to pay those new artificial customers.

Now I suppose I just don't see the logic in this line of thought. I mean I get what you are saying. I would just counter that all demand is coming out of someone else's pockets. Dollars are recycled throughout the economy. So why is a dollar that is taxed out of the pocket of a private sector employee by the government that ends up back in the pocket of a private sector employee due to the spending of a public sector employee materially different than a dollar spent out of the pocket of a private sector employee that ends up back in the pocket of another private sector employee? A dollar spent is a dollar spent is a dollar spent. Not to mention when the government itself uses tax money to purchase office supplies, energy, vehicles, buildings, F-22 Raptors, etc. from the private sector the overwhelming majority of those tax dollars end up back in the pockets of the private sector? One can argue that the public sector doesn't allocate capital as efficiently as the private sector. But that's a different conversation altogether. One can't credibly argue that the public sector doesn't recycle capital as the private sector just the same. I mean think about it. In an era of trillion dollar deficits it's not as if the government is taxing dollars out of the private sector and parking it on the sidelines.

OAW

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by turtle777

Bullshit. Discuss the claims in the link on its merits, or shuddup.

-t

What a troll. You shuddup and stop posting BS.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by turtle777

We could have 0% unemployment if we just decided to run a $5T deficit and "pay off" all those unemployable people.

-t

Actually, the opposite is true.

If you stop paying unemployment benefits, the unemployment will be 0%. Haha...

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by mduell

Number of jobs doesn't tell the whole unemployment story, there's also the size of the labor force.

True. The Labor Force Participation Rate is down to the crappy Pres. Reagan levels. Except ppl live longer these days and a higher percentage of ppl over 65.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by OAW

Indeed. But state and local governments can receive federal funds which they then turn around to directly pay such workers. As was the case with the Stimulus Program. Bear in mind that many GOP governors would criticize the Stimulus Program in the media ... and then turn around and tout the "balanced budgets" they achieved while conveniently failing to mention that there was no way for them to pull that off without mass layoffs if it were not for the Stimulus Program funds shoring up their budgets.

Don't hate the player, hate the game

Now I suppose I just don't see the logic in this line of thought. I mean I get what you are saying. I would just counter that all demand is coming out of someone else's pockets. Dollars are recycled throughout the economy. So why is a dollar that is taxed out of the pocket of a private sector employee by the government that ends up back in the pocket of a private sector employee due to the spending of a public sector employee materially different than a dollar spent out of the pocket of a private sector employee that ends up back in the pocket of another private sector employee? A dollar spent is a dollar spent is a dollar spent.

Well I know this doesn't answer the question you're trying to ask, but voluntary transactions in the free market are materially different than involuntary tax transactions in that they increase the total wealth of both parties, otherwise both parties wouldn't agree to it. That's a fundamental premise of free market capitalism. So in this sense a dollar spent is not always a dollar spent, because the government can and often does spend money on things that just aren't worth the cost, and a private company would not continue to do so. Of course, this government inefficiency is a necessary evil, because there are some things that we require as a society that no private enterprise would provide (eg firefighters). But to say that government spending produces the same big picture positive outcome for the economy that private spending does, is simply not correct.

Not to mention when the government itself uses tax money to purchase office supplies, energy, vehicles, buildings, F-22 Raptors, etc. from the private sector the overwhelming majority of those tax dollars end up back in the pockets of the private sector? One can argue that the public sector doesn't allocate capital as efficiently as the private sector. But that's a different conversation altogether. One can't credibly argue that the public sector doesn't recycle capital as the private sector just the same.

I don't think that's a different conversation altogether, I think that's exactly the answer to the question. Each private transaction creates a tiny bit of wealth, while each public transaction destroys a tiny bit of it. Add it up over thousands of "recycle" cycles, and after a billion here and a billion there pretty soon you're talking about some serious money. Like I said above, some government drag on the economy is necessary, but let's not forget that it IS a drag, lest we convince ourselves we can fix the economy by adding more of it. We're steering the ship, not propelling it, and all steering comes at the expense of propulsion.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

That's a fundamental premise of free market capitalism. So in this sense a dollar spent is not always a dollar spent, because the government can and often does spend money on things that just aren't worth the cost, and a private company would not continue to do so. Of course, this government inefficiency is a necessary evil, because there are some things that we require as a society that no private enterprise would provide (eg firefighters). But to say that government spending produces the same big picture positive outcome for the economy that private spending does, is simply not correct.

Is government inefficient? Yes.

But, it doesn't change the fact that a dollar spent in the US economy is still a dollar spent in the US economy.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

Is government inefficient? Yes.

But, it doesn't change the fact that a dollar spent in the US economy is still a dollar spent in the US economy.

I just explained why that's false. If you want to respond to that explanation, please do.

Edit: I mean to say, I do appreciate your brevity, but in this case it's actually too brief, as it seems that your post has already been addressed.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

I just explained why that's false. If you want to respond to that explanation, please do.

Because you are confusing efficiency and profit margins, with money injected into the economy.

A dollar spent in the US economy is still a dollar spent in the US economy.

If I run a phone company and have $200 million in revenue, it's still $200 million in revenue and being taxed on. Does it matter if I charge government and business customers $40/mo for DSL, while I only charge a customer $20/mo of the same service?

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

Because you are confusing efficiency and profit margins, with money injected into the economy.

A dollar spent in the US economy is still a dollar spent in the US economy.

If I run a phone company and have $200 million in revenue, it's still $200 million in revenue and being taxed on. Does it matter if I charge government and business customers $40/mo for DSL, while I only charge a customer $20/mo of the same service?

So if your DSL product is only actually worth $20, but you manage to get $40 for it from government, you think that this means the "economy" has somehow created $20 more of prosperity out of nothingness? If that were true, then we could solve all our problems by just over-paying $10trillion for government DSL. But of course that's not true.

Spending is not the goal, spending is just an imperfect measurement for the goal, which is prosperity/productivity/wealth or some non-corporeal concept that is loosely described by these words. Intentionally undermining the accuracy of this imperfect measurement tool (by increasing spending just for the sake of spending) doesn't let us take a short-cut to prosperity, all it does is reduce our ability to quantify our stagnant progress towards prosperity. The accuracy of the measurement tool relies on the premise of the free market, that voluntary transactions improve the situation of both parties and therefore create wealth. The more deviance from this premise, the less accurately GDP or "dollars spent" reflects a meaningful metric of prosperity. So does it matter if you charge government twice as much as the market would otherwise bear? Yes, it makes the information gained from "dollars spent" half as informative.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

So if your DSL product is only actually worth $20, but you manage to get $40 for it from government, you think that this means the "economy" has somehow created $20 more of prosperity out of nothingness? If that were true, then we could solve all our problems by just over-paying $10trillion for government DSL. But of course that's not true.

So you have a problem with the free market and price discrimination?

'Worth' is whatever the market bears. Are iPads worth $500? Are text messages worth 25 cents per text?

DSL is 'worth' $20 to a residential customer, but the same service is 'worth' $40 to a business or government. It profit maximization using price discrimination. Welcome to free market capitalism.

Again, you are still confusing efficiency and profit margins, with money injected into the economy.

I rather have the government hire a bookkeeper in the US for $50k/yr than a private company hiring someone from India for $30k/yr.

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

So you have a problem with the free market and price discrimination?

'Worth' is whatever the market bears. Are iPads worth $500? Are text messages worth 25 cents per text?

DSL is 'worth' $20 to a residential customer, but the same service is 'worth' $40 to a business or government. It profit maximization using price discrimination. Welcome to free market capitalism.

Tax dollars aren't in a "free" market

Again, you are still confusing efficiency and profit margins, with money injected into the economy.

I'm not, but you seem to be, since you think that "money injected" is equivalent to "what the market will bear" and "free market capitalism."

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

I'm not, but you seem to be, since you think that "money injected" is equivalent to "what the market will bear" and "free market capitalism."

Um... I'm being trying to tell you that 'money injected' is NOT equivalent to "what the market will bear" and "free market capitalism."

Those are 2 separate issues. You are convoluting 2 separate issues into one.

A dollar spend in the US economy is a dollar spent in the US economy.

$40 from business/government is worth $40, $20 from residential customer is worth $20.

You are somehow arguing that $40 from business and government customers are only worth $20, because I offer the same service to residential customers for $20.

(

Last edited by hyteckit; May 9, 2012 at 02:34 AM.

)

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

|

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by hyteckit

Um... I'm being trying to tell you that 'money injected' is NOT equivalent to "what the market will bear" and "free market capitalism."

I have no idea what you mean. Please repeat the same sentence about 12 more times.

$40 from business/government is worth $40, $20 from residential customer is worth $20.

I've been confused by why you raised this example, because you seem to be fixated on "business" and "government" paying the exact same amount, when the premise is that they don't. Are you denying the premise that government spenders are less cutthroat or uncompromising than the private sector equivalents?

You are somehow arguing that $40 from business and government customers are only worth $20, because I offer the same service to residential customers for $20.

I was saying that because I gave you the benefit of the doubt that you were using a fair example, in which government ends up paying more than the private sector for the same product. Now I suspect that I shouldn't have given it, and I'll have to ask you to clarify your analogy.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Dec 1999

Status:

Offline

|

|

Originally Posted by turtle777

Bullshit. Discuss the claims in the link on its merits, or shuddup.

I don't need to. There are numerous websites dedicated to demonstrating why and how Karl Denninger is wrong on almost everything he complains about. He set himself up for Streisand effect when he started to delete comments and forum posts that demonstrated why his analysis is flawed, or, his sources incorrect.

Furthermore, he doesn't hold a degree in either Economics or Statistics, much less journalism. He's a guy with an opinion blog. Also, I'm pretty sure we went over this once before. I don't know how or why this guy keeps finding his way into your arguments.

On to his claims: his entire analysis is broken because of a reading comprehension problem, "In accordance with usual practice, BLS will not revise the official household survey estimates for December 2011 and earlier months. To show the impact of the population adjustment, however, differences in selected December 2011 labor force series based on the old and new population estimates are shown in table B."

"Over a million" people didn't exit the workforce. The adjustments in workforce take into account projected population growth of the United States using 2010 census data. You can not get much more accurate than the census. It is referenced in the very table Karl Denninger posted on his website.

So instead he makes up his own graphs under the assumption that zero people were born in 2011. I can tell you right now, that number is more than zero. The original Bureau of Labor Statistics graphs are accurate.

(

Last edited by olePigeon; May 9, 2012 at 01:27 PM.

)

|

|

"…I contend that we are both atheists. I just believe in one fewer god than

you do. When you understand why you dismiss all the other possible gods,

you will understand why I dismiss yours." - Stephen F. Roberts

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

Don't hate the player, hate the game

Nice!

Originally Posted by Uncle Skeleton

Well I know this doesn't answer the question you're trying to ask, but voluntary transactions in the free market are materially different than involuntary tax transactions in that they increase the total wealth of both parties, otherwise both parties wouldn't agree to it. That's a fundamental premise of free market capitalism. So in this sense a dollar spent is not always a dollar spent, because the government can and often does spend money on things that just aren't worth the cost, and a private company would not continue to do so. Of course, this government inefficiency is a necessary evil, because there are some things that we require as a society that no private enterprise would provide (eg firefighters). But to say that government spending produces the same big picture positive outcome for the economy that private spending does, is simply not correct.

Now I don't know about you, but every time I pay my bills it certainly doesn't increase my wealth!  Perhaps with my mortgage being a notable exception. And even that is now suspect due to the housing crisis and the declining home values. My point being, when money comes out of my pocket it doesn't increase my wealth unless I've exchanged it for a good that will continue to appreciate in value. Money spent on a service like the electric bill? Gone. Money spent on taking the wife out to dinner? Gone. Money spent feeding and clothing my children? Gone. And I suppose I look at taxes like I do other necessities in life like utilities, insurance, gasoline, etc. It's not something I particularly wish to pay but it's part of the "price of doing business" in a civilized society so to speak. So "voluntary vs. involuntary" is a distinction without much of a difference for me. In any event, my overall point here is regarding economic activity ... or alternatively speaking, dollars exchanging hands. If a dollar is spent in the private sector or the public sector that dollar has exchanged hands just the same. So when economic activity in the private sector is tepid at best due to lackluster demand, to further decrease aggregate demand with austerity policies that slash public sector spending only exacerbates the problem.

Suppose our good friends on the right were able to realize their wet dream of eliminating the Departments of Education, Commerce, and HUD tomorrow. Is that going to increase your discretionary income? It certainly won't for me. But it will surely eliminate all of the income for the former employees of those agencies. It will surely eliminate all of the income of private sector vendors that was derived from the goods and services that were formerly provided to those agencies. Laying off employees and running vendors out of business simply isn't a recipe for economic recovery. You don't increase economic growth in the private sector by taking fuel out of the fire.

OAW

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by OAW

Now I don't know about you, but every time I pay my bills it certainly doesn't increase my wealth!  Perhaps with my mortgage being a notable exception. And even that is now suspect due to the housing crisis and the declining home values. My point being, when money comes out of my pocket it doesn't increase my wealth unless I've exchanged it for a good that will continue to appreciate in value. Money spent on a service like the electric bill? Gone. Money spent on taking the wife out to dinner? Gone. Money spent feeding and clothing my children? Gone.

Wealth is more than your bank balance. A person who has electricity, fine dining (and the happy spouse that comes with it), and healthy well cared for children is far wealthier than someone with none of those things, even if neither person has a dime to their name.

And I suppose I look at taxes like I do other necessities in life like utilities, insurance, gasoline, etc. It's not something I particularly wish to pay but it's part of the "price of doing business" in a civilized society so to speak.

And I suppose you see it that way because you "won" the race between your principles and conservative ones. Government only grows and grows, it doesn't shrink, so it's not surprising that a person who already supported progressive (aka growing) government would think of this as a fair deal. But just take a moment to consider what this would seem like to someone of a different persuasion. Not only did they "lose" the race, but it's progressively getting worse and worse over time, with no expectation of ever changing. They're not going to be in the mood to exchange their dollars for luxuries, not with that forecast. They're going to be hoarding like it's the Great Depression. We'll get back to this in a moment...

So "voluntary vs. involuntary" is a distinction without much of a difference for me.

The difference is between spending your own money/resources vs spending someone else's. I work in the public sector, and I can assure you that I never work nearly as hard at conserving Other People's Money as I do at conserving my own.

In any event, my overall point here is regarding economic activity ... or alternatively speaking, dollars exchanging hands. If a dollar is spent in the private sector or the public sector that dollar has exchanged hands just the same. So when economic activity in the private sector is tepid at best due to lackluster demand, to further decrease aggregate demand with austerity policies that slash public sector spending only exacerbates the problem.

As I was explaining to hyteckit, dollars changing hands is a sign of economic prosperity, not a cause. It's a gauge, and you can boost the gauge by pushing the needle with your finger, but that doesn't affect what the gauge is measuring, it just makes the measurement less informative.

Suppose our good friends on the right were able to realize their wet dream of eliminating the Departments of Education, Commerce, and HUD tomorrow. Is that going to increase your discretionary income? It certainly won't for me. But it will surely eliminate all of the income for the former employees of those agencies. It will surely eliminate all of the income of private sector vendors that was derived from the goods and services that were formerly provided to those agencies. Laying off employees and running vendors out of business simply isn't a recipe for economic recovery. You don't increase economic growth in the private sector by taking fuel out of the fire.

...and now we're back. People aren't stupid, they can tell that the government is spending more than they can afford, and they know who's going to end up paying for it. So they have to cover their rears. This quenches demand. They can't spend on luxuries if they're saving up for doomsday. If the government starts to steer away from the precipice, a proportionate amount of that quenched demand can be freed back into the economy. In short, the very existence of government obligations inhibits economic activity, and removing them dis-inhibits it.

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Jun 2001

Location: planning a comeback !

Status:

Offline

|

|

Originally Posted by olePigeon

I don't need to. There are numerous websites dedicated to demonstrating why and how Karl Denninger is wrong on almost everything he complains about.

Interesting. Could you post a few, please ?

Originally Posted by olePigeon

Furthermore, he doesn't hold a degree in either Economics or Statistics, much less journalism. He's a guy with an opinion blog. Also, I'm pretty sure we went over this once before. I don't know how or why this guy keeps finding his way into your arguments.

What are your credentials ? Do you have the "required" (whatever that means) degrees to be allowed to critize him for NOT having the degrees ? I would sure hope so, lest you be a hypocrite.

-t

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by Uncle Skeleton

Wealth is more than your bank balance. A person who has electricity, fine dining (and the happy spouse that comes with it), and healthy well cared for children is far wealthier than someone with none of those things, even if neither person has a dime to their name.

Well if we are looking at it that way then the roads, bridges, clean water and air, nature reserves on public lands, public health agencies, strong military for the national defense, etc. that those "involuntary transactions" called taxes pay for make us all "wealthier" as well.

Originally Posted by Uncle Skeleton

And I suppose you see it that way because you "won" the race between your principles and conservative ones. Government only grows and grows, it doesn't shrink, so it's not surprising that a person who already supported progressive (aka growing) government would think of this as a fair deal. But just take a moment to consider what this would seem like to someone of a different persuasion. Not only did they "lose" the race, but it's progressively getting worse and worse over time, with no expectation of ever changing. They're not going to be in the mood to exchange their dollars for luxuries, not with that forecast. They're going to be hoarding like it's the Great Depression. We'll get back to this in a moment...

Well I'm going to have to respectfully disagree with your underlying premise on this one. First of all I simply don't buy into this notion of "Progressive = Big Government ... Conservative = Small Government". I mean I know our good friends on the right like to tell themselves that but that doesn't necessarily make it true. Since 1980 Republican Administrations are 0 for 3 when it comes to shrinking the size of government. In fact, government drastically expanded under Reagan and Bush II. Government actually shrank under the Clinton Administration and the given the economic disaster that the Obama Administration inherited it grew sharply in the first two years and is now back down to Bush II levels and headed in the right direction due to the wind down of the Iraq and Afghanistan Wars. So you'll have to pardon me if 30+ years of political history leaves me with the distinct impression that conservatives talk a good game about "small government principles" when they are out of power ... and then do the exact opposite when they are in power.

In any event, if we are to have a discussion about the proper "size of government" then the first thing we have to do is have a mutual understanding on how that's measured. In other words, what are the criteria used to determine this?

- Total Revenue

- Total Expenditures

- Revenue as a % of GDP

- Expenditures as a % of GDP

- # of Government Employees

- Average Tax Burden per Capita

- # of Government Statutes

- Etc

If Revenue as a % of GDP is 20% today and next year it's still 20% but the Total Revenue increased substantially due to GDP growth ... did the "size of government" grow?

If the # of Government Employees shrank significantly due to budget cuts but the Average Tax Burden per Capita remained the same ... did the "size of government" shrink?

You say "Government only grows and grows, it doesn't shrink". Ok. But again, that depends on how you measure it. IMO the most sensible measure for the "size of government" is Expenditures as a % of GDP ... whether those expenditures are direct spending or spending through the tax code (i.e. is the mortgage interest deduction anything other than government subsidization of the housing market?) So if that measure remained constant but Total Expenditures or the # of Government Employees grew due to population or GDP growth .... did the "size of government" grow too? Personally, I would expect Total Expenditures and/or # of Government Employees to increase because the government would be servicing a larger population and a more robust economy. And I certainly wouldn't view that as a "bad" thing under those circumstances. My point here is that I'll need to you layout exactly what you mean by "size of government" and how you feel it should be measured in order to continue this particular sidebar.

In the meantime, I'll address another aspect of your underlying premise. In my estimation "Progressive" or "Conservative" is actually more oriented in values and priorities than the "size of government" per se. For example, let's say hypothetically that Expenditures as % of GDP is presently at 30%. And I think it should be more along the line of 25% because my tax burden is too high. But as a "Progressive" I think that 25% should reflect a defense budget that is only 7 times larger than our nearest competitor and not 10. And those savings redirected into shoring up social safety net programs and investing in public infrastructure. Because that more reflects my values and priorities with respect to the role of government. What would that do to your notion that "progressive government = growing government"? As a "Progressive", I think that the 700-800 billion spent on TARP was a necessary evil. But it would have been better spent paying off the mortgages on every US homeowner's primary residence as opposed to going directly to big banks. Because my values and priorities dictate that government should serve the people broadly and not mega-wealthy corporations. Sure the people got a "stabilized" financial sector and avoided another Great Depression ... but they also got left holding the bag of public debt and upside down mortgages. While the "too big to fail" banks only got bigger. My point here is that "Progressive" is more about if there is a dollar that's going to be spent by the government ... what should the government spend it on. As opposed to spending an extra dollar for the sake of spending an extra dollar.

Originally Posted by Uncle Skeleton

The difference is between spending your own money/resources vs spending someone else's. I work in the public sector, and I can assure you that I never work nearly as hard at conserving Other People's Money as I do at conserving my own.

Indeed. But this same phenomenon exists in the private sector. As a former traveling IT consultant, I can assure you that firm partners spared no expense taking the team out to really lavish restaurants for dinner when it was billable to the client.

Originally Posted by Uncle Skeleton

As I was explaining to hyteckit, dollars changing hands is a sign of economic prosperity, not a cause. It's a gauge, and you can boost the gauge by pushing the needle with your finger, but that doesn't affect what the gauge is measuring, it just makes the measurement less informative.

If you disagree that "dollars changing hands" is an appropriate measure of economic prosperity, then I'd be interested in hearing what you think is. I suspect you will be hard pressed to come up with one that doesnt' involve "dollars changing hands" though.

Originally Posted by Uncle Skeleton

...and now we're back. People aren't stupid, they can tell that the government is spending more than they can afford, and they know who's going to end up paying for it. So they have to cover their rears. This quenches demand. They can't spend on luxuries if they're saving up for doomsday. If the government starts to steer away from the precipice, a proportionate amount of that quenched demand can be freed back into the economy. In short, the very existence of government obligations inhibits economic activity, and removing them dis-inhibits it.

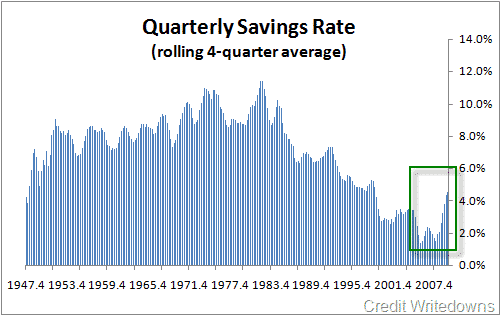

You've touched upon a few topics here. First let me say that deficit spending is a separate issue. One can shrink the "size of government" and still run a deficit. One can grow the "size of government" and still run a surplus. But honestly I suspect that was not your main point. You say people are "saving up for doomsday" and that's what's depressing aggregate demand. Well not so much per the data. And I certainly disagree that the savings that is taking place is due to deficit spending by the government. Let me illustrate ....

The US savings rate began to fall of a cliff starting in 1982. Right around the time that conservatives ascended to power with the Reagan Administration. Coincidence? Or a consequence of a marked change in public policy? But I digress. That's a debate for another time.  For now just note that this downward trend reversed in 2007 right when The Great Recession began. I would argue that this was due to people being skittish about the 750K+/month job losses that ensued and a soaring unemployment rate as opposed to deficit spending by the government. And as the private sector job losses were stemmed and replaced with 2+ years of uninterrupted private sector job growth Americans soon returned to their old habits:

The good news is, a recent pick-up in consumer spending is fending off fears of another U.S. recession.

The bad news is, it's coming at the expense of Americans' savings.

On average, consumers put 3.6% of their hard-earned dough into savings in September, the government reported Friday. It marks the lowest level of saving since December 2007, when consumers stashed away only 2.6% of their income.

But deciphering the meaning of the savings rate is a tricky business.

On one hand, many economists had hoped the Great Recession would spark a newfound period of thrift and frugality, lessening consumers' vulnerability to financial shocks in the future. The recession did have this effect for a while, sending the savings rate as high as 8.3% in May 2008.

On the other hand, American businesses have argued that without an increase in demand for their products, there's no incentive for them to create more jobs. If consumers continue to save rather than spend their money, why should the restaurant down the street, the local big-box retailer or even large American manufacturers ramp up their hiring?

Savings rate falls to lowest since 2007 - Oct. 28, 2011

So what all of this tells us is that A) US consumers are NOT "hoarding" or "saving up for doomsday". Quite the contrary actually, and B) the present spending capacity of US consumers is not sufficient to increase demand enough for businesses to expand and create more jobs. It's been tapped out.

Unless there is significant increase in aggregate demand, businesses have no incentive to expand and create more jobs. But without more jobs those US consumers simply don't have the spending capacity to generate the needed increase in aggregate demand themselves. Classic Catch-22. But to get things back on track this increase in aggregate demand has to come from somewhere. So the only options are A) Increased exports to foreign consumers, and B) increased public sector spending.

I mean it is what it is. A policy of austerity is the polar opposite of what we should be doing right now. Restoring robust economic growth should be the priority in the short term. Getting the federal debt under control should be the priority for the medium and long term. An long term endeavor that will be aided significantly with robust economic growth. And next to impossible to achieve without it.

OAW

(

Last edited by OAW; May 9, 2012 at 07:31 PM.

)

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Aug 2007

Location: Phoenix, Arizona

Status:

Offline

|

|

Originally Posted by OAW

Government actually shrank under the Clinton Administration

OAW

A good deal of that was due to the closing of military bases as a result of the collapse of the Warsaw Pact nations. (AKA the "peace dividend")

|

|

45/47

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: Nov 2002

Location: Rockville, MD

Status:

Offline

|

|

Originally Posted by OAW

Well if we are looking at it that way then the roads, bridges, clean water and air, nature reserves on public lands, public health agencies, strong military for the national defense, etc. that those "involuntary transactions" called taxes pay for make us all "wealthier" as well.

Right, now you're almost up to speed with my first post

Public and private spending both buy things of value, however public spending doesn't demand as competitive a price as private spending does. This creates a drag, a (small) net reduction in wealth rather than a (small) net increase. Just like a rudder to steer a ship (or aileron a plane), a small drag on propulsion is worthwhile since it steers you in the right direction, but let's not forget that this drag exists in the first place. If propulsion is flagging, you can't make up for it by just jacking up the use of your rudder or aileron.

Well I'm going to have to respectfully disagree with your underlying premise on this one. First of all I simply don't buy into this notion of "Progressive = Big Government ... Conservative = Small Government". I mean I know our good friends on the right like to tell themselves that but that doesn't necessarily make it true. Since 1980 Republican Administrations are 0 for 3 when it comes to shrinking the size of government. In fact, government drastically expanded under Reagan and Bush II. Government actually shrank under the Clinton Administration and the given the economic disaster that the Obama Administration inherited it grew sharply in the first two years and is now back down to Bush II levels and headed in the right direction due to the wind down of the Iraq and Afghanistan Wars. So you'll have to pardon me if 30+ years of political history leaves me with the distinct impression that conservatives talk a good game about "small government principles" when they are out of power ... and then do the exact opposite when they are in power.

Neocons aren't conservatives, they're just strange bedfellows.

Conservative, as the name suggests, means you want to conserve things the way they are (or more often, the way they recently were), not take risks, stick with tried and true (to bring it back to the regressive aspect: also avoiding things which were recently tried but not proven true). Progressive means you want to try something new. I think this simple template fits rather well.

In the meantime, I'll address another aspect of your underlying premise. In my estimation "Progressive" or "Conservative" is actually more oriented in values and priorities than the "size of government" per se.

I agree. Progressives want to expand the mandate of government. They want it to adopt new nanny-state roles in society. Conservatives want to keep it sand-boxed, per the constitution.

Indeed. But this same phenomenon exists in the private sector. As a former traveling IT consultant, I can assure you that firm partners spared no expense taking the team out to really lavish restaurants for dinner when it was billable to the client.

But is there any natural force that punishes companies with lax oversight of such things? What about lax governments?

If you disagree that "dollars changing hands" is an appropriate measure of economic prosperity, then I'd be interested in hearing what you think is. I suspect you will be hard pressed to come up with one that doesnt' involve "dollars changing hands" though.

No tool is perfect, but it is still prudent to remember the specific weaknesses of the tool you choose. I'm not saying it's the wrong tool, I'm saying it's the wrong way to use that tool. You have to remain cognizant of it's limitations, and just because there is no better tool doesn't mean that the best tool we have is infallible.

the present spending capacity of US consumers is not sufficient to increase demand enough for businesses to expand and create more jobs. It's been tapped out.

...

So the only options are A) Increased exports to foreign consumers, and B) increased public sector spending.

Some would say that public sector spending is also tapped out. More than "some."

|

|

|

| |

|

|

|

|

|

|

|

Clinically Insane

Join Date: Dec 1999

Status:

Offline

|

|

Originally Posted by turtle777

Interesting. Could you post a few, please ?

It started with this blog posting an email conversation with Karl, which spawned this satire website in response to how Karl Denninger conducted himself in the emails. You can hop on Google and find many, many more.

The guy is, shall we say, odd. He's the only person I know who's on the fringe of both right and left, and nothing in the middle. And by both fringes, I mean he's a staunch conservative Republican (as in guest speaker for Limbaugh, Beck, etc.), but supports the Occupy Wall Street movement and voted for Obama. It's very hard to pinpoint his position, if he even has one. I'm just as confused about him as he is about the subjects on which comments.

Maybe he's a Blue Dog, I don't know. With so much attention from Conservative talk shows, it's a shame he doesn't check his own work or at least confer with an expert in the field.

Originally Posted by turtle777

What are your credentials ? Do you have the "required" (whatever that means) degrees to be allowed to critize him for NOT having the degrees ? I would sure hope so, lest you be a hypocrite.

I have no credentials, but I do cite references, and I also don't pretend to be an expert in the field. I dont own and operate a website called "Market Ticker" and criticize economic policy. I also don't need to do anything like that for subjects I'm passionate about, because there's already a website called Quack Watch run by real doctors and physicians, and not some guy playing doctor on a blog.

|

|

"…I contend that we are both atheists. I just believe in one fewer god than

you do. When you understand why you dismiss all the other possible gods,

you will understand why I dismiss yours." - Stephen F. Roberts

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

An awesome speech at the TED Conference that fundamentally demonstrates this insane notion that the wealthy are "job creators". By Seattle billionaire venture-capitalist Nick Hanauer. I cite it here in its entirety. See here for the accompanying presentation slides.

Originally Posted by Nick Hanauer

It is astounding how significantly one idea can shape a society and its policies. Consider this one.

If taxes on the rich go up, job creation will go down.

This idea is an article of faith for Republicans and seldom challenged by Democrats and has shaped much of today's economic landscape.

But sometimes the ideas that we know to be true are dead wrong. For thousands of years people were sure that earth was at the center of the universe. It's not, and an astronomer who still believed that it was, would do some lousy astronomy.

In the same way, a policy maker who believed that the rich and businesses are "job creators" and therefore should not be taxed, would make equally bad policy.

I have started or helped start, dozens of businesses and initially hired lots of people. But if no one could have afforded to buy what we had to sell, my businesses would all have failed and all those jobs would have evaporated.

That's why I can say with confidence that rich people don't create jobs, nor do businesses, large or small. What does lead to more employment is a "circle of life" like feedback loop between customers and businesses. And only consumers can set in motion this virtuous cycle of increasing demand and hiring. In this sense, an ordinary middle-class consumer is far more of a job creator than a capitalist like me.

So when businesspeople take credit for creating jobs, it's a little like squirrels taking credit for creating evolution. In fact, it's the other way around.

Anyone who's ever run a business knows that hiring more people is a capitalist's course of last resort, something we do only when increasing customer demand requires it. In this sense, calling ourselves job creators isn't just inaccurate, it's disingenuous.

That's why our current policies are so upside down. When you have a tax system in which most of the exemptions and the lowest rates benefit the richest, all in the name of job creation, all that happens is that the rich get richer.

Since 1980, the share of income for the richest Americans has more than tripled while effective tax rates have declined by close to 50%.

If it were true that lower tax rates and more wealth for the wealthy would lead to more job creation, then today we would be drowning in jobs. And yet unemployment and under-employment is at record highs.

Another reason this idea is so wrong-headed is that there can never be enough super-rich Americans to power a great economy. The annual earnings of people like me are hundreds, if not thousands, of times greater than those of the median American, but we don't buy hundreds or thousands of times more stuff. My family owns three cars, not 3,000. I buy a few pairs of pants and a few shirts a year, just like most American men. Like everyone else, we go out to eat with friends and family only occasionally.

I can't buy enough of anything to make up for the fact that millions of unemployed and underemployed Americans can't buy any new clothes or cars or enjoy any meals out. Or to make up for the decreasing consumption of the vast majority of American families that are barely squeaking by, buried by spiraling costs and trapped by stagnant or declining wages.

Here's an incredible fact. If the typical American family still got today the same share of income they earned in 1980, they would earn about 25% more and have an astounding $13,000 more a year. Where would the economy be if that were the case?

Significant privileges have come to capitalists like me for being perceived as "job creators" at the center of the economic universe, and the language and metaphors we use to defend the fairness of the current social and economic arrangements is telling. For instance, it is a small step from "job creator" to "The Creator". We did not accidentally choose this language. It is only honest to admit that calling oneself a "job creator" is both an assertion about how economics works and the a claim on status and privileges.

The extraordinary differential between a 15% tax rate on capital gains, dividends, and carried interest for capitalists, and the 35% top marginal rate on work for ordinary Americans is a privilege that is hard to justify without just a touch of deification.

We've had it backward for the last 30 years. Rich businesspeople like me don't create jobs. Rather they are a consequence of an eco-systemic feedback loop animated by middle-class consumers, and when they thrive, businesses grow and hire, and owners profit. That's why taxing the rich to pay for investments that benefit all is a great deal for both the middle class and the rich.

So here's an idea worth spreading.

In a capitalist economy, the true job creators are consumers, the middle class. And taxing the rich to make investments that grow the middle class, is the single smartest thing we can do for the middle class, the poor and the rich.

Thank You.

Was Nick Hanauer’s TED Talk on Income Inequality Too Rich for Rich People? | Business | TIME.com

Well said Mr. Hanauer. Well said.

OAW

|

|

|

| |

|

|

|

|

|

|

|

Mac Elite

Join Date: Apr 2001

Status:

Offline

|

|

|

(

Last edited by el chupacabra; Oct 23, 2013 at 11:38 PM.

)

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Location: Zip, Boom, Bam

Status:

Offline

|

|

^ That whole post was pretty awesome. Kind of like a snapshot of the real world smacking the shit out of the usual hackneyed liberal pipe dreams.

|

|

|

| |

|

|

|

|

|

|

|

Addicted to MacNN

Join Date: May 2001

Status:

Offline

|

|

Originally Posted by el chupacabra

I don't even know where to start with this. Perhaps he works at some simple monopoly like Walmart or something and has other people doing most the work; but even then Walmart opens up stores in places where there was no previous demand; if you can call that expansion and hiring. ALL companies take risk before there is known the for-sure demand, they do what little marketing research they can afford 1st, they plea to inverters to take a risk 2nd, they get loans 3rd, investors do more marketing research, hire people, create product, and then see if there is demand by trying to convince people they need something. If there isn't they go out of business. That is the correct loop. It is set up so that more money has to be accumulated at the top, otherwise there is no motivation to start these projects to begin with. The economy is always chasing its tail.

So poorly written, I don't know where to begin.

Let me summarize what you wrote.

El Chupacabra got a free education, but not smart enough to do well in school. However, he has done well making a life for himself in the last few years under Pres. Obama.

Sounds like a positive testimonial for Pres. Obama.

Your whole post is nothing but nonsense. Most liberals are just unemployed welfare receiving drunks and stoners? But according to conservatives, liberals control the media, hollywood, science, education, and so forth? Which one is it?

(

Last edited by hyteckit; May 28, 2012 at 02:31 AM.

)

|

|

Bush Tax Cuts == Job Killer

June 2001: 132,047,000 employed

June 2003: 129,839,000 employed

2.21 million jobs were LOST after 2 years of Bush Tax Cuts.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forum Rules

|

|

|

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

|

HTML code is Off

|

|

|

|

|

|

|

|

|

|

|

|